What is the formula for marginal profit?

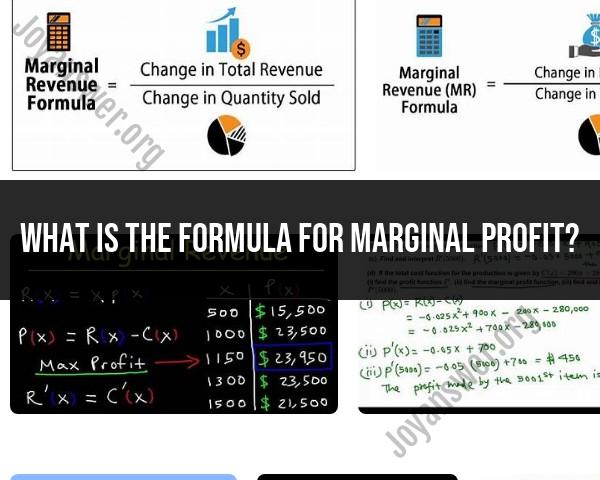

The marginal profit represents the additional profit generated by producing and selling one more unit of a product. The formula for calculating marginal profit is derived from the change in total profit concerning a change in the quantity of units sold. The marginal profit formula is as follows:

Here:

- is the change in total profit.

- is the change in the quantity of units sold.

Alternatively, you can express it using calculus as the derivative of the total profit function with respect to quantity:

In practical terms, you may need to use historical data or business projections to determine the change in total profit and the change in quantity, allowing you to calculate the marginal profit for a specific quantity change. Keep in mind that marginal profit is a useful concept in business decision-making, helping companies optimize production levels and pricing strategies to maximize overall profitability.

Marginal Profit: Formula and Applications

1. Marginal Profit Formula:

The formula for calculating marginal profit is:

Marginal Profit (MP) = Marginal Revenue (MR) - Marginal Cost (MC)

- Marginal Revenue (MR): The additional revenue earned from selling one more unit of a product.

- Marginal Cost (MC): The additional cost incurred to produce and sell one more unit of a product.

2. Decision-Making in Business:

Marginal profit plays a crucial role in various business decisions by revealing the profitability of producing and selling additional units. Here are some key scenarios:

- Pricing: Businesses can use marginal profit to determine optimal pricing strategies by analyzing how price changes impact both marginal revenue and marginal cost.

- Production Levels: By comparing marginal profit to fixed costs, businesses can decide when increasing production is no longer profitable.

- Product Mix: Analyzing the marginal profits of different products helps businesses allocate resources efficiently and focus on offerings with higher profit potential.

- Special Offers: Understanding the impact of discounts or promotions on marginal profit helps businesses assess their effectiveness and potential profitability.

3. Practical Examples:

- A bakery owner is considering adding a new type of cake to their menu. They calculate the marginal cost of ingredients, labor, and marketing for each cake. They also estimate the price they can charge and the likely sales volume. By calculating the marginal profit, they can decide if the new cake is a worthwhile addition.

- A clothing store is running a discount promotion. They track the change in sales volume and the discounted price per item. By calculating the marginal profit before and after the discount, they can assess the effectiveness of the promotion and its impact on overall profit.

- A manufacturer is considering outsourcing production of a specific component. They compare the marginal cost of in-house production with the quoted price from the outsourcing company. By calculating the marginal profit in both scenarios, they can decide whether outsourcing is a cost-effective option.

Remember, marginal profit analysis is a valuable tool for informed decision-making, but it should be considered alongside other factors like overall market conditions, competitor strategies, and long-term business goals.