Can two-stage least squares be used to estimate a full system of equations?

Yes, two-stage least squares (2SLS) can be used to estimate a full system of equations, especially in the context of econometrics and structural equation modeling. 2SLS is a statistical technique that is commonly employed when you have a system of equations with endogeneity or when you need to address issues related to simultaneous equations.

Here's how the process works:

Identification: In a system of equations, you may have endogenous variables that are correlated with the error terms. 2SLS helps address this by first finding instrumental variables (IVs) that are correlated with the endogenous variables but not correlated with the error terms. This is often done in the identification stage.

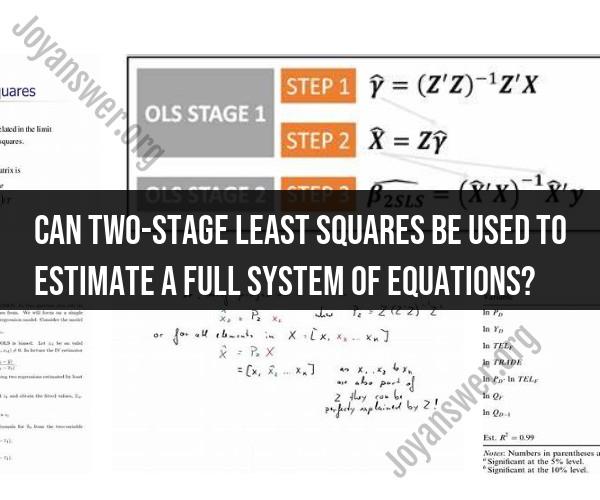

First Stage Regression: In the first stage of 2SLS, you regress the endogenous variables on the IVs to obtain predicted values for the endogenous variables. These predicted values are used as proxies for the true, but unobservable, values of the endogenous variables.

Second Stage Estimation: In the second stage, you use the predicted values from the first stage in your structural equations. You estimate the full system of equations using these predicted values as if they were observed, non-endogenous variables. This helps correct for the endogeneity problem.

Inference: Finally, you perform inference tests and assess the goodness of fit for your estimated model.

The use of 2SLS can be particularly valuable when you have a system of equations where some variables are endogenous (i.e., influenced by other variables in the system) and you want to obtain consistent and unbiased parameter estimates. It's a useful technique in econometrics for dealing with issues like simultaneous equations and omitted variable bias in structural equation modeling.