What is macro economy?

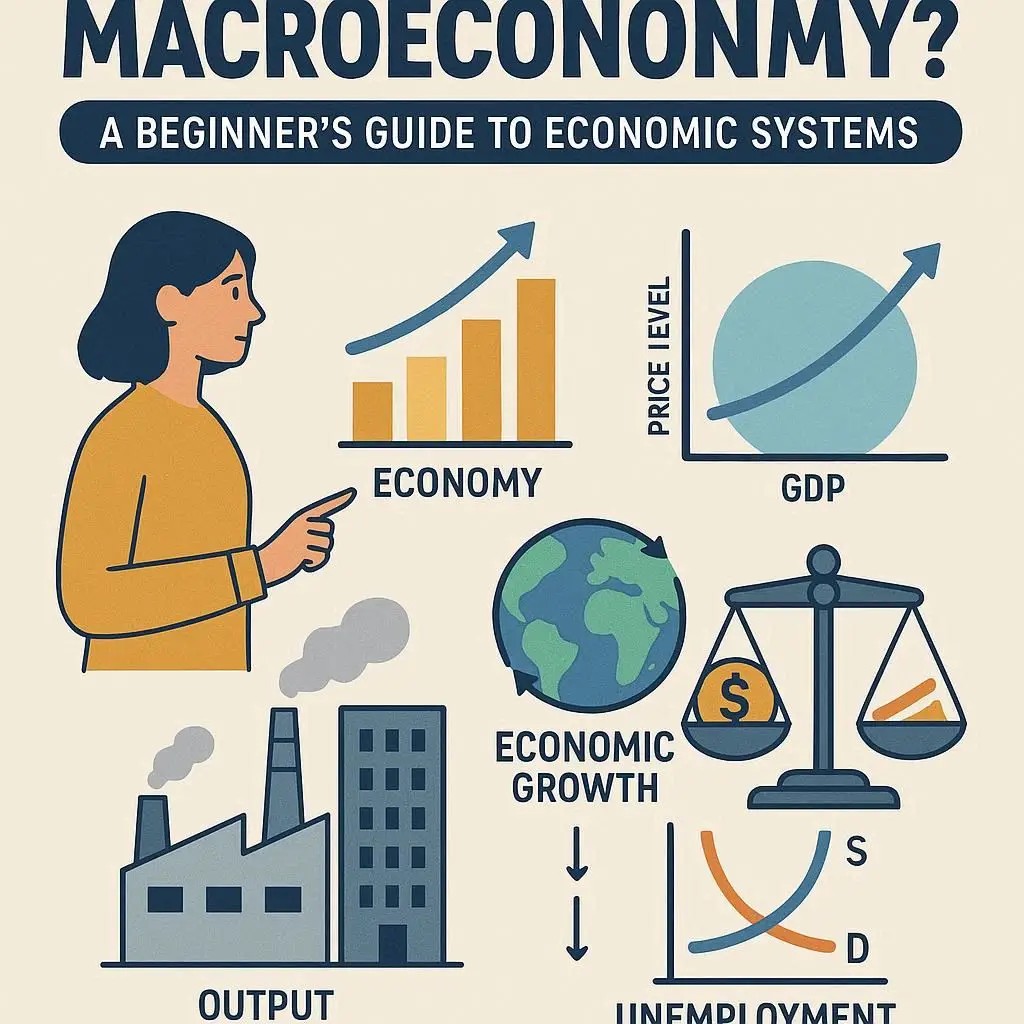

What Is Macroeconomy? A Beginner’s Guide to Economic Systems

When people talk about “the economy,” they’re often referring to the macroeconomy—the big picture of how money, goods, services, and resources move within a country or even the world. But what exactly does macroeconomy mean, and why is it important? Let’s break it down in simple terms.

What Is the Macroeconomy?

The macroeconomy refers to the overall economic system of a country or region, focusing on large-scale factors rather than individual businesses or consumers. It looks at how the economy works as a whole and how different parts—like households, companies, governments, and international trade—interact with each other.

While microeconomics studies individual decisions (like how one family budgets money or how one company sets prices), macroeconomics zooms out to study the big trends that shape national and global economies.

Key Elements of the Macroeconomy

A beginner’s guide wouldn’t be complete without looking at the main areas economists study when analyzing the macroeconomy:

1. Gross Domestic Product (GDP)

GDP measures the total value of goods and services produced in a country. It’s one of the most important indicators of economic health.

2. Employment and Unemployment

The macroeconomy looks at job creation, unemployment rates, and labor force participation, since they reflect how well an economy uses its workforce.

