1. How does a personal loan affect your credit score?

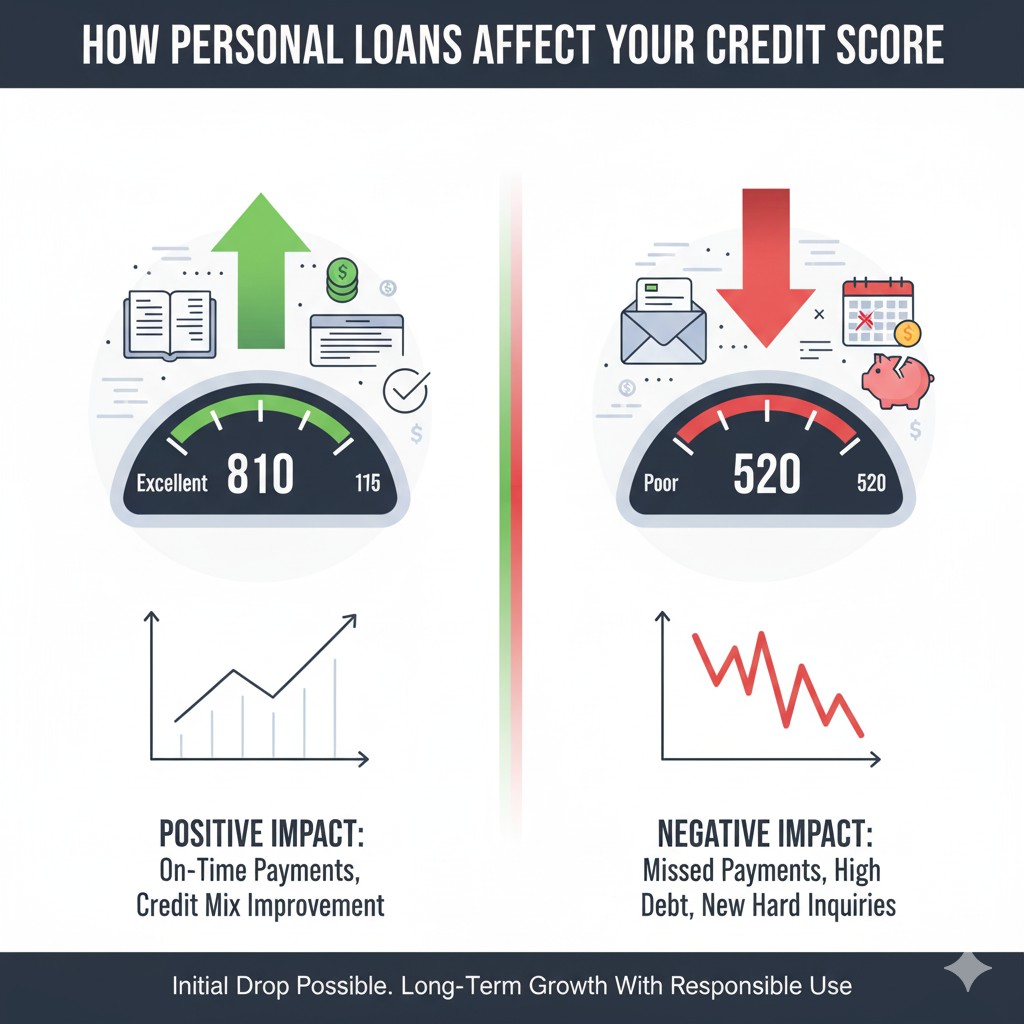

Personal loans can affect your credit score in several ways. Below are the most important impacts:

- Hard inquiry: When you apply, lenders usually run a hard credit check which may lower your score by a few points temporarily.

- New credit account: Opening a new loan adds a tradeline, which can reduce your average account age — potentially lowering the score initially.

- Payment history: On-time payments boost your score; missed or late payments damage it significantly.

- Credit mix: Having installment loans (like personal loans) can improve your credit mix, which helps your score.

- Reducing credit card utilization: Using a personal loan to pay down credit card balances can reduce revolving utilization and may raise your score.

2. Secured vs Unsecured Personal Loans

Secured personal loan: Backed by collateral such as a vehicle, savings account, or other asset. Because collateral lowers lender risk, secured loans usually have lower interest rates and may be available to borrowers with weaker credit. Defaulting can lead to loss of the collateral.

Unsecured personal loan: Not backed by collateral; approval is based on credit history, income, and debt-to-income ratio. These loans usually have higher interest rates and stricter qualification criteria. Defaulting doesn’t immediately forfeit property but results in collections and severe credit damage.

3. How a personal loan can help improve your credit score

- Consolidate high-interest revolving debt: Move credit card balances to an installment loan — this lowers utilization and makes payments more predictable.

- Build positive payment history: Consistent on-time monthly payments are the single most important driver of a higher score.

- Diversify your credit mix: If you only have credit cards, adding an installment loan can help scoring models that prefer a mix of credit types.

- Set and follow a repayment plan: Use a realistic budget so you avoid missed payments that would hurt your score.

Note: Improvement takes time. Scores are updated as lenders report payments (usually monthly), and it can take several billing cycles to see meaningful changes.

4. Factors that determine your credit score

While scoring models vary (FICO vs VantageScore), most use similar categories and weights:

- Payment history (≈35%): Whether you pay on time.

- Amounts owed / Utilization (≈30%): How much of your available credit you're using.

- Length of credit history (≈15%): Average age of accounts and how long specific accounts have been open.

- Credit mix (≈10%): Different types of credit (credit cards, installment loans, mortgages, etc.).

- New credit (≈10%): Recent inquiries and recently opened accounts.

5. What is a good credit score?

Common FICO score ranges (approximate):

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800–850: Exceptional

Different lenders and models treat these ranges differently; what’s “good” for a credit card might differ from a mortgage or prime personal loan offer.

Frequently Asked Questions

Next steps & tips

- Compare loan offers (APR, fees, term) and check whether the lender reports to major credit bureaus.

- Use a personal loan for consolidation only if it lowers your interest and you have a plan to avoid accruing new card debt.

- Automate payments to avoid late payments.

- Monitor your credit with free services and get a free annual report from each bureau.

Interactive: Estimate Your Score Impact

Use this estimator to see a rough effect. This is an educational tool — real outcomes vary by credit profile and lender.