What is modern macroeconomics?

Modern macroeconomics is the study of the economy as a whole—focusing on aggregate outcomes like GDP, inflation, unemployment, interest rates, and economic growth—using contemporary theories, models, and tools developed since the mid-20th century.

Key Features of Modern Macroeconomics

Aggregate Focus

Looks at the economy’s big picture rather than individual markets (that’s microeconomics).

Studies national income, total spending, overall employment, and price levels.

Dynamic Models

Uses mathematical and computational models (like Dynamic Stochastic General Equilibrium, DSGE models) to analyze how economies evolve over time under uncertainty.

Microeconomic Foundations

Unlike older approaches, modern macro builds models from individual behavior (households, firms, governments) and how their choices aggregate.

Policy-Oriented

Strong focus on the role of monetary policy (central banks controlling interest rates and money supply) and fiscal policy (government spending and taxation).

Expectations Matter

Incorporates rational expectations (people form expectations about the future based on available information) which affect consumption, investment, and inflation.

Global and Open-Economy Perspective

Recognizes that trade, capital flows, and globalization affect domestic economies.

Major Schools of Thought in Modern Macroeconomics

Keynesian Economics – emphasizes government intervention to stabilize demand during recessions.

Monetarism – stresses the role of money supply and central banks in controlling inflation.

New Classical Economics – focuses on rational expectations and market efficiency.

New Keynesian Economics – combines Keynesian ideas with microfoundations, explaining price stickiness and justifying policy intervention.

Real Business Cycle (RBC) Theory – attributes economic fluctuations to technology and productivity shocks, not just demand shifts.

Key Concepts

GDP (Gross Domestic Product) – the value of goods and services produced in a country.

Inflation & Deflation – changes in the general price level.

Unemployment – measurement and causes of joblessness.

Business Cycles – expansions and recessions in economic activity.

Economic Growth – long-run increases in output per person.

Stabilization Policies – tools to reduce volatility and support growth.

In short:

Modern macroeconomics is about understanding, modeling, and managing the overall economy—using advanced tools, microeconomic underpinnings, and global perspectives to guide policies that stabilize inflation, reduce unemployment, and foster sustainable growth.

