What is the equation for predicting 24 months after they went public?

Predictive modeling involves using mathematical and statistical techniques to create models that forecast future outcomes based on historical data and relevant variables. When it comes to anticipating the performance of a company post-IPO (Initial Public Offering), several factors can be considered in predictive modeling. While there isn't a specific "one-size-fits-all" equation for this complex task, here's an overview of the process and some key factors to consider:

1. Data Collection and Variables:

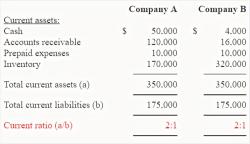

- Gather historical financial data, market trends, industry data, and other relevant information for both the company and its peers in the same industry.

- Variables to consider might include revenue growth, profit margins, debt levels, market share, industry growth rate, competitive landscape, and more.

2. Feature Selection:

- Identify the most relevant variables that could impact the post-IPO performance.

- Use techniques like regression analysis, correlation, and domain expertise to select the most influential factors.

3. Model Building:

- Choose an appropriate modeling technique based on the nature of the data and the problem, such as linear regression, logistic regression, decision trees, or machine learning algorithms.

- Split the data into training and testing sets to train and validate the model's accuracy.

4. Model Evaluation:

- Assess the model's performance using appropriate evaluation metrics, such as mean squared error, R-squared, or accuracy.

- Refine the model as needed by adjusting variables or techniques to improve predictions.

5. Interpretation:

- Analyze the coefficients or feature importance scores to understand the impact of each variable on the predicted outcome.

- This step can provide insights into which factors are the strongest predictors of post-IPO performance.

6. Continuous Monitoring and Refinement:

- Predictive models should be regularly updated and refined as new data becomes available and the company's performance unfolds post-IPO.

- Continuous monitoring helps improve the accuracy of the predictions and adapt to changing market conditions.

While a precise equation might not be available due to the complexity and dynamic nature of post-IPO performance, predictive modeling offers a structured approach to anticipate performance by leveraging historical data and relevant variables. Keep in mind that predictive modeling is not without limitations, and external factors like economic changes, industry shifts, and unforeseen events can impact a company's performance post-IPO.

For accurate and effective predictive modeling in the context of a specific company's post-IPO performance, it's advisable to collaborate with experienced data analysts, financial experts, and industry professionals who can tailor the approach to the company's unique circumstances.