How to forecast financial statements?

Forecasting financial statements is a critical aspect of strategic planning for businesses. It involves estimating future financial performance based on historical data, market trends, and various assumptions. Here's a step-by-step guide on how to forecast financial statements:

1. Gather Historical Financial Data:

- Collect and review historical financial statements, including income statements, balance sheets, and cash flow statements. This provides a baseline for your forecasts.

2. Define the Forecast Period:

- Determine the time horizon for your financial forecasts. Common periods include one year, three years, or five years. The forecast period may vary based on the industry and business objectives.

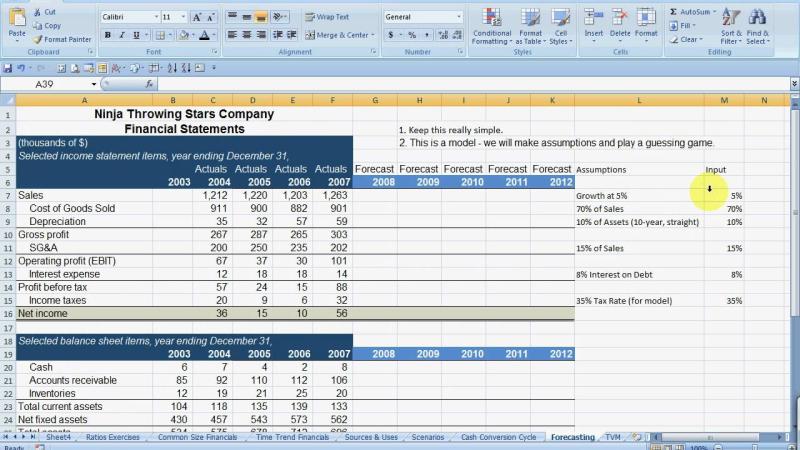

3. Identify Key Assumptions:

- Clearly outline the assumptions that will drive your financial forecasts. These may include assumptions about sales growth, pricing, cost of goods sold, operating expenses, capital expenditures, and working capital changes.

4. Forecast Sales:

- Start by forecasting sales revenues. Consider market trends, historical sales data, and any relevant external factors. Break down sales by product lines or business segments if applicable.

5. Estimate Cost of Goods Sold (COGS):

- Estimate the direct costs associated with producing goods or services. This includes costs like raw materials, labor, and manufacturing overhead. Calculate the gross margin by subtracting COGS from sales.

6. Project Operating Expenses:

- Forecast operating expenses, including salaries, marketing costs, rent, utilities, and other overhead expenses. Adjust these based on expected changes in the business.

7. Forecast Other Income and Expenses:

- Include any additional income or expenses not covered in the operating expenses, such as interest income, interest expenses, and taxes.

8. Project Capital Expenditures:

- Estimate capital expenditures for purchasing or upgrading assets. This may include equipment, technology, or facilities.

9. Estimate Changes in Working Capital:

- Forecast changes in working capital, including accounts receivable, accounts payable, and inventory. Consider the impact on cash flow.

10. Create Pro Forma Financial Statements:

- Using the gathered information and calculations, create pro forma financial statements, including:

- Pro Forma Income Statement

- Pro Forma Balance Sheet

- Pro Forma Cash Flow Statement

11. Review and Validate:

- Review the forecasted financial statements for consistency and accuracy. Validate assumptions and ensure they align with the overall business strategy.

12. Sensitivity Analysis:

- Conduct sensitivity analysis to assess the impact of variations in key assumptions on financial outcomes. Identify potential risks and opportunities.

13. Monitor and Update:

- Regularly monitor actual financial performance against the forecast. Update the forecast as needed based on changes in the business environment.

14. Use Financial Modeling Tools:

- Consider using financial modeling tools or software to streamline the forecasting process and perform scenario analysis.

15. Seek Professional Advice:

- In complex scenarios, consider seeking advice from financial professionals or consultants to ensure accuracy and reliability.

Remember that financial forecasting involves a degree of uncertainty, and assumptions may need to be adjusted as conditions change. Regularly revisit and update your forecasts to support informed decision-making and strategic planning.

How can one forecast financial statements?

Forecasting financial statements is predicting a company's future financial performance by examining past data and anticipating future trends. It's crucial for various reasons, including:

- Strategic planning: Helps make informed decisions about investments, resource allocation, and growth strategies.

- Performance measurement: Tracks progress towards financial goals and identifies areas for improvement.

- Risk management: Anticipates potential financial challenges and prepares mitigation strategies.

Here are some common methods for financial statement forecasting:

1. Trend analysis: Extrapolates historical trends in revenue, expenses, and other key metrics into the future. This is a simple yet effective method for stable businesses in predictable environments.

2. Ratio analysis: Analyzes historical ratios, such as profit margin or debt-to-equity ratio, to identify patterns and predict future values. This method is useful for understanding underlying relationships between financial variables.

3. Budgeting: Creates detailed projections for specific income and expense categories based on assumptions about sales, production costs, and other factors. This is a bottom-up approach that requires detailed planning and input from various departments.

4. Discounted cash flow (DCF): Estimates the present value of future cash flows generated by the company. This method is complex but useful for valuing businesses and making investment decisions.

5. Statistical models: Employs statistical techniques, such as regression analysis, to forecast financial variables based on historical data and economic indicators. This requires technical expertise and access to relevant data.

Here are some additional factors to consider when forecasting financial statements:

- Economic conditions: Overall economic growth, inflation, and interest rates can significantly impact a company's performance.

- Industry trends: Understanding specific industry trends and disruptions is crucial for accurate forecasts.

- Management decisions: Strategic decisions made by company leadership can significantly impact future financial performance.

- Unforeseen events: Be prepared to adjust forecasts for unexpected events like natural disasters or market crashes.

Remember, financial forecasting is not an exact science, and there will always be some degree of uncertainty. However, by using appropriate methods, considering relevant factors, and regularly updating forecasts, you can improve the accuracy of your predictions and make informed decisions for your business.

I hope this provides a helpful overview of financial statement forecasting! Let me know if you have any further questions about specific methods or challenges in this area.