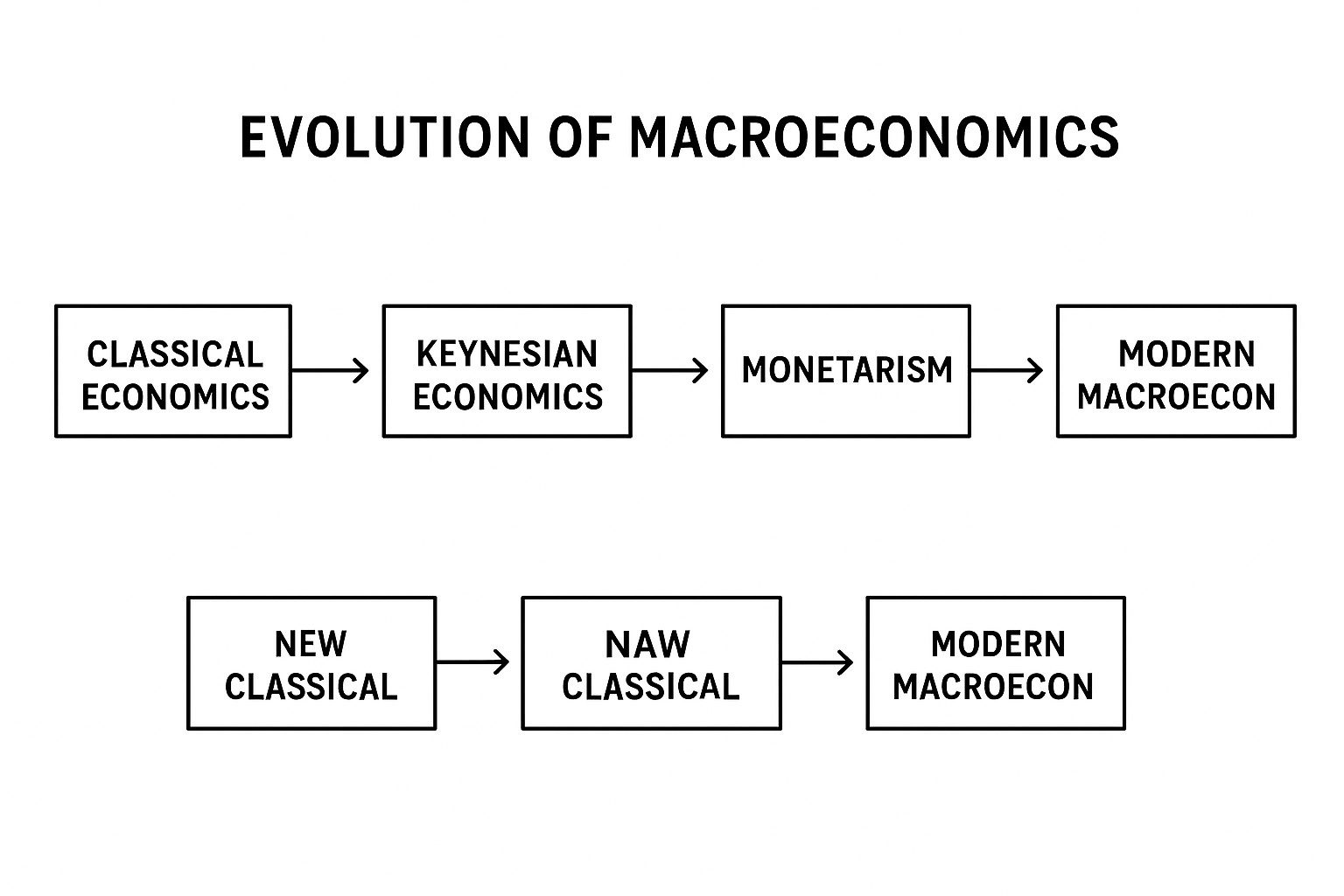

Here’s a visual timeline of the evolution of macroeconomics, showing how the field developed from classical theories to modern approaches:

Timeline: Evolution of Macroeconomics

| Period | School/Approach | Key Focus & Concepts |

|---|---|---|

| 18th–19th Century | Classical Economics | Adam Smith, David Ricardo. Focused on free markets, self-regulating economies, Say’s Law (supply creates its own demand), long-run growth. |

| 1930s–1940s | Keynesian Economics | John Maynard Keynes. Emphasized aggregate demand, government intervention, fiscal policy to combat unemployment and recessions. |

| 1950s–1960s | Neo-Keynesian Economics | Integrated Keynesian ideas with mathematical modeling; focused on equilibrium and consumption/investment functions. |

| 1970s | Monetarism | Milton Friedman. Highlighted money supply’s role in controlling inflation; skepticism of discretionary fiscal policy. |

| 1970s–1980s | New Classical Economics | Robert Lucas. Rational expectations; markets clear quickly; emphasized microfoundations of macro behavior. |

| 1980s–1990s | New Keynesian Economics | Combined Keynesian policies with microeconomic foundations; explained price stickiness and menu costs; justified monetary/fiscal interventions. |

| 1980s–present | Real Business Cycle (RBC) Theory | Focus on productivity shocks, technology changes as drivers of economic fluctuations. |

| 1990s–present | Modern Macroeconomics / DSGE Models | Advanced computational models; integrates microfoundations, expectations, stochastic shocks; used for policy simulations by central banks. |

Summary:

Classical → Keynesian → Neo/Monetarist → New Classical/New Keynesian → Modern Macro

Modern macro relies heavily on mathematical modeling, microeconomic foundations, and policy analysis to understand economic fluctuations and guide interventions.

Modern macroeconomics is primarily characterized by a microfounded approach, meaning it builds aggregate models from the decisions of individual, optimizing agents like households and firms. This contrasts with earlier models that relied on observed relationships between aggregate variables without a strong theoretical basis for individual behavior.

1. Defining Characteristics of Modern Macroeconomics

Microfoundations: Modern models are built from the ground up, starting with the behavior of individual households and firms.

This provides a more consistent and rigorous foundation than older, aggregate-level models. Rational Expectations: Agents in the economy are assumed to be forward-looking.

They don't just react to past events; they anticipate future policy changes and economic conditions and adjust their behavior accordingly. This assumption has profound implications for the effectiveness of government policy. Stochastic Shocks: Economic fluctuations are explained as responses to random, unpredictable shocks.

