What are the three primary financial statements?

The three primary financial statements are essential tools used by businesses to communicate their financial performance and position to stakeholders. These statements provide valuable insights into a company's financial health and are crucial for decision-making. The three primary financial statements are:

Income Statement (Profit and Loss Statement):

- The income statement provides a summary of a company's revenues, expenses, gains, and losses over a specific period, typically a quarter or a fiscal year.

- It shows how much revenue the company generated from its operations, the costs and expenses incurred in generating that revenue, and the resulting net income or net loss.

- The income statement follows a basic equation: Revenue - Expenses = Net Income (or Net Loss).

- Key components of the income statement include:

- Revenue (Sales)

- Cost of Goods Sold (COGS)

- Gross Profit

- Operating Expenses (such as salaries, rent, utilities)

- Operating Income

- Non-operating Income or Expenses

- Net Income

Balance Sheet:

- The balance sheet provides a snapshot of a company's financial position at a specific point in time, usually the end of a reporting period.

- It presents a company's assets, liabilities, and shareholders' equity, following the fundamental accounting equation: Assets = Liabilities + Shareholders' Equity.

- The balance sheet is divided into two main sections:

- Assets: Resources owned or controlled by the company, including cash, inventory, property, plant, equipment, and investments.

- Liabilities: Obligations or debts owed by the company to external parties, such as loans, accounts payable, and accrued expenses.

- Shareholders' Equity: The residual interest in the company's assets after deducting liabilities, representing shareholders' ownership in the company.

- The balance sheet provides insights into a company's liquidity, solvency, and overall financial health.

Cash Flow Statement:

- The cash flow statement provides an overview of a company's cash inflows and outflows during a specific period, categorizing cash flows into operating, investing, and financing activities.

- It shows how cash is generated and used by the company in its day-to-day operations, investments in assets, and financing activities.

- The cash flow statement is divided into three main sections:

- Operating Activities: Cash flows from the company's primary business operations, including revenue, expenses, and changes in working capital.

- Investing Activities: Cash flows from the buying and selling of long-term assets, such as property, plant, equipment, and investments.

- Financing Activities: Cash flows from raising capital (e.g., issuing stock or bonds) and repaying debt, as well as dividend payments to shareholders.

- The cash flow statement helps assess a company's ability to generate cash, its liquidity position, and its ability to meet financial obligations.

These three primary financial statements work together to provide a comprehensive view of a company's financial performance, position, and cash flows, enabling stakeholders to make informed decisions about investments, lending, and other financial matters.

Financial Statements: Unveiling a Company's Health

Financial statements are crucial documents used to understand a company's financial performance and health. Here's a breakdown of the information provided in each of the three main statements, along with their key differences and insights:

1. Income Statement:

- Focus: Reflects a company's performance over a specific period (usually a quarter or a year).

- Information provided:

- Revenues: Total income generated from sales of goods or services.

- Expenses: Costs incurred in generating those revenues, including cost of goods sold, operating expenses, and interest expenses.

- Net income (or loss): The bottom line - difference between revenues and expenses, indicating profitability (positive) or loss (negative).

- Earnings per share (EPS): Net income divided by the number of outstanding shares, indicating earnings per share for investors.

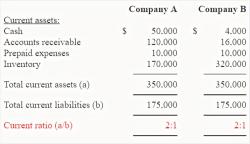

2. Balance Sheet:

- Focus: Represents a company's financial position at a specific point in time (like a snapshot on a particular date).

- Information provided:

- Assets: Everything the company owns or controls, categorized as current assets (cash, inventory, receivables) and non-current assets (property, equipment, investments).

- Liabilities: The company's debts and obligations to creditors, categorized as current liabilities (short-term debts) and non-current liabilities (long-term debts).

- Shareholders' equity: The difference between assets and liabilities, representing the owners' claim on the company's assets.

3. Key Differences:

- Timeframe: Income statement (period) vs. Balance sheet (point in time).

- Focus: Income statement (performance) vs. Balance sheet (financial position).

- Equation: Income statement (Revenue - Expenses = Net Income) vs. Balance sheet (Assets = Liabilities + Shareholders' Equity).

4. Cash Flow Statement:

- Focus: Analyzes the movement of cash in and out of a company, categorized as operating activities, investing activities, and financing activities.

- Insights: Provides valuable information about a company's ability to generate cash to meet its financial obligations and sustain its operations.

By analyzing all three statements together, you can gain a comprehensive understanding of a company's:

- Profitability: From the income statement.

- Financial position: From the balance sheet.

- Cash flow management: From the cash flow statement.

This combination allows you to assess the company's overall financial health, its ability to generate profits, and its potential for future growth and stability.