Is current ratio good or bad?

The current ratio is not inherently good or bad; its interpretation depends on the specific circumstances of the company and the industry in which it operates. The current ratio is a measure of short-term liquidity, indicating a company's ability to cover its short-term liabilities with its short-term assets. Here's how to interpret the current ratio:

Current Ratio Above 1:

- A current ratio greater than 1 suggests that a company has more current assets than current liabilities. In general, a ratio above 1 is considered favorable because it indicates that the company should be able to cover its short-term obligations. However, a very high current ratio might imply that the company is not efficiently using its assets, as a significant portion is tied up in less productive assets.

Current Ratio Equal to 1:

- A current ratio of 1 means that a company's current assets are exactly equal to its current liabilities. While this technically indicates that the company can meet its short-term obligations, it provides little margin for unexpected changes or delays in cash inflows.

Current Ratio Below 1:

- A current ratio below 1 implies that a company may struggle to cover its short-term obligations with its current assets. This could raise concerns about liquidity risk and the company's ability to meet its near-term financial obligations.

It's important to consider the following when evaluating the current ratio:

Industry Standards:

- The acceptable range for the current ratio can vary by industry. Some industries naturally have lower current ratios due to their business models, while others may require higher liquidity.

Company History:

- Comparing the current ratio to the company's historical performance is essential. A significant deviation from the company's historical average may warrant further investigation.

Nature of Operations:

- Some companies, especially those with consistent and predictable cash flows, may operate well with lower current ratios. Others, with more uncertain cash flows, may need a higher current ratio for financial flexibility.

Other Financial Metrics:

- It's crucial to consider the current ratio alongside other financial metrics and ratios for a comprehensive view of the company's financial health. For example, combining it with the quick ratio (which excludes inventory) can provide additional insights.

In summary, the current ratio is a valuable tool for assessing short-term liquidity, but it should be evaluated in the context of the company's industry, historical performance, and other financial indicators. It's not inherently good or bad but serves as a part of a broader financial analysis.

The current ratio, a key financial metric, provides valuable insights into a company's short-term liquidity and ability to meet its immediate obligations. Evaluating a company's financial health requires understanding the implications of a high or low current ratio.

A high current ratio: Interpreting the potential benefits and drawbacks

A high current ratio, generally above 2:1, indicates that a company has ample current assets to cover its short-term liabilities. This can be advantageous in several ways:

Enhanced Liquidity: The company has a greater cushion to meet its immediate obligations, reducing the risk of insolvency or default.

Increased Confidence: Investors and creditors view a company with a high current ratio as more financially stable and creditworthy.

Improved Negotiating Power: The company has a stronger position when negotiating with suppliers or creditors due to its financial strength.

Potential Drawbacks of a High Current Ratio:

Inefficient Asset Utilization: A very high current ratio may suggest that the company is not effectively utilizing its assets to generate revenue. Excess cash or inventory could be invested to improve profitability.

Missed Opportunities: Holding too many current assets may prevent the company from pursuing growth opportunities that require additional capital investments.

A low current ratio: Assessing potential risks and areas for improvement

A low current ratio, generally below 1:1, raises concerns about a company's ability to meet its short-term obligations. This can lead to several risks:

Liquidity Issues: The company may struggle to pay its bills, increasing the risk of bankruptcy or financial distress.

Damage to Reputation: A low current ratio can erode investor and creditor confidence, making it more challenging to raise capital.

Reduced Negotiating Power: The company may have less leverage when negotiating with suppliers or creditors due to its weak financial position.

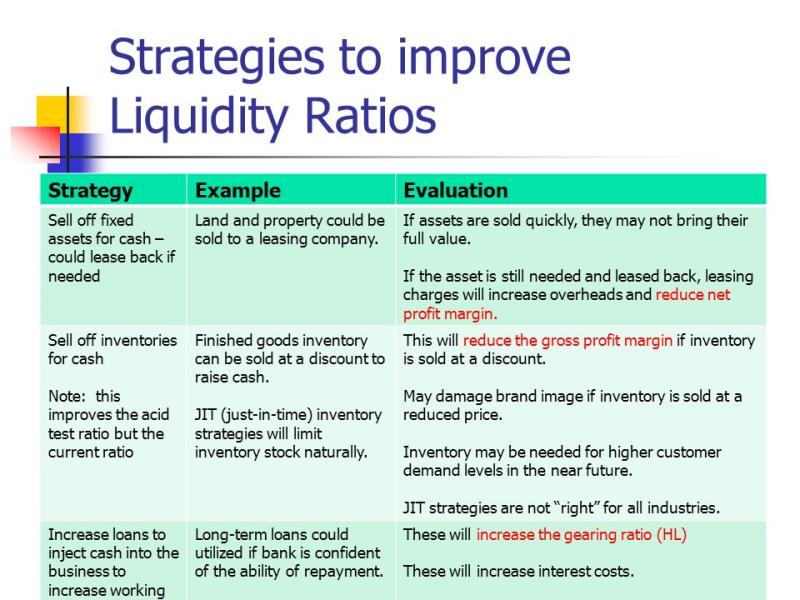

Potential Areas for Improvement:

Managing Inventory: Efficient inventory management can reduce tied-up capital and improve liquidity.

Collecting Receivables: Implementing effective credit policies and collection processes can expedite cash inflow.

Negotiating Payment Terms: Extending payment terms with suppliers can free up cash reserves.

Considering Industry Norms and Contextual Factors

Comparing a company's current ratio to industry benchmarks provides a more meaningful interpretation. Current ratio norms vary across industries due to differing operational and asset-intensive nature.

Additionally, contextual factors like the company's growth stage, economic conditions, and competitive landscape influence the interpretation of the current ratio.

Utilizing the Current Ratio as Part of a Comprehensive Financial Analysis

The current ratio should be evaluated alongside other financial metrics, such as the quick ratio, debt-to-equity ratio, and interest coverage ratio, to gain a holistic understanding of a company's financial health.

In conclusion, the current ratio is a valuable tool for assessing a company's short-term liquidity and financial strength. While a high current ratio generally indicates a strong financial position, it's crucial to consider industry norms, contextual factors, and a comprehensive financial analysis to make informed judgments.