Explore State Programs

Explore property tax relief programs across the United States. Click on a state to view detailed information about its exemptions, deferrals, and other programs for seniors. Please note that program details can change; always verify with your local tax assessor's office.

Select a State

Click on a state in the map to see its senior property tax relief details here.

Understanding Relief Programs

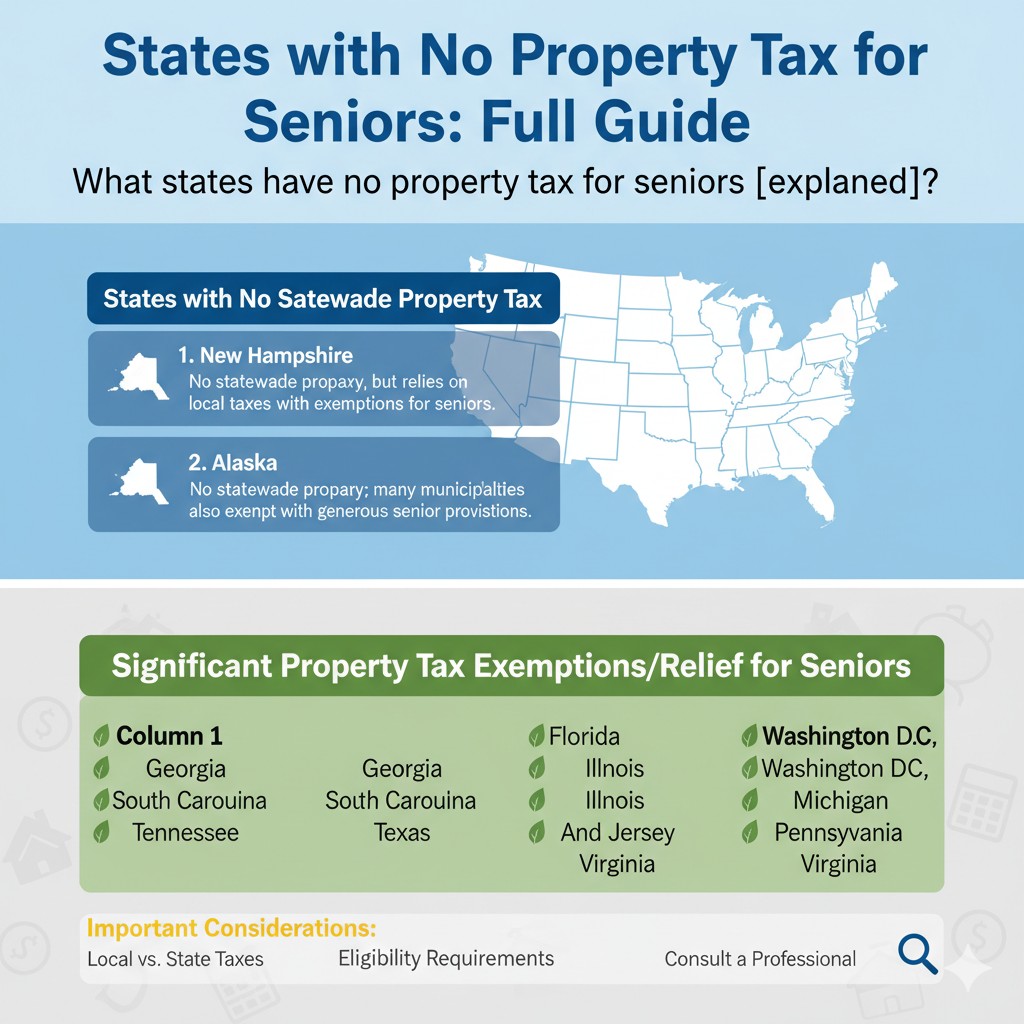

While no state offers a complete elimination of property taxes for all seniors, nearly all provide some form of relief. These programs generally fall into three categories. Click each type to learn more about how they function.

This is the most common type of relief. An exemption, often called a "homestead exemption," removes a portion of your home's value from taxation. For example, if your home is valued at $300,000 and you receive a $50,000 exemption, you will only be taxed on a value of $250,000. The amount varies significantly by state and sometimes by local jurisdiction.

A tax freeze locks in the property tax rate or the assessed value of your home at the level it was when you qualified. This protects you from future increases in property values or tax rates, making your annual tax bill predictable. This is particularly valuable in areas with rapidly rising home prices.

Deferral programs allow seniors to postpone paying their property taxes until a later date, typically when the home is sold or upon the owner's death. The deferred taxes accrue as a lien on the property, often with interest, which must be paid back from the proceeds of the sale. This can help seniors with limited cash flow remain in their homes.

Common Eligibility Requirements

While specific requirements vary, most states have similar criteria for their senior property tax relief programs. This section outlines the most common eligibility factors. The chart below shows the typical minimum age requirements across the states that offer these programs.

Age

Most programs require homeowners to be at least 65 years old. However, some states set the minimum age as low as 61, and others offer benefits for surviving spouses who may be younger.

Residency & Ownership

You must typically own and occupy the property as your primary residence (domicile). Many states also have a minimum residency period, requiring you to have lived in the state and/or home for a certain number of years.

Income Limits

Many, but not all, relief programs are means-tested. This means your annual household income must be below a certain threshold to qualify. These limits can range from very low (under $20,000) to more moderate levels (over $75,000) and are often adjusted for inflation.

How to Apply for Relief

Applying for senior property tax relief is a proactive process; the benefits are not automatic. Follow these general steps to ensure you receive any relief you are entitled to. The process is handled at the local level, so your primary point of contact will be your county or municipal tax office.

Contact Your Local Tax Assessor

This is the most critical first step. Your local tax assessor's or collector's office administers these programs. Visit their website or call them to confirm your state and county's specific programs, eligibility requirements, and deadlines.

Gather Necessary Documents

You will likely need to provide proof of age, residency, and income. Common documents include a driver's license or birth certificate, utility bills or property deeds, and copies of your federal income tax returns or Social Security benefit statements.

Complete and Submit the Application

Fill out the application form completely and accurately. These forms are typically available for download from your county's website. Pay close attention to the filing deadline, as late applications are often rejected.

Re-apply or Renew as Needed

Some states require you to re-apply for the exemption each year, while others have an automatic renewal process. Be sure to clarify whether you need to take any action in subsequent years to maintain your tax relief.