Do Morningstar fund ratings help investors?

Morningstar fund ratings can be a useful tool for investors seeking information and guidance when evaluating mutual funds and other investment vehicles. Morningstar is a widely recognized financial services company that provides independent investment research and analysis. Morningstar assigns ratings to mutual funds based on various factors, and these ratings can offer investors valuable insights. Here's how Morningstar fund ratings can help investors:

Objective Evaluation:

- Morningstar's fund ratings are based on a rigorous and systematic evaluation process. They consider both quantitative and qualitative factors, including historical performance, risk-adjusted returns, fund manager expertise, fees, and other relevant criteria. This provides investors with an objective and comprehensive assessment of a fund's attributes.

Consolidated Information:

- Morningstar condenses a significant amount of information into a simple and easy-to-understand rating system. This helps investors quickly assess the overall quality of a fund without delving into extensive details. The ratings provide a snapshot of a fund's past performance and key characteristics.

Performance Comparison:

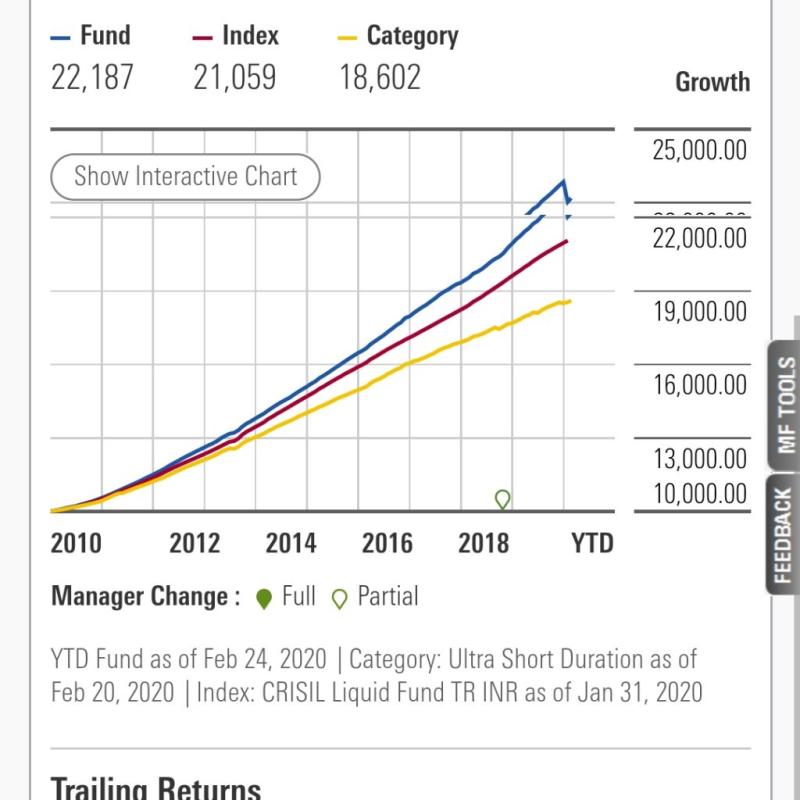

- Morningstar fund ratings allow investors to compare the performance of different funds within the same category. The ratings help identify funds that have consistently outperformed their peers or have exhibited strong risk-adjusted returns.

Risk Assessment:

- Morningstar considers risk factors when assigning fund ratings. Investors can use these ratings to gauge the level of risk associated with a particular fund. This includes an assessment of volatility, downside risk, and other factors that may impact investment returns.

Long-Term Perspective:

- Morningstar's ratings are based on a long-term perspective, considering a fund's performance over multiple years. This approach helps investors assess a fund's ability to deliver consistent returns and navigate various market conditions.

Fund Manager Evaluation:

- Morningstar evaluates the expertise and track record of fund managers. This information is crucial for investors who want to understand the leadership behind a fund and assess the manager's ability to make sound investment decisions.

Fee Considerations:

- Morningstar considers the fees associated with a fund when assigning ratings. Lower-cost funds may receive higher ratings if they deliver competitive performance, providing investors with insights into the cost-effectiveness of a particular investment.

Morningstar Medalist Ratings:

- In addition to the star ratings, Morningstar designates certain funds as "Medalist" funds. These are funds that Morningstar analysts believe have a strategic advantage or stand out in terms of their overall quality.

While Morningstar fund ratings offer valuable information, it's important for investors to use them as one part of a broader due diligence process. Consideration of individual investment goals, risk tolerance, and time horizon is crucial. Moreover, past performance does not guarantee future results, and investors should regularly review their investment portfolios to ensure alignment with their financial objectives.

Demystifying Morningstar Fund Ratings: Insights, Limitations, and Alternatives

Morningstar fund ratings have become a popular tool for investors seeking guidance on mutual fund selection. However, it's crucial to understand both their value and limitations before using them:

1. Valued Insights:

- Performance Comparison: Ratings offer a quick and accessible way to compare the past performance of various funds within a category.

- Risk Assessment: The star rating system (from 1 to 5 stars) provides a basic indicator of a fund's historical risk level.

- Analyst Insights: Beyond the star rating, Morningstar offers detailed analyst reports with qualitative assessments of a fund's management, strategy, and fees.

- Convenient Tool: The user-friendly website and mobile app provide easy access to ratings, reports, and other data for researching investment options.

2. Evaluation Factors:

- Risk-Adjusted Return: Morningstar's proprietary quantitative research methodology, called Morningstar Risk-Adjusted Return (MRAR), assesses a fund's performance relative to its peers while adjusting for risk.

- Consistency: Consistency of performance over extended periods plays a significant role in determining the star rating.

- Expenses: Management fees and other fund expenses are factored into the rating, as lower fees generally offer greater potential for long-term returns.

- Qualitative Analysis: Analyst reports consider additional factors like the fund's management team, investment strategy, and competitive landscape.

3. Limitations and Criticisms:

- Past Performance: Ratings reflect past performance, which may not guarantee future results. Market conditions and other factors can significantly impact future returns.

- Quantitative Bias: Overreliance on quantitative measures might overlook qualitative aspects like a fund's potential for future growth or its fit within a specific investment strategy.

- Short-Term Focus: The rating system's emphasis on recent performance might not capture the long-term potential of some funds.

- Subjectivity in Analyst Reports: Analyst reports, while valuable, involve subjective assessments and opinions that may differ from other analysts.

4. Using Ratings for Informed Decisions:

- Starting Point: Use ratings as a starting point for research, not the sole basis for investment decisions.

- Combine with Other Research: Consider factors like your investment goals, risk tolerance, and time horizon alongside the ratings.

- Read Analyst Reports: Thoroughly review analyst reports for deeper insights into a fund's strengths and weaknesses.

- Seek Professional Advice: Consult with a financial advisor for personalized recommendations tailored to your unique financial situation.

5. Alternative Sources:

- Lipper: Offers similar fund ratings and analysis along with a focus on fund flows and portfolio holdings.

- S&P Global Market Intelligence: Provides comprehensive data and analysis on mutual funds and other investment products.

- Bloomberg: Offers detailed fund data, news, and analysis for professional investors.

- Financial advisors: Professional advisors can offer personalized recommendations and guidance based on your specific needs and goals.

Remember, no single source provides all the information necessary for making informed investment decisions. Use Morningstar ratings and other tools as resources for research and combine them with your own analysis and professional advice to make confident choices for your portfolio.