How do you calculate compound interest?

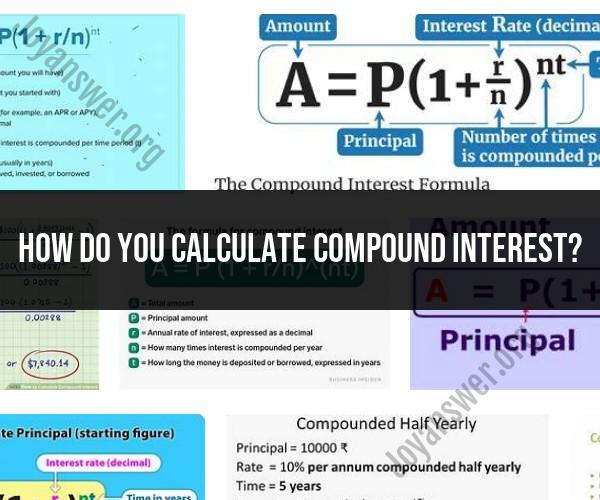

You can calculate compound interest using the following formula:

A = P(1 + r/n)^(nt)

Where:

- A = the future value of the investment/loan, including interest.

- P = the principal amount (the initial amount of money).

- r = the annual interest rate (in decimal form).

- n = the number of times that interest is compounded per year.

- t = the number of years the money is invested or borrowed for.

Here's a step-by-step guide on how to calculate compound interest:

Convert the Annual Interest Rate to Decimal: If the annual interest rate is given as a percentage, divide it by 100 to convert it to decimal form. For example, if the annual interest rate is 5%, you would use 0.05 for "r."

Determine the Number of Compounding Periods: Find out how many times the interest is compounded per year (n). Common values include annually (1), semi-annually (2), quarterly (4), and monthly (12).

Determine the Time Period: Determine how many years (t) you plan to invest or borrow the money for.

Apply the Formula: Plug the values you've collected into the compound interest formula:

A = P(1 + r/n)^(nt)

Calculate: Perform the calculations step by step following the order of operations (parentheses first, then exponents, then multiplication/division from left to right):

- Calculate (1 + r/n).

- Raise the result to the power of (nt).

- Multiply the principal amount (P) by the result from the previous step to find A.

Finalize the Calculation: Round the result to the desired number of decimal places if necessary.

Here's a simple example to illustrate the calculation:

Suppose you invest $1,000 at an annual interest rate of 5%, compounded annually (n = 1), for 3 years (t = 3).

A = 1000(1 + 0.05/1)^(1*3)

A = 1000(1 + 0.05)^3

A = 1000(1.05)^3

A = 1000(1.157625)

A ≈ $1,157.63

So, the future value of your $1,000 investment after 3 years at a 5% annual interest rate, compounded annually, is approximately $1,157.63.

You can use this formula to calculate compound interest for various financial scenarios, such as investments, loans, or savings accounts, by adjusting the values of P, r, n, and t accordingly.