These can be supply shocks (like a sudden oil price increase), technology shocks, or preference shocks. Modern models analyze how these shocks are transmitted throughout the economy. Emphasis on the Business Cycle: A major focus is on understanding the causes of short-run economic fluctuations—the business cycle—and how they differ from long-run economic growth.

Dynamic Analysis: Modern models are inherently dynamic, meaning they consider how current decisions affect future outcomes and how future expectations influence current behavior.

2. How Macroeconomics Evolved Since Keynes

John Maynard Keynes's work, particularly The General Theory (1936), was a revolutionary departure from the classical view that markets would self-correct.

The Neoclassical Synthesis (1950s-1970s): Following Keynes, a new generation of economists created a "neoclassical synthesis," which combined Keynes's ideas about short-run demand management with the classical view that markets would return to full employment in the long run.

This was the dominant school of thought for decades. The Monetarist and New Classical Critique (1970s): The high inflation and stagnant growth ("stagflation") of the 1970s challenged the Keynesian consensus.

Monetarists, led by Milton Friedman, argued that changes in the money supply were the primary cause of inflation. New Classical economists, like Robert Lucas, introduced the concept of rational expectations, arguing that traditional Keynesian policy was ineffective because people would anticipate it and change their behavior, nullifying its intended effect. New Keynesian Economics (1980s-Present): In response to the New Classical critique, New Keynesians sought to provide microfoundations for traditional Keynesian ideas.

They introduced concepts like "sticky wages" and "sticky prices" to explain why markets don't clear instantly, thereby justifying the continued relevance of monetary and fiscal policy in the short run. This school of thought is the basis for much of modern mainstream macroeconomics.

What is a Dynamic Stochastic General Equilibrium (DSGE) model?

A Dynamic Stochastic General Equilibrium (DSGE) model is the workhorse of modern macroeconomics.

Dynamic: It models how decisions made in the present affect the future.

Stochastic: It incorporates random shocks that drive economic fluctuations.

General Equilibrium: It models the entire economy as a system where all markets (goods, labor, financial) are interconnected and jointly determined.

Agent-based: It builds on the idea that economic outcomes are the result of individuals and firms optimizing their behavior.

DSGE models are used by central banks and other policy institutions to simulate the effects of policy changes and external shocks on the economy.

4. Major Debates and Controversies in Modern Macroeconomics

Rules vs. Discretion: This debate concerns whether central banks should follow a rigid, predictable rule for setting interest rates or have the discretion to react to economic conditions as they see fit. Proponents of rules argue they prevent a "time inconsistency" problem, where a central bank might promise low inflation but later renege to stimulate growth.

Fiscal Policy vs. Monetary Policy: A long-standing debate revolves around which type of policy is more effective for stabilizing the economy. The global financial crisis of 2008 and the COVID-19 pandemic led to a resurgence of interest in fiscal policy (government spending and taxation), though monetary policy (interest rates and money supply) remains the primary tool for most central banks.

The Zero Lower Bound (ZLB): A major challenge for central banks since 2008 is that their primary tool—interest rates—cannot be lowered below zero. This has prompted debates about unconventional monetary policies, like quantitative easing (QE), and whether they have long-term side effects.

Rational Expectations vs. Bounded Rationality: While rational expectations are a cornerstone of modern theory, a growing body of work in behavioral economics and behavioral macroeconomics argues that humans have cognitive limitations and often act in ways that are not fully rational.

5. The Role of Central Banks in Modern Macroeconomic Theory

In modern macroeconomic theory, central banks are viewed as the key institutions responsible for monetary policy.

Inflation Targeting: Many central banks, including the Federal Reserve and the European Central Bank, operate under a framework of inflation targeting, where they explicitly or implicitly aim to keep inflation around a specific target, typically 2%.

Managing Expectations: Central bank communication is a critical part of modern monetary policy.

By clearly communicating their goals and policy intentions, central banks can influence private sector expectations about future inflation and economic growth, which can make their policies more effective. Lender of Last Resort: Central banks also act as a "lender of last resort" to commercial banks during a financial crisis, providing liquidity to prevent bank runs and the collapse of the financial system.

The global financial crisis of 2008 and the COVID-19 pandemic demonstrated the critical importance of this function.