3. Inflation and Prices

Inflation tracks how prices rise over time. Economists study inflation to ensure money keeps its value and that wages can support living costs.

4. Government Policy (Fiscal Policy)

Governments influence the macroeconomy through spending, taxation, and borrowing. Fiscal policies can stimulate growth or slow down an overheating economy.

5. Money and Banking (Monetary Policy)

Central banks, like the Federal Reserve in the U.S., regulate money supply and interest rates to keep the economy stable.

6. International Trade

The macroeconomy also considers imports, exports, exchange rates, and how countries interact in the global market.

Why Understanding the Macroeconomy Matters

Understanding the macroeconomy helps people make sense of everyday issues like:

Why prices at the grocery store rise

Why interest rates on loans or mortgages change

Why job opportunities grow or shrink

Why governments adjust taxes or spending

For businesses, it helps with planning investments and predicting market demand. For individuals, it explains how global and national events affect personal finances.

The macroeconomy is the big-picture view of how an entire economy functions. By studying things like GDP, unemployment, inflation, and government policy, economists—and everyday people—can better understand the forces shaping their financial lives.

In short, while microeconomics looks at the trees, macroeconomics studies the whole forest.

Microeconomy vs. Macroeconomy at a Glance

| Aspect | Microeconomy | Macroeconomy |

|---|---|---|

| Focus | Individual households, firms, and markets | The economy as a whole |

| Scope | Small-scale decisions | Large-scale national & global trends |

| Key Topics | Supply & demand, pricing, consumer choices, competition | GDP, unemployment, inflation, government policy, trade |

| Questions Asked | “How does one company set its prices?” | “Why is unemployment rising in the country?” |

| Goal | Understand individual behavior in markets | Understand overall economic performance |

| Example | Why coffee prices at one café go up | Why the cost of living in an entire country increases |

What are the core concepts and goals of macroeconomics?

Macroeconomics is the branch of economics that studies the behavior and performance of an economy as a whole.

How does macroeconomics differ from microeconomics?

The key difference between macroeconomics and microeconomics is the scope of their study.

What are some key indicators used in macroeconomics, such as GDP and inflation?

Macroeconomists use several key indicators to measure and assess the health of an economy.

Gross Domestic Product (GDP): This is the total monetary value of all goods and services produced within a country's borders in a specific time period.

It serves as a primary measure of economic output and size. Inflation: This refers to a general increase in the prices of goods and services over time, which reduces the purchasing power of money. The most common measure is the Consumer Price Index (CPI), which tracks the average change in prices for a basket of consumer goods.

Unemployment Rate: This is the percentage of the labor force that is jobless and actively seeking employment.

It's a key indicator of the health of the labor market and overall economic activity. Interest Rates: These are the cost of borrowing money and the return on savings, typically set by a country's central bank.

They influence consumer spending, business investment, and inflation.

What is the role of government policy in influencing a macroeconomy?

Government policy plays a crucial role in influencing the macroeconomy, primarily through two main tools:

Fiscal Policy: This involves the government's use of its spending and taxation powers to influence economic activity.

For example, during a recession, a government might increase its spending on infrastructure projects or cut taxes to boost aggregate demand and create jobs. Conversely, it might raise taxes or cut spending to slow down an overheated economy and fight inflation. Monetary Policy: This is the process by which a central bank, such as the U.S. Federal Reserve, manages the money supply and interest rates to achieve macroeconomic goals.

To stimulate the economy, a central bank might lower interest rates to make borrowing cheaper, encouraging spending and investment. To combat inflation, it might raise interest rates to reduce the money supply and cool down economic activity.

What are some of the main schools of thought in macroeconomics?

Over time, different schools of thought have emerged to explain how the macroeconomy functions and what policies are most effective.

Classical Economics: Based on the ideas of economists like Adam Smith, this school believes that markets are self-regulating and will naturally return to full employment without government intervention.

Keynesian Economics: Developed by John Maynard Keynes in response to the Great Depression, this school argues that government intervention, particularly through fiscal policy, is necessary to stabilize the economy and combat unemployment during recessions.

Monetarism: Led by Milton Friedman, this school emphasizes the role of the money supply in influencing economic activity.

Monetarists believe that stable economic growth can be achieved by controlling the rate at which the money supply grows. New Classical Economics: This modern school extends classical ideas, incorporating rational expectations into its models.

It suggests that government policies are often ineffective because individuals and firms will anticipate and counteract them. New Keynesian Economics: This school, a modern adaptation of Keynesianism, accepts the idea of rational expectations but argues that market imperfections, such as "sticky" prices and wages, can cause market failures and justify a role for government intervention.