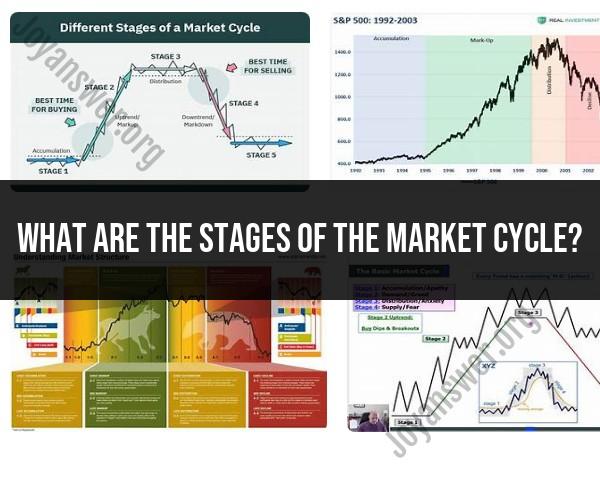

What are the stages of the market cycle?

The market cycle refers to the recurring pattern of ups and downs in the financial markets over time. While the specifics may vary, the market cycle typically consists of four main stages:

Expansion: This stage marks the beginning of a new market cycle. During the expansion phase, economic growth is robust, corporate earnings are rising, and investor optimism is high. Stock prices generally trend upward, fueled by increasing consumer spending, business investment, and confidence in the economy. Interest rates may be low, and monetary policy may be accommodative to support growth. The expansion phase is characterized by a bull market, where asset prices generally rise.

Peak: The peak represents the climax of the market cycle, signaling the end of the expansion phase. At this stage, economic indicators may begin to show signs of overheating, such as inflationary pressures, rising interest rates, and excessive speculation in asset markets. Stock prices may reach their highest levels, and investor sentiment may become euphoric. However, the peak is often followed by a period of consolidation or correction as market participants reassess valuations and adjust their expectations.

Contraction: Also known as the downturn or recession, the contraction phase occurs when economic activity begins to slow, leading to a decline in corporate earnings, rising unemployment, and deteriorating business conditions. Stock prices may enter a bear market, characterized by sustained declines of 20% or more from previous highs. During this stage, investor sentiment turns pessimistic, and risk aversion increases. Central banks may implement monetary stimulus measures to support the economy and stabilize financial markets.

Trough: The trough represents the bottom of the market cycle, where economic conditions reach their weakest point. Unemployment may peak, corporate earnings may decline sharply, and consumer confidence may hit rock bottom. However, the trough also marks the beginning of the recovery phase, as economic indicators start to improve, and investor sentiment begins to rebound. Stock prices may stabilize and eventually start to recover as investors anticipate better prospects ahead.

It's important to note that the market cycle is not perfectly predictable, and the duration and amplitude of each stage may vary. Additionally, external factors such as geopolitical events, regulatory changes, and technological advancements can influence market dynamics and alter the trajectory of the cycle. Nonetheless, understanding the stages of the market cycle can help investors navigate market fluctuations, make informed decisions, and manage risk effectively.

What are the recognized stages comprising the market cycle?

The commonly recognized stages of a market cycle are:

1. Accumulation: This is the initial stage where the market is consolidating after a period of decline. Prices are typically low, and trading activity is often subdued. Investors might be cautious and hesitant to enter the market, but some may see this stage as an opportunity to buy at a discount.

2. Mark-Up: As buying interest starts to pick up, prices begin to rise steadily. Positive economic data, improving corporate earnings, and increased investor confidence can fuel this stage. The market sentiment becomes more optimistic, attracting new investors and further propelling prices upwards.

3. Distribution: As the market reaches its peak, some investors who bought earlier start to take profits, leading to profit-taking and a gradual slowdown in the price increase. This stage can be characterized by increased volatility and potential corrections, where prices experience temporary pullbacks.

4. Mark-Down: This is the final stage, where the market enters a sustained decline. Investor confidence weakens, selling pressure mounts, and prices fall more rapidly. Negative economic news, disappointing corporate earnings, or a shift in investor sentiment can trigger this stage.

It's important to remember that these stages are idealized representations and may not always occur in a clear-cut, sequential manner. The duration of each stage can vary significantly, and some cycles might be shorter or experience overlapping characteristics.

Furthermore, identifying the exact stage a market is currently in can be challenging, and even experienced investors can make mistakes in their assessments. Market cycles are complex and influenced by various factors, making perfect prediction nearly impossible.