What is the formula for calculating yield?

The formula for calculating yield can vary depending on the context, and there are different types of yield calculations used in various fields such as finance, chemistry, and agriculture. Here are a few common types of yield calculations and their respective formulas:

Yield in Finance (Yield to Maturity - YTM):

The yield to maturity (YTM) is used to calculate the annual rate of return an investor can expect to receive if they hold a fixed-income security, such as a bond, until it matures. The formula for YTM is relatively complex and typically requires the use of financial calculators or spreadsheet software, but it can be expressed as:

YTM = C + (F - P) / n / ((F + P) / 2)

Where:

- YTM is the yield to maturity.

- C is the annual coupon payment.

- F is the face value of the bond.

- P is the purchase price of the bond.

- n is the number of years to maturity.

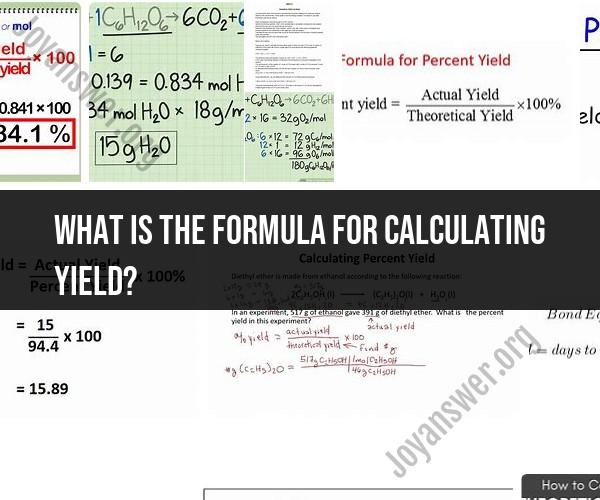

Yield in Chemistry (Yield of a Chemical Reaction):

In chemistry, yield is used to calculate the efficiency of a chemical reaction, particularly in terms of the amount of product obtained compared to the theoretical maximum (stoichiometric yield). The formula for yield in chemistry is:

Yield (%) = (Actual Yield / Theoretical Yield) × 100

Where:

- Yield (%) is the percentage yield.

- Actual Yield is the amount of product obtained in the experiment.

- Theoretical Yield is the maximum amount of product that should theoretically be obtained based on the stoichiometry of the reaction.

Yield in Agriculture (Crop Yield):

In agriculture, yield refers to the amount of agricultural produce, such as crops, harvested per unit area (e.g., per acre or hectare). The formula for calculating crop yield is straightforward:

Yield = Total Harvested Quantity / Total Area

Where:

- Yield is the crop yield per unit area.

- Total Harvested Quantity is the total quantity of the crop harvested.

- Total Area is the total land area used for cultivation.

It's important to use the appropriate formula for the specific context in which you are calculating yield, as different fields have their own methods and definitions for yield calculations. Be sure to clarify the context and units when working with yield calculations.

Calculating Yield: The Formula and Essentials for Investment Analysis

Yield is a measure of the return on an investment over a period of time. It is typically expressed as a percentage and calculated by dividing the income generated by the investment by the cost of the investment.

The most common type of yield is current yield, which is calculated by dividing the annual income from an investment by the current market price of the investment. For example, if a bond pays $50 per year in interest and has a current market price of $1,000, its current yield would be 5%.

Another type of yield is dividend yield, which is calculated by dividing the annual dividends paid by a stock by the current market price of the stock. For example, if a stock pays $2 per year in dividends and has a current market price of $50, its dividend yield would be 4%.

Yield can also be calculated for other types of investments, such as real estate and commodities. For example, the yield on a rental property would be calculated by dividing the annual rental income from the property by the cost of the property. The yield on a commodity, such as oil or gold, would be calculated by dividing the annual change in the price of the commodity by the current price of the commodity.

Investment Returns Unveiled: How to Calculate Yield Effectively

Yield is an important tool for investment analysis because it allows investors to compare the returns on different investments. For example, an investor might compare the current yield of a bond to the dividend yield of a stock to decide which investment is more attractive.

Yield can also be used to calculate the total return on an investment. The total return on an investment is the sum of the income generated by the investment and the change in the price of the investment. For example, the total return on a bond would be the sum of the interest payments received and the change in the price of the bond.

Yield Calculation Demystified: A Step-by-Step Guide to Crunching the Numbers

To calculate the yield on an investment, follow these steps:

- Determine the income generated by the investment over a period of time. This could be interest payments, dividends, or rental income.

- Determine the cost of the investment. This could be the purchase price of the investment or the current market price of the investment.

- Divide the income generated by the investment by the cost of the investment.

- Multiply the result by 100 to express the yield as a percentage.

Here is an example of how to calculate the yield on a bond:

A bond has a current market price of $1,000 and pays $50 per year in interest. The yield on the bond would be calculated as follows:

Yield = (Annual interest payment / Bond price) * 100

Yield = ($50 / $1,000) * 100

Yield = 5%

Therefore, the yield on the bond is 5%.

Yield is a powerful tool for investment analysis that can help investors make better investment decisions. By understanding how to calculate yield, investors can compare the returns on different investments and calculate the total return on an investment.