Why annuities are a poor investment choice?

While annuities can offer certain benefits, they are not suitable for everyone, and there are criticisms and drawbacks associated with this investment choice. Here are some reasons why annuities might be considered a poor investment choice for some individuals:

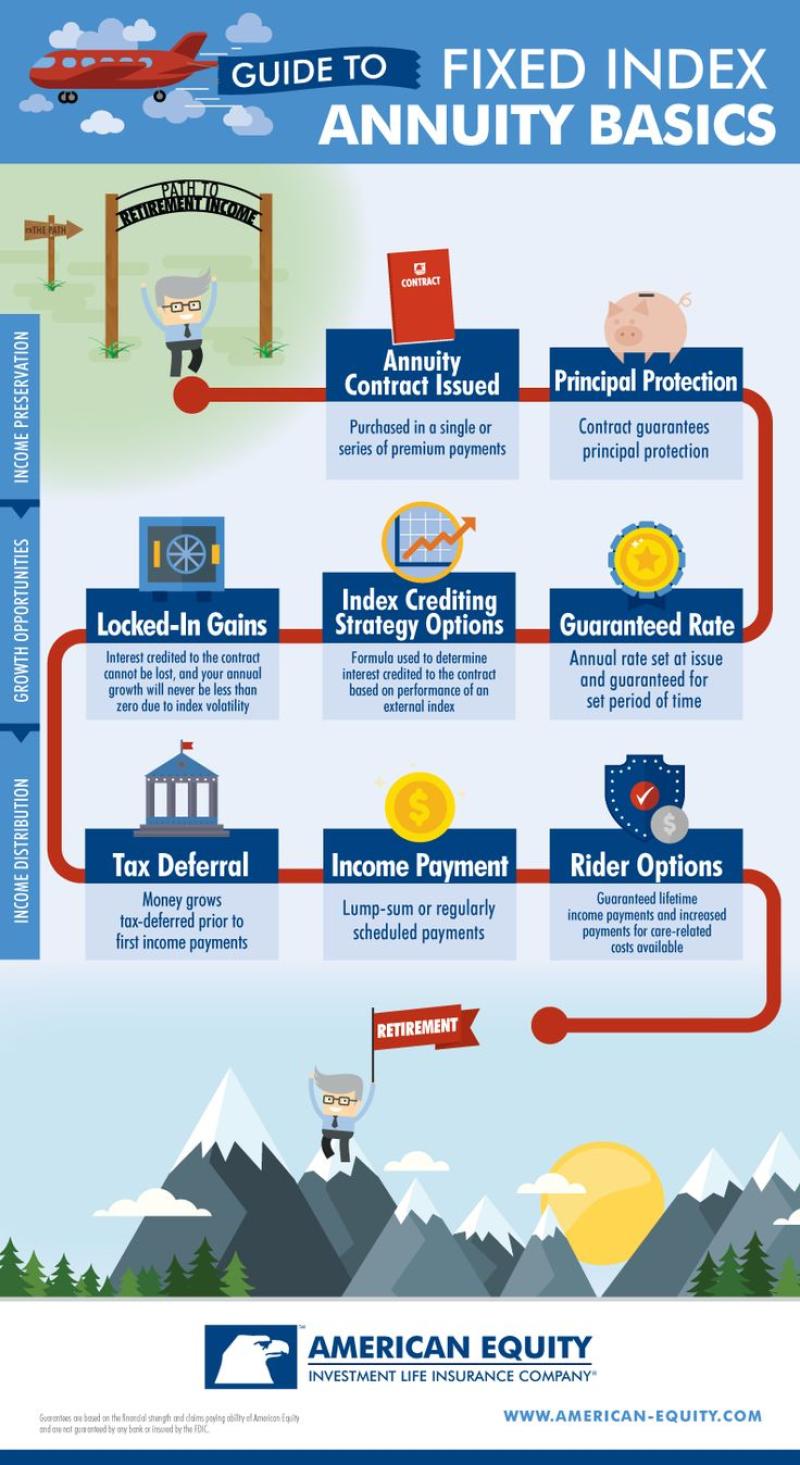

Complexity and Lack of Transparency:

- Annuities can be complex financial products with intricate features, fees, and conditions. The lack of transparency in some annuity contracts can make it challenging for investors to fully understand the terms and costs involved.

High Fees and Expenses:

- Annuities often come with various fees, including surrender charges, administrative fees, and mortality and expense charges. These fees can significantly reduce the overall returns on the investment.

Limited Liquidity:

- Annuities typically have limited liquidity, and early withdrawals may result in surrender charges or penalties. This lack of flexibility can be a disadvantage for individuals who may need access to their funds for unexpected expenses.

Low Returns in Low-Interest Environments:

- In a low-interest-rate environment, the returns offered by some annuities may be relatively low. This can make it challenging for investors to achieve competitive returns, especially when compared to other investment options.

