What does a bank statement provide on it?

A bank statement is a document issued by a bank to an account holder, providing a summary of financial transactions over a specific period. Here are the key pieces of information typically found on a bank statement:

Account Information:

- Account Holder's Name: The legal name(s) of the account holder(s).

- Account Number: The unique identifier for the bank account.

Statement Period:

- The specific time frame covered by the statement (e.g., monthly, quarterly).

Beginning and Ending Balances:

- Beginning Balance: The balance in the account at the start of the statement period.

- Ending Balance: The balance in the account at the end of the statement period.

Transaction Details:

- Date: The date when a transaction occurred.

- Description: A brief description of the transaction, often provided by the payee or the bank.

- Type of Transaction: Whether it is a deposit, withdrawal, transfer, or other transaction.

- Amount: The monetary value of the transaction.

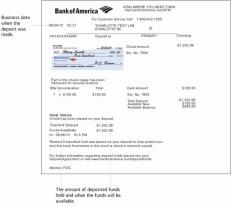

Deposits:

- Details of all deposits made during the statement period, including the source and amount.

Withdrawals:

- Information on all withdrawals, whether made in-person, through ATMs, or electronic transactions.

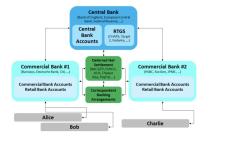

Transfers:

- Details of funds transferred between different accounts within the same bank.

Check Numbers:

- If the account holder writes checks, the statement may include the check numbers and amounts.

Service Charges and Fees:

- Any fees or service charges assessed by the bank, such as maintenance fees or overdraft charges.

Interest Earned:

- For interest-bearing accounts, the statement may show the interest earned during the period.

Cleared and Pending Transactions:

- Cleared transactions have been processed by the bank.

- Pending transactions are those that the bank has received but not yet processed.

Running Balance:

- Some statements provide a running balance after each transaction, helping account holders track their available funds.

Overdraft Notifications:

- If applicable, the statement may include information about overdrafts, including fees and policies.

Contact Information:

- The bank's contact details, including customer service information.

It's important for account holders to carefully review their bank statements regularly. This helps in identifying any discrepancies, unauthorized transactions, or errors and ensures that the account remains secure and accurate. If there are any concerns or questions about the statement, account holders should contact their bank promptly.

Bank Statement Details and Interpretation:

1. Details provided:

A bank statement offers a summary of your account activity over a specific period, usually a month. Here are some key details it typically includes:

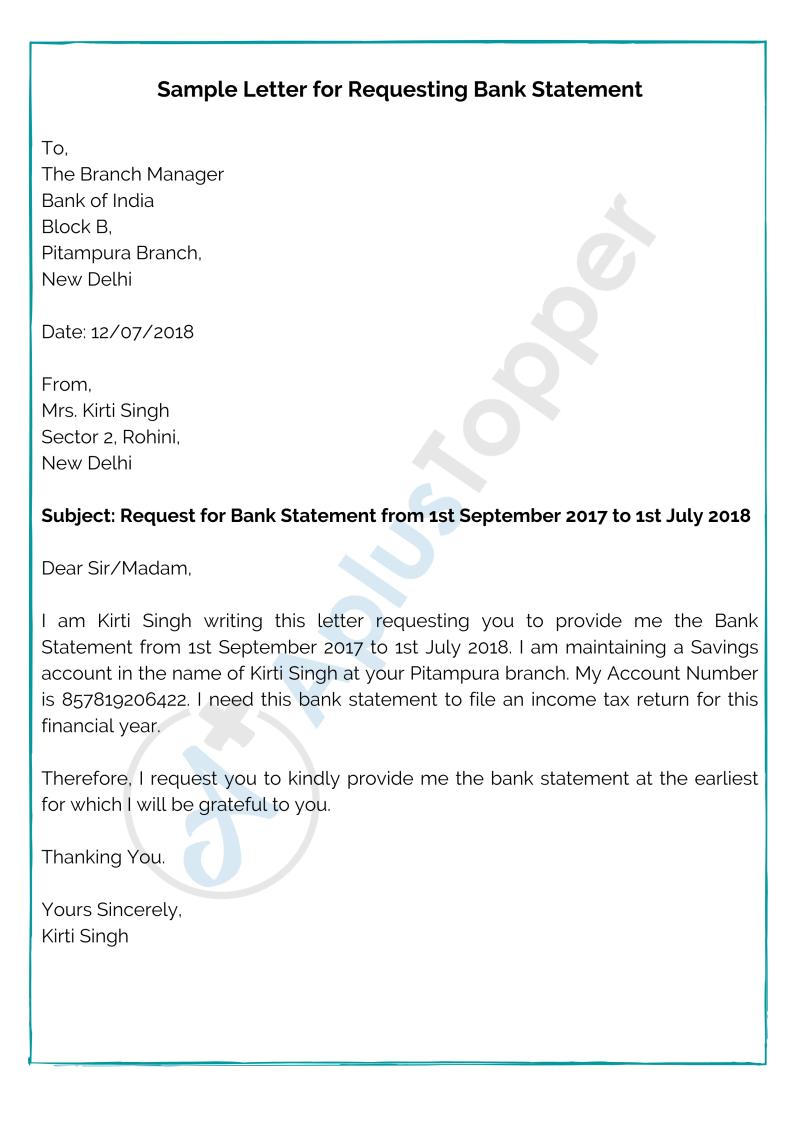

- Account holder information: Name, address, account number, bank branch details.

- Statement period: Dates covered by the statement.

- Beginning and ending balance: Your account balance at the start and end of the period.

- Transaction details:

- Date and time of each transaction.

- Description of the transaction (payee, merchant name, etc.).

- Amount of each transaction (deposits, withdrawals, fees).

- Transaction type (debit, credit, transfer).

- Reference number for each transaction.

- Account fees: Details of any charges incurred (e.g., monthly maintenance fee, ATM fees).

- Interest earned (if applicable): Amount of interest accrued on your balance during the period.

2. Interpretation and reconciliation:

Here's how to effectively interpret and reconcile your statement:

- Review transactions: Compare each transaction with your records (receipts, online purchases) to ensure accuracy.

- Reconcile: Identify and address any discrepancies (missing transactions, incorrect amounts). Contact your bank if needed.

- Analyze spending: Categorize expenses to understand spending patterns and identify areas for potential savings.

- Monitor account activity: Look for suspicious transactions or unauthorized charges. Report them immediately to your bank.

3. Common elements:

While specific details may vary between banks, some common elements found on most statements include:

- Statement header: Bank logo, statement date, account information.

- Transaction table: Lists all transactions with details mentioned above.

- Account activity summary: Total deposits, withdrawals, fees, and net change in balance.

- Available balance: The amount of money currently available in your account.

- Contact information: Bank's customer service details.

Additional tips:

- Keep your bank statements organized for future reference and potential tax purposes.

- Sign up for electronic statements to save paper and access them easily.

- Utilize online banking features to monitor your account activity in real-time.

- Consider setting up transaction alerts for large withdrawals or suspicious activity.

By understanding the details provided and effectively interpreting your bank statements, you can gain valuable insights into your financial situation and make informed decisions about your money.