How to calculate the yield of a dividend stock?

Calculating the yield of a dividend stock is a straightforward process. The dividend yield is a measure of the annual dividend income you receive relative to the current market price of the stock. Here's a step-by-step guide on how to calculate the dividend yield:

Determine the Annual Dividend Payment: Find out the annual dividend payment for the stock you're interested in. This information can usually be found on financial news websites, the company's investor relations website, or in financial reports. The annual dividend payment is the total amount of dividends paid in a year.

Find the Current Stock Price: Look up the current market price of the stock. You can find this information on financial news websites, stock market apps, or by checking with your brokerage account.

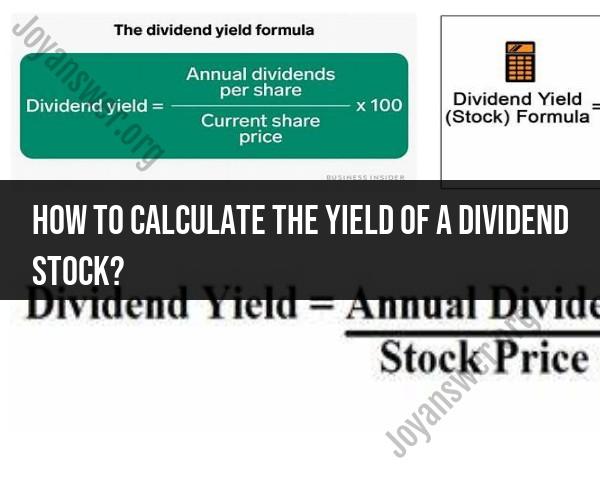

Calculate the Dividend Yield:

Dividend Yield = (Annual Dividend Payment / Current Stock Price) x 100

To calculate the dividend yield, divide the annual dividend payment by the current stock price, and then multiply the result by 100 to express it as a percentage.

For example, if a stock has an annual dividend payment of $2.00 and the current stock price is $50.00:

Dividend Yield = ($2.00 / $50.00) x 100 = 4%

So, in this example, the dividend yield for the stock would be 4%.

The dividend yield is a useful metric for investors to assess the income potential of a dividend stock. However, keep in mind that a high yield doesn't always indicate a better investment, as it can be influenced by various factors, including changes in the stock price and the company's financial health. Always conduct thorough research and analysis before making investment decisions based solely on dividend yield.

How to calculate the yield of a dividend stock for investment purposes?

The dividend yield of a stock is calculated by dividing the annual dividend per share by the current stock price. The formula is as follows:

Dividend yield = (annual dividend per share / current stock price) * 100

For example, if a stock pays an annual dividend of $1 per share and the current stock price is $100, the dividend yield would be 1%.

What factors and formulas are involved in determining the dividend yield of a stock?

The two main factors that determine the dividend yield of a stock are the annual dividend per share and the current stock price. The higher the annual dividend per share, the higher the dividend yield. The lower the current stock price, the higher the dividend yield.

Other factors that can affect the dividend yield of a stock include the company's financial health, its dividend policy, and market conditions. For example, a company that is struggling financially may be more likely to cut its dividend, which would lower the dividend yield. A company with a history of increasing its dividend is more likely to continue to do so, which would increase the dividend yield. Market conditions can also affect the dividend yield of a stock. For example, if the stock market is volatile, investors may be more likely to buy dividend-paying stocks, which can drive up the stock price and lower the dividend yield.

How to assess the potential returns of a dividend-paying stock in your portfolio?

To assess the potential returns of a dividend-paying stock in your portfolio, you need to consider the following factors:

- The company's financial health and dividend policy: A company with a strong financial position and a history of increasing its dividend is more likely to continue to pay dividends in the future.

- The stock's current dividend yield: A stock with a high dividend yield can provide you with a steady stream of income.

- The stock's price-to-earnings ratio (P/E ratio): The P/E ratio is a measure of how expensive a stock is relative to its earnings. A stock with a low P/E ratio may be a good investment, as it is undervalued relative to its earnings.

- Your investment goals: If you are looking for income, you may want to focus on stocks with high dividend yields. If you are looking for capital appreciation, you may want to focus on stocks with low P/E ratios and strong growth potential.

You should also consider the overall risk of your portfolio. Dividend-paying stocks are generally considered to be less risky than non-dividend-paying stocks. However, there is still some risk involved, as companies can cut or eliminate their dividends if they are struggling financially.

It is important to do your own research and consult with a financial advisor before making any investment decisions.