What is the current ratio in accounting?

The current ratio is a financial metric used in accounting to assess a company's short-term liquidity and its ability to cover its short-term obligations with its short-term assets. It is also known as the working capital ratio or liquidity ratio. The current ratio is expressed as a ratio, and it is calculated by dividing a company's current assets by its current liabilities. The formula for the current ratio is:

Here's a breakdown of the components:

Current Assets:

- Current assets are assets that are expected to be converted into cash or used up within one year or the operating cycle of the business, whichever is longer. Examples include cash, accounts receivable, inventory, and short-term investments.

Current Liabilities:

- Current liabilities are obligations that the company is expected to settle within one year or the normal operating cycle. This category includes accounts payable, short-term debt, accrued liabilities, and other obligations due in the short term.

The current ratio provides insight into a company's ability to meet its short-term financial obligations. A ratio above 1 indicates that the company has more current assets than current liabilities, suggesting a potentially healthy liquidity position. However, a very high current ratio might also indicate that the company is not efficiently using its resources.

On the other hand, a current ratio below 1 may signal potential difficulties in meeting short-term obligations, raising concerns about liquidity. It's essential to consider industry benchmarks and the company's specific circumstances when interpreting the current ratio.

Keep in mind that while the current ratio provides valuable information about short-term liquidity, it does not provide a complete picture of a company's overall financial health. It should be used in conjunction with other financial ratios and qualitative analysis for a more comprehensive assessment.

Understanding Current Ratio in Accounting:

1. Definition and Calculation:

The current ratio, also known as the working capital ratio, is a financial metric used to assess a company's short-term liquidity or its ability to pay its short-term obligations (due within one year) with its current assets.

Formula: Current Ratio = Current Assets / Current Liabilities

- Current Assets: Include cash, inventory, accounts receivable, prepaid expenses, and other assets expected to be converted to cash within a year.

- Current Liabilities: Include accounts payable, accrued expenses, short-term debt, and other obligations due within a year.

2. Reflecting Liquidity Position:

A higher current ratio indicates a better liquidity position. It means the company has more current assets readily available to cover its short-term debts, suggesting a lower risk of defaulting on these obligations. Conversely, a lower ratio raises concerns about potential liquidity issues and the company's ability to meet its short-term commitments.

3. Benchmarks and Standards:

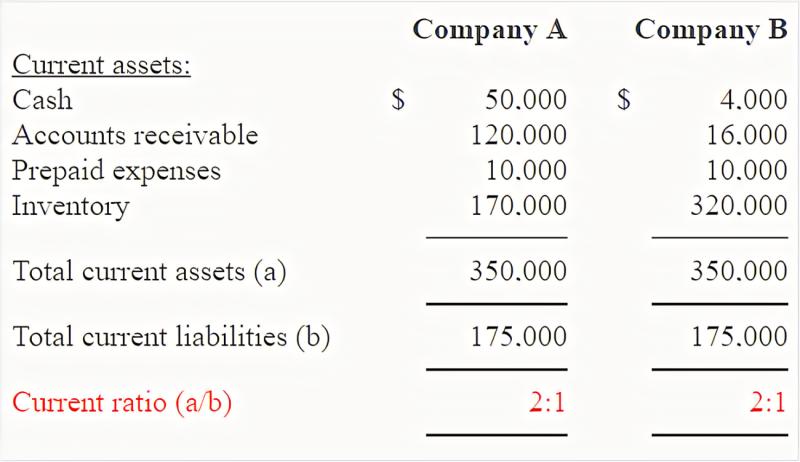

There's no one-size-fits-all ideal current ratio, as it can vary significantly across industries and company sizes. However, some general benchmarks exist:

- 2:1 or higher: Generally considered good, indicating sufficient current assets to cover liabilities.

- 1:1 to 2:1: Indicates moderate liquidity, requiring closer monitoring.

- Below 1:1: Raises concerns about potential liquidity problems and possible difficulty meeting short-term obligations.

Remember:

- Industry specifics matter. A healthy ratio for one industry might not be for another.

- Consider company size and growth stage. Smaller companies or those in rapid growth might have lower ratios due to higher investment needs.

- Long-term solvency also matters. A good current ratio doesn't guarantee long-term financial health.

Additional Notes:

- Analyzing the current ratio alongside other financial metrics like the quick ratio and debt-to-equity ratio provides a more comprehensive picture of a company's financial health.

- Trends over time are crucial. A declining current ratio could signal potential trouble, even if it falls within the general benchmark range.

By understanding the current ratio and its limitations, you can gain valuable insights into a company's short-term financial health and make informed investment or business decisions.