How to calculate tax equivalent yield?

The tax-equivalent yield (TEY) is a measure used to compare the yield on tax-exempt investments, such as municipal bonds, to the yield on taxable investments, like corporate bonds or certificates of deposit (CDs), after accounting for the impact of taxes. It helps investors determine whether a tax-exempt investment provides a higher after-tax return compared to a taxable investment. Here's how to calculate the tax equivalent yield:

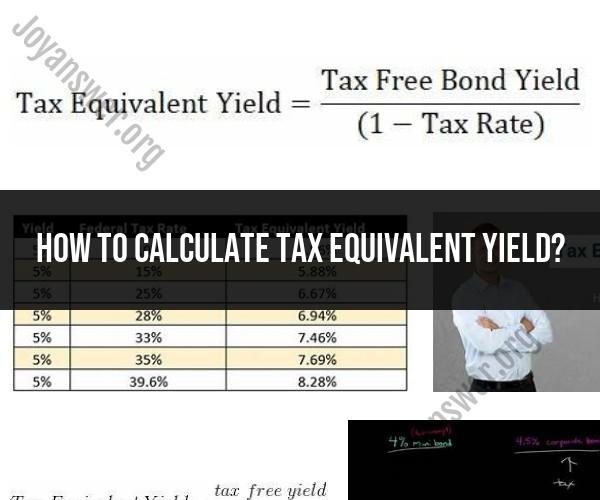

Formula for Tax Equivalent Yield (TEY):

TEY = Tax-Free Yield / (1 - Tax Rate)

Where:

- TEY is the tax-equivalent yield.

- Tax-Free Yield is the yield (interest rate) on the tax-exempt investment.

- Tax Rate is the investor's marginal tax rate, expressed as a decimal (e.g., 25% as 0.25).

Step-by-Step Calculation:

Determine the Yield on the Tax-Exempt Investment:

- Find the annual yield (interest rate) offered by the tax-exempt investment, such as a municipal bond. This is the tax-free yield.

Determine Your Marginal Tax Rate:

- Identify your marginal tax rate, which is the tax rate you pay on the last dollar of income earned. This rate depends on your income and tax filing status. Express this rate as a decimal (e.g., 25% as 0.25).

Use the Formula:

- Plug the values into the formula:TEY = Tax-Free Yield / (1 - Tax Rate)

Calculate the TEY:

- Perform the calculation to find the tax-equivalent yield.

Example:

Let's say you're considering investing in a municipal bond with a tax-free yield of 3.5%. You are in the 25% federal income tax bracket. To find the tax-equivalent yield:

TEY = 0.035 / (1 - 0.25)TEY = 0.035 / 0.75TEY = 0.0467 or 4.67%

In this example, the tax-equivalent yield is approximately 4.67%. This means that, to achieve the same after-tax return with a taxable investment, you would need to find a taxable bond or investment that offers a yield of 4.67% or higher, given your 25% tax rate.

The tax-equivalent yield helps you compare the attractiveness of tax-exempt investments to taxable investments while accounting for your specific tax situation. Keep in mind that state and local taxes may also apply to some investments, so consider those factors in your calculations for a more accurate assessment.

Tax-Equivalent Yield: Understanding the Concept and How to Calculate It

The tax-equivalent yield (TEY) of an investment is the yield that a taxable investment would need to provide in order to equal the after-tax yield of a tax-exempt investment. TEY is a useful tool for comparing the returns of taxable and tax-exempt investments.

To calculate TEY, use the following formula:

TEY = Taxable yield / (1 - Marginal tax rate)

Where:

- TEY is the tax-equivalent yield

- Taxable yield is the yield of the taxable investment

- Marginal tax rate is the investor's highest tax rate

Example:

An investor with a marginal tax rate of 25% is considering investing in a taxable bond with a yield of 5%. To calculate the TEY of the bond, the investor would use the following formula:

TEY = 5% / (1 - 0.25)

TEY = 6.67%

This means that the investor would need to earn a yield of 6.67% on a taxable bond to equal the after-tax yield of a 5% tax-exempt bond.

Tax Efficiency in Investments: How to Compute Tax-Equivalent Yield

TEY can be a helpful tool for investors who are trying to choose between taxable and tax-exempt investments. For example, an investor in a high tax bracket may want to consider investing in tax-exempt bonds, even if they have a lower yield than taxable bonds. This is because the investor would still earn a higher after-tax return on the tax-exempt bonds.

The Tax Angle: Determining Tax-Equivalent Yield for Your Investments

When determining the TEY of an investment, it is important to consider the following factors:

- Your marginal tax rate: The higher your marginal tax rate, the higher the TEY you will need to earn on a taxable investment to equal the after-tax yield of a tax-exempt investment.

- The type of investment: Different types of investments have different tax treatments. For example, dividends from stocks are typically taxed at a lower rate than interest from bonds.

- Your investment goals: When choosing between taxable and tax-exempt investments, it is important to consider your investment goals. For example, if you are saving for retirement, you may want to consider investing in tax-deferred accounts, such as 401(k)s and IRAs.

If you are unsure about how to calculate TEY or how to choose between taxable and tax-exempt investments, you should consult with a financial advisor.