What is the minimum age for an IRA distribution?

The minimum age for an IRA (Individual Retirement Account) distribution without incurring early withdrawal penalties depends on the type of IRA and the specific circumstances. Here are the key age milestones and rules for IRA distributions:

Traditional IRA:

- The minimum age for penalty-free withdrawals from a Traditional IRA is 59½ years old. Withdrawals taken before this age are generally subject to a 10% early withdrawal penalty, in addition to regular income tax.

Roth IRA:

- Contributions to a Roth IRA can be withdrawn at any time without taxes or penalties since they were made with after-tax dollars.

- For earnings (investment gains) in a Roth IRA, you must be at least 59½ and have held the account for at least five years to make tax-free withdrawals. However, there are some exceptions, such as using up to $10,000 for a first-time home purchase or certain qualified education expenses.

Inherited IRAs:

- If you inherit an IRA, the rules for distributions depend on your relationship to the original account owner and the type of IRA.

- Spousal beneficiaries can generally treat the inherited IRA as their own and delay distributions until age 72 (if applicable) or take withdrawals at any age without penalties.

- Non-spousal beneficiaries, such as children or other heirs, may have to start taking required minimum distributions (RMDs) based on their life expectancy, regardless of their age.

Qualified Plans (401(k), 403(b), etc.) Rollovers:

- If you're rolling over funds from an employer-sponsored retirement plan like a 401(k) or 403(b) into an IRA, you can generally do so at any age without penalties when done correctly. You may still be subject to the distribution rules of the original plan.

Early Withdrawal Exceptions:

- There are certain exceptions to the early withdrawal penalty for both Traditional and Roth IRAs. These exceptions include disability, qualified medical expenses, higher education expenses, a first-time home purchase (up to $10,000), and specific IRS-defined hardship situations.

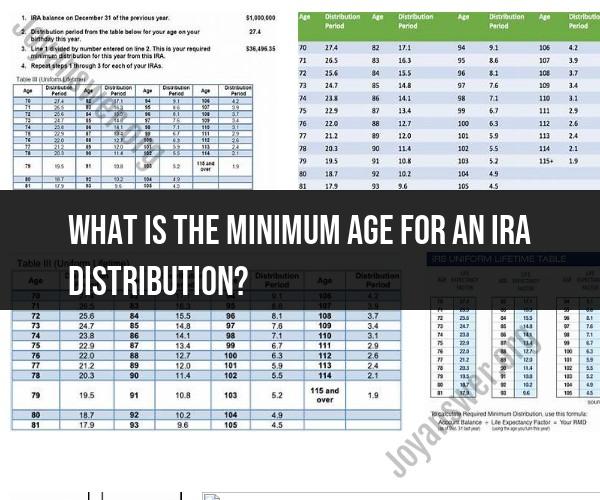

Required Minimum Distributions (RMDs):

- Starting at age 72 (formerly 70½ for those born before July 1, 1949), Traditional IRA owners are required to take annual RMDs. Roth IRAs do not have RMD requirements during the original owner's lifetime.

Keep in mind that IRA rules can change over time due to tax laws and regulations, so it's essential to consult with a financial advisor or tax professional for the most up-to-date information and to ensure compliance with IRA distribution rules based on your individual circumstances.

1. IRA Distributions: Unpacking the Minimum Age Requirements

The minimum age requirement for taking IRA distributions is 59 ½. However, there are some exceptions to this rule. For example, you may be able to take penalty-free IRA distributions before age 59 ½ if you meet certain criteria, such as if you are disabled, have substantial medical expenses, or are taking early retirement from your job.

2. Retirement Savings and Age: When You Can Begin IRA Distributions

Most people begin taking IRA distributions in retirement. However, you can begin taking IRA distributions at any time after you reach age 59 ½. If you take IRA distributions before age 59 ½, you may have to pay a 10% early withdrawal penalty.

3. Financial Freedom in Retirement: Understanding the Age Limit for IRA Distributions

The age limit for taking IRA distributions is 72. However, if you are still working at age 72, you can delay taking IRA distributions until you retire.

It is important to note that you must take required minimum distributions (RMDs) from your IRA starting at age 72 (73 if you reach age 72 after December 31, 2022), even if you are still working. RMDs are calculated based on your life expectancy and the balance of your IRA.

Conclusion

The minimum age requirement for taking IRA distributions is 59 ½. However, there are some exceptions to this rule. You can begin taking IRA distributions at any time after you reach age 59 ½, but if you take them before age 59 ½, you may have to pay a 10% early withdrawal penalty. The age limit for taking IRA distributions is 72, but you can delay taking RMDs until you retire if you are still working.

It is important to plan your IRA distributions carefully so that you have enough money to live comfortably in retirement. You should work with a financial advisor to develop a retirement income strategy that meets your individual needs.