What are the sap tax procedures to configure?

Configuring tax procedures in SAP involves setting up the system to handle various aspects of taxation, including the calculation, reporting, and compliance with tax authorities. SAP offers flexibility in configuring tax procedures to accommodate different tax types and legal requirements in various countries and industries. Here's a comprehensive guide on the key steps and components involved in configuring tax procedures in SAP:

Access the Tax Configuration:

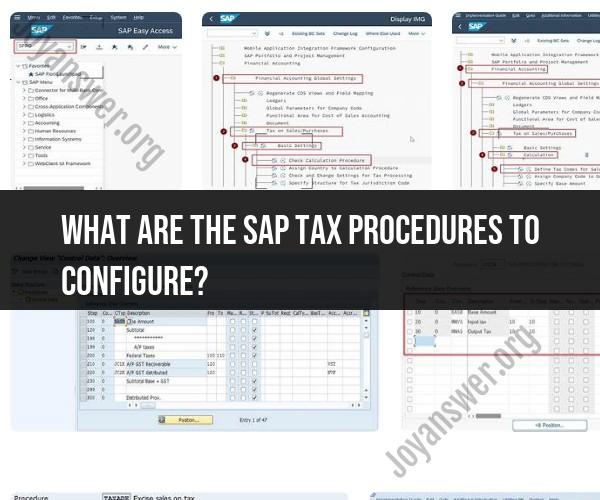

- Log in to your SAP system and access the tax configuration menu. The specific path to access tax configuration may vary depending on your SAP version and module (e.g., SAP Financial Accounting or SAP Materials Management). Common transaction codes for tax configuration include FTXP (for defining tax codes), OBCL (for defining tax procedures), and J1ID (for tax determination in SAP for specific countries).

Define Tax Codes:

- Tax codes represent various tax types (e.g., VAT, sales tax, withholding tax) and tax rates applicable in your country or region. Define tax codes and assign tax percentages or amounts to each code. Tax codes are typically defined based on the tax jurisdiction and tax category.

Configure Tax Procedures:

- Tax procedures in SAP determine how taxes are calculated and posted in different scenarios. Configure tax procedures based on the tax laws and requirements of your country. Key components of tax procedure configuration include:

a. Access Sequences: These define the order in which the system searches for tax conditions during tax calculation. Access sequences are used to determine the tax jurisdiction and relevant tax codes for a transaction.

b. Condition Types: Condition types are used to represent different tax conditions, such as input tax, output tax, and withholding tax. Define condition types for each relevant tax code and specify whether it's a tax that should be calculated, posted, or both.

c. Tax Codes Determination: Assign condition types to the relevant access sequences and condition tables. This determines how tax codes are determined based on the transaction data.

d. Tax Calculation: Configure tax calculation procedures, such as tax base amount determination, rounding rules, and calculation formulas, based on the tax laws and regulations applicable to your business.

e. Tax Accounts: Define G/L accounts for tax-related postings, such as input tax accounts, output tax accounts, and clearing accounts. Assign these G/L accounts to the relevant tax codes.

Maintain Tax Jurisdictions:

- Tax jurisdictions define the geographical areas subject to specific tax rates and regulations. Depending on your country, you may need to set up tax jurisdictions and assign them to tax codes. This is essential for determining the correct tax rates based on the transaction location.

Tax Reporting and Compliance:

- Configure the system to generate tax reports required by tax authorities. SAP provides standard tax reporting tools, but you may need to customize reports to meet specific legal requirements.

Testing and Validation:

- After configuring tax procedures, thoroughly test the system by simulating various transactions to ensure that taxes are calculated and posted accurately. Validate that the tax codes and procedures align with legal requirements.

Documentation and Training:

- Document your tax configuration settings, including tax codes, condition types, and procedures. Provide training to relevant personnel to ensure they understand how taxes are handled in the SAP system.

Compliance Updates:

- Stay informed about changes in tax laws and regulations that may affect your tax procedures. Regularly update and adjust your tax configuration to remain compliant.

Monitoring and Maintenance:

- Monitor tax-related postings and reporting regularly to identify and address any issues or discrepancies. Perform routine maintenance to keep the tax configuration up to date.

Legal and Tax Expertise:

- Consider engaging legal and tax experts who are knowledgeable about SAP tax procedures to ensure that your configuration meets all legal requirements and is optimized for tax efficiency.

Tax configuration in SAP is a complex process that requires a deep understanding of both SAP functionality and tax laws in your country or region. It's important to work closely with tax professionals and SAP consultants to ensure accurate and compliant tax procedures within your SAP system.

SAP Tax Procedure Configuration: Key Steps and Considerations

Key steps:

- Define tax conditions: Tax conditions are used to calculate the amount of tax that needs to be paid on a transaction. To define tax conditions, go to the Customizing transaction SPRO and navigate to Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Define Condition Types.

- Define tax codes: Tax codes are used to assign tax conditions to transactions. To define tax codes, go to the Customizing transaction SPRO and navigate to Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Define Tax Codes.

- Assign tax procedures to countries: Tax procedures are used to control how taxes are calculated and posted for different countries. To assign tax procedures to countries, go to the Customizing transaction SPRO and navigate to Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Assign Country to Calculation Procedure.

- Configure tax calculation and posting: You can configure tax calculation and posting in the Customizing transaction SPRO by navigating to Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Basic Settings > Check Calculation Procedure.

Considerations:

- Country-specific tax requirements: When configuring tax procedures in SAP, it is important to consider the specific tax requirements of the countries where you operate.

- Tax code mappings: You may need to map your existing tax codes to the tax codes in SAP.

- Tax reporting requirements: You need to make sure that your SAP system is configured to generate the required tax reports.

Tax Handling in SAP: Configuring Tax Procedures

SAP provides a variety of tools and features for handling taxes. These tools and features can be used to configure tax procedures, calculate taxes, and post taxes to the general ledger.

To configure tax procedures in SAP, you need to use the Customizing transaction SPRO. In the Customizing transaction, you can define tax conditions, tax codes, and tax procedures. You can also assign tax procedures to countries and configure tax calculation and posting.

Once you have configured tax procedures in SAP, you can use the tax calculation engine to calculate taxes on transactions. The tax calculation engine takes into account the tax conditions and tax codes that have been assigned to the transaction.

The calculated taxes are then posted to the general ledger. SAP provides a variety of posting rules for posting taxes to the general ledger. You can choose the posting rules that best meet your business needs.

Tax Management in SAP: Setting Up Tax Procedures for Your Business

To set up tax procedures in SAP for your business, you need to follow these steps:

- Identify the tax requirements of your business. This includes identifying the countries where you operate and the types of taxes that you need to pay.

- Configure tax conditions, tax codes, and tax procedures in SAP.

- Assign tax procedures to countries.

- Configure tax calculation and posting.

- Test the tax procedures to make sure that they are working correctly.

You may need to work with a tax advisor or an SAP consultant to help you set up tax procedures in SAP.

Here are some additional tips for setting up tax procedures in SAP:

- Use the SAP standard tax procedures where possible. This will help to simplify your configuration and reduce the risk of errors.

- Make sure that your tax procedures are aligned with your business processes.

- Test your tax procedures regularly to make sure that they are up to date and that they are working correctly.

- Document your tax procedures so that you can easily understand and maintain them.

By following these tips, you can ensure that your SAP system is configured to handle taxes correctly and efficiently.