Does annual compounding pay more money than daily compounding?

Yes, annual compounding typically pays less money than daily compounding for the same nominal interest rate. The frequency of compounding, or how often the interest is added to the principal balance, affects the total amount of interest earned or paid on an investment or loan.

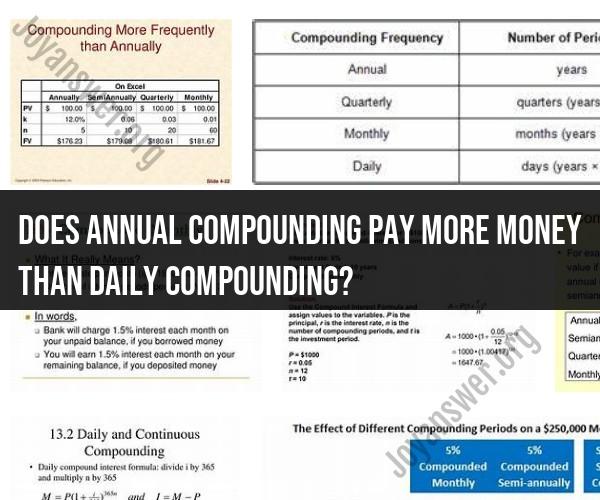

Annual Compounding: With annual compounding, interest is added to the principal once a year. The interest is calculated based on the initial principal amount for the entire year. This results in a lower overall amount of interest compared to more frequent compounding methods.

Daily Compounding: Daily compounding, on the other hand, adds interest to the principal on a daily basis. Each day, the interest is calculated based on the current principal balance, which includes any previously accrued interest. Daily compounding leads to the highest overall interest earnings or costs compared to other compounding frequencies.

The formula to calculate compound interest is:

Where:

- is the future value of the investment or loan, including both principal and interest.

- is the initial principal (the starting amount of money).

- is the annual nominal interest rate (expressed as a decimal).

- is the number of times that interest is compounded per year.

- is the number of years the money is invested or borrowed for.

If you compare two investments or loans with the same nominal interest rate but different compounding frequencies, the investment or loan with daily compounding will yield higher returns or incur higher costs over time.

It's important to note that while daily compounding can result in more significant interest earnings for savings accounts or investments, it can also lead to higher interest costs for loans. Therefore, it's essential to understand the compounding frequency when evaluating financial products and making financial decisions.

Annual Compounding vs. Daily Compounding: Which Pays More?

Daily compounding pays more than annual compounding. This is because interest is calculated on the principal amount plus any accrued interest. So, when interest is compounded more frequently, it earns interest on the interest, which leads to a higher overall return.

Here is a simple example:

Let's say you invest $1,000 at an interest rate of 5%. If your interest is compounded annually, you will earn $50 in interest each year. However, if your interest is compounded daily, you will earn $50.25 in interest each year.

Over time, the difference in interest earned can become significant. For example, if you invest $1,000 at an interest rate of 5% for 10 years, you will earn $511.63 in interest if your interest is compounded annually. However, you will earn $538.62 in interest if your interest is compounded daily.

Maximizing Returns: Comparing Annual and Daily Compounding

When choosing an investment, it is important to compare the annual percentage yield (APY) offered by different institutions. The APY takes into account the frequency of compounding, so it is a good indicator of how much interest you can expect to earn on your investment.

In general, you can expect to earn a higher return on your investment if you choose an account that offers daily compounding. However, there are other factors to consider when choosing an investment, such as fees and risks.

Compound Interest: Frequency and Financial Impact

The frequency of compounding can have a significant impact on the overall return of your investment. As the example above shows, daily compounding can lead to a higher overall return than annual compounding.

However, it is important to note that the frequency of compounding is just one factor that affects the overall return of your investment. Other factors, such as the interest rate and the investment term, also play a role.

Conclusion

If you are looking to maximize your returns, you should choose an investment that offers daily compounding. However, it is important to compare the APY offered by different institutions and to consider other factors, such as fees and risks, before making a decision.