What is the formula for calculating taxes?

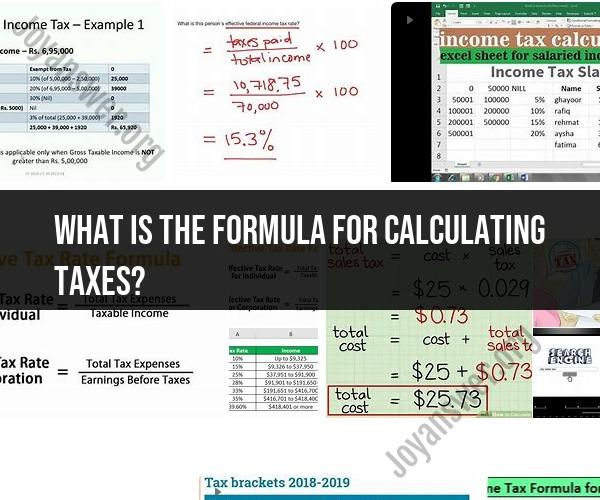

The formula for calculating taxes can vary significantly depending on the type of tax, the tax rate, and the tax regulations of the specific country or jurisdiction. Here are some common tax formulas for different types of taxes:

Income Tax:

The formula for calculating income tax depends on the tax laws in your country. In many countries, income tax is calculated using progressive tax brackets. A simplified formula might look like this:

Income Tax = (Tax Rate x Taxable Income) - Deductions and Credits

The "Tax Rate" varies depending on your income level, and "Taxable Income" is your total income minus any deductions or exemptions. Deductions and credits can reduce the amount of taxable income.

Sales Tax:

Sales tax is typically calculated as a percentage of the purchase price. The formula is straightforward:

Sales Tax = (Sales Tax Rate x Purchase Price)

The "Sales Tax Rate" is set by the government and varies by jurisdiction.

Property Tax:

Property tax is usually calculated based on the assessed value of the property and the property tax rate. The formula is as follows:

Property Tax = (Assessed Value x Property Tax Rate)

The "Assessed Value" is determined by local authorities, and the "Property Tax Rate" is set by the municipality or county.

Corporate Income Tax:

Corporate income tax is calculated similarly to individual income tax, with tax rates applied to the company's taxable income. The formula is:

Corporate Income Tax = (Tax Rate x Taxable Income) - Deductions and Credits

Like individual income tax, deductions and credits can reduce the taxable income.

Capital Gains Tax:

Capital gains tax is applied to the profit from the sale of assets such as stocks or real estate. The formula is:

Capital Gains Tax = (Tax Rate x Capital Gain)

The "Capital Gain" is the difference between the selling price and the purchase price of the asset.

Value Added Tax (VAT) or Goods and Services Tax (GST):

VAT or GST is calculated as a percentage of the value added at each stage of production or distribution. The formula for the final consumer is:

VAT/GST = (Tax Rate x Price of Goods or Services)

Each business along the supply chain collects and remits the VAT/GST on the value it adds to the product or service.

These are general formulas, and the actual calculations can be more complex due to factors like deductions, credits, exemptions, and tax credits. Tax laws and regulations can change over time, so it's essential to refer to the specific tax code of your jurisdiction or consult with a tax professional for accurate calculations. Additionally, some countries may have different tax systems, such as flat taxes or hybrid systems, which may use different formulas.

Tax Calculation Formula: Understanding the Basics

The tax calculation formula is the equation used to calculate the amount of taxes that an individual or entity owes. The formula varies depending on the type of tax being calculated, but it typically includes the following elements:

- Taxable income: This is the amount of income that is subject to taxation. It is calculated by subtracting certain deductions and exemptions from gross income.

- Tax rate: This is the percentage of taxable income that is owed in taxes. Tax rates can vary depending on the type of tax being calculated, the taxpayer's income level, and other factors.

- Tax credits: These are amounts that can be subtracted from taxes owed. Tax credits can be available for a variety of reasons, such as education expenses, charitable giving, and childcare costs.

The basic tax calculation formula is as follows:

Taxes owed = Taxable income * Tax rate - Tax credits

For example, let's say that an individual has a taxable income of $50,000 and a tax rate of 15%. They also have a tax credit of $1,000. Their taxes owed would be calculated as follows:

Taxes owed = $50,000 * 0.15 - $1,000 = $6,000

Mastering Tax Calculations: Formulas and Essentials

There are a variety of different tax calculation formulas, depending on the type of tax being calculated. For example, the formula for calculating income tax is different from the formula for calculating sales tax.

In addition to the basic tax calculation formula, there are a number of other factors that can affect the amount of taxes that an individual or entity owes. For example, taxpayers may be eligible for certain deductions and credits that can reduce their tax liability.

It is important to note that tax laws can be complex and change frequently. Therefore, it is advisable to consult with a tax professional to ensure that you are calculating your taxes correctly.

Demystifying Taxation: The Formula for Calculating Taxes

Taxation can be a complex topic, but the basic formula for calculating taxes is relatively straightforward. By understanding the basic formula and the various factors that can affect tax liability, taxpayers can better understand their tax obligations and make informed decisions about their finances.

Here are some tips for understanding and calculating taxes:

- Know your taxable income. This is the amount of income that is subject to taxation. It is calculated by subtracting certain deductions and exemptions from gross income.

- Understand your tax rate. This is the percentage of taxable income that is owed in taxes. Tax rates can vary depending on the type of tax being calculated, the taxpayer's income level, and other factors.

- Be aware of tax credits. These are amounts that can be subtracted from taxes owed. Tax credits can be available for a variety of reasons, such as education expenses, charitable giving, and childcare costs.

- Use a tax calculator. There are a variety of tax calculators available online and in software programs. These calculators can help you to calculate your taxes quickly and easily.

- Consult with a tax professional. If you have any questions about your taxes, it is advisable to consult with a tax professional. They can help you to understand the tax laws and calculate your taxes correctly.