Inflation Risk:

- Fixed annuities may not provide adequate protection against inflation. The fixed nature of the income payments may result in a diminishing real purchasing power over time, potentially impacting the investor's lifestyle.

Opportunity Cost:

- Money invested in an annuity is tied up and may not be available for other potentially more profitable investment opportunities. This opportunity cost can impact the overall growth of an investor's portfolio.

Complex Tax Implications:

- Annuities have complex tax implications, and the tax treatment can vary depending on the type of annuity and the timing of withdrawals. Understanding and managing the tax consequences can be challenging for investors.

Limited Upside Potential:

- Some annuities, particularly fixed or indexed annuities, may have limited upside potential compared to other investments like stocks. This limitation can impact the overall growth potential of an investor's portfolio.

Alternatives to Annuities:

Diversified Investment Portfolio:

- Consider building a diversified investment portfolio that includes a mix of asset classes such as stocks, bonds, and real estate. This approach provides flexibility, liquidity, and the potential for competitive returns.

Systematic Withdrawal Plans:

- Rather than purchasing an annuity, some investors may prefer to create their own systematic withdrawal plan from a well-diversified investment portfolio. This allows for greater flexibility and control over withdrawals.

Immediate Annuity Alternatives:

- For those seeking a stream of income, alternatives like dividend-paying stocks, bonds, or real estate investment trusts (REITs) may provide income potential without the complexities and fees associated with certain annuities.

Long-Term Care Insurance:

- For individuals concerned about long-term care costs, long-term care insurance may be a more targeted and cost-effective solution than certain types of annuities.

It's important for individuals considering annuities to carefully evaluate their financial goals, risk tolerance, and investment preferences. Consulting with a financial advisor can help assess whether an annuity aligns with their overall financial strategy or if there are more suitable alternatives based on their individual circumstances.

Annuities can be a complex financial instrument, and while they offer certain benefits, they also come with drawbacks that make them a poor choice for some investors. Let's delve into the criticisms and alternatives to understand their suitability better:

1. Reasons for Skepticism:

- High fees: Annuities often have hefty surrender charges for early withdrawals, along with annual administrative and mortality and expense (M&E) fees, eroding returns.

- Limited liquidity: Unlike stocks or mutual funds, accessing invested money in an annuity can be difficult and involve penalties, hindering flexibility.

- Lower potential returns: Compared to equities or index funds, annuities typically offer lower average returns over the long term.

- Complex contracts: Annuity contracts can be lengthy and convoluted, making it difficult for individuals to fully understand all the terms and potential pitfalls.

- Sales practices: Some agents may oversell annuities as suitable for everyone, overlooking individual financial needs and risk tolerance.

2. Criticisms and Drawbacks:

- Lock-in period: Funds deposited in an annuity are locked in for a specified period, limiting access to your money for emergencies or other investment opportunities.

- Market exposure limitations: Certain annuities limit your exposure to potential market gains, hindering overall portfolio growth.

- Tax implications: Depending on the type of annuity, withdrawals may be taxed as income, potentially impacting your after-tax returns.

- Inheritance considerations: Bequests through annuities may be less favorable compared to other inheritance options due to tax complications and potential penalties.

- Loss of control: Once invested, you relinquish some control over your money compared to more flexible investment options.

3. Alternative Investment Options:

- Index funds: Low-cost, diversified options offering broad market exposure and long-term growth potential.

- Target-date funds: Automatically adjust asset allocation based on your retirement date, simplifying management.

- Roth IRAs: Tax-advantaged accounts with tax-free withdrawals in retirement, promoting long-term growth.

- Individual stocks: For experienced investors, direct stock ownership offers potential for higher returns but with increased risk.

- Real estate: Can provide income and potential appreciation but requires active management and significant upfront capital.

4. Financial Goals and Risk Tolerance:

The suitability of annuities depends on individual factors:

- Age and retirement goals: For those close to retirement with limited income sources, annuities offering guaranteed income streams can be beneficial.

- Risk tolerance: Annuities offer stability but lower potential returns, making them suitable for low-risk investors.

- Investment portfolio diversification: They can provide diversification and income within a balanced portfolio, but shouldn't be the sole investment vehicle.

5. Pre-Annuity Discussions and Considerations:

- Consultation with a financial advisor: Seek professional guidance to determine if an annuity aligns with your specific financial goals and risk tolerance.

- Review fees and surrender charges: Carefully understand all associated costs and penalties before committing your money.

- Compare potential returns: Analyze potential returns of an annuity versus alternative investment options based on your financial situation.

- Assess liquidity needs: Ensure the chosen annuity type offers sufficient flexibility for potential future needs.

- Ask questions and clarify doubts: Don't hesitate to ask detailed questions about the annuity contract and its implications before signing.

Remember, annuities can be a valuable tool for some investors, but their suitability depends greatly on individual circumstances and financial goals. By understanding the criticisms, drawbacks, and alternatives, you can make informed decisions and select investment options that align with your long-term financial well-being.