What is the formula for operating profit?

Operating profit, also known as operating income or operating earnings, measures a company's profitability from its core business operations, excluding the impact of interest and taxes. It's a key indicator of a company's operational efficiency and performance. Here’s the formula for calculating operating profit and some financial insights:

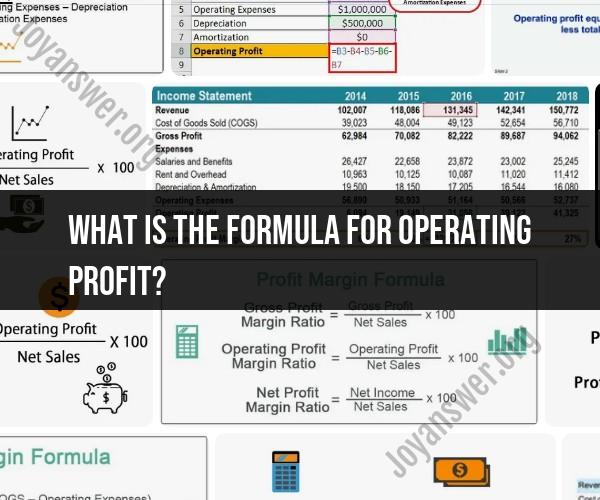

Operating Profit Formula

Where:

- Gross Profit is calculated as:

- Operating Expenses include selling, general and administrative expenses (SG&A), depreciation, and other overhead costs not directly tied to production.

Detailed Breakdown

- Revenue (Sales): Total income generated from selling goods or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold, such as raw materials and labor.

- Gross Profit: The profit a company makes after deducting the COGS from revenue. It shows how efficiently a company produces and sells its products.

- Operating Expenses: These are expenses required to run the business that aren't directly tied to the production process. They include:

- Selling Expenses: Costs related to selling the product, such as advertising and sales commissions.

- General and Administrative Expenses (G&A): Overhead costs, such as salaries of administrative staff, office rent, and utilities.

- Depreciation and Amortization: The allocation of the cost of tangible and intangible assets over their useful lives.

- Other Operating Expenses: Any other costs related to the day-to-day operations of the business.

Example Calculation

Let's consider a company with the following financial figures:

- Revenue: $1,000,000

- COGS: $600,000

- Selling Expenses: $100,000

- G&A Expenses: $150,000

- Depreciation and Amortization: $50,000

Step-by-Step Calculation:

Calculate Gross Profit:

Calculate Total Operating Expenses:

\text{Total Operating Expenses} = \text{Selling Expenses} + \text{G&A Expenses} + \text{Depreciation and Amortization}Calculate Operating Profit:

Financial Insights

Indicator of Core Business Performance:

- Operating profit focuses on the profitability from core business activities, excluding non-operating income and expenses, providing a clear view of operational efficiency.

Comparison Across Periods:

- Comparing operating profit over different periods helps identify trends and the impact of operational changes or strategies.

Benchmarking Against Competitors:

- Operating profit margins can be compared with industry peers to gauge relative performance and operational efficiency.

Decision-Making Tool:

- Insights from operating profit can guide management decisions on cost control, pricing strategies, and investment in business operations.

Conclusion

Operating profit is a vital metric for assessing a company’s operational efficiency and core business profitability. By understanding and analyzing this figure, businesses can make informed decisions to enhance their performance and competitiveness in the market.

What is the mathematical formula used to calculate operating profit?

The mathematical formula used to calculate operating profit is:

Operating Profit = Revenue - Cost of Goods Sold (COGS) - Operating Expenses

Here's a breakdown of the terms:

- Operating Profit: This represents the profit generated from the core business activities after accounting for the costs directly associated with producing and selling the goods or services, as well as the indirect costs of running the business.

- Revenue: This is the total amount of income generated from selling goods or services.

- Cost of Goods Sold (COGS): This refers to the direct costs involved in producing the goods or services sold. It typically includes the cost of materials, labor directly involved in production, and any directly related overhead costs.

- Operating Expenses: These are the indirect costs associated with running the business on a day-to-day basis. They don't directly involve the production of goods or services but are necessary for the overall functioning of the business. Examples include rent, salaries for administrative staff, marketing and advertising costs, utilities, and depreciation.

Note: Sometimes you might see the operating profit referred to as operating income or EBIT (Earnings Before Interest and Taxes). These terms are all essentially equivalent.