Can I make a deposit at any credit union?

Generally, you can make a deposit at any credit union, but there are some important things to keep in mind:

Membership: Credit unions are member-owned financial institutions. To make a deposit at a credit union, you typically need to be a member of that credit union. Each credit union has its own membership requirements, so you'll need to join and open an account with the credit union first.

Location: Credit unions may have branch locations, shared branches, or shared service centers that allow members of other credit unions to conduct certain transactions, including deposits. Shared branches and service centers are a network of credit unions that have agreements to provide services to members of other participating credit unions. However, not all credit unions participate in shared branching, so you should check with your credit union or the credit union you plan to visit to confirm.

Identification: When making a deposit, you will need to provide proper identification. This typically includes a government-issued ID, such as a driver's license or passport, and your credit union account number.

Type of Deposit: Credit unions accept various types of deposits, including cash, checks, and electronic transfers. Make sure you know the types of deposits accepted by your credit union.

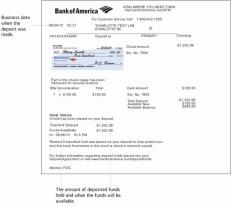

Deposit Slip: It's a good practice to fill out a deposit slip with the details of your deposit, such as the amount of cash and checks, and the account(s) to which you want to credit the funds. This helps ensure that your deposit is processed accurately.

Operating Hours: Check the operating hours of the credit union branch or shared branch where you plan to make a deposit. Credit union branches may have different hours of operation, and some may offer extended hours or weekend availability.

Fees: Be aware of any fees associated with making a deposit. Some credit unions may charge fees for certain types of transactions or for using shared branches, so it's a good idea to ask about potential fees before making a deposit.

To make a deposit at a credit union other than your own, it's a good practice to call ahead or check their website to confirm their policies and ensure that you meet any membership or transaction requirements. Additionally, some credit unions offer online and mobile banking options, which can be a convenient way to make deposits and manage your accounts without visiting a physical branch.

Can you make a deposit at any credit union, or are there specific requirements?

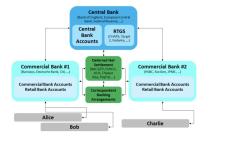

In general, you can only make deposits at credit unions where you have an account. However, some credit unions participate in a shared branching network, which allows members of one credit union to make deposits and withdrawals at branches of other credit unions in the network.

To find out if a credit union participates in shared branching, you can use the CO-OP Shared Branch Locator.

What are the general procedures and considerations for making deposits at credit unions?

To make a deposit at a credit union, you will need to provide your account number and a form of identification, such as a driver's license or passport. You may also need to provide a deposit slip, which can be obtained from the credit union.

If you are depositing cash, you will need to count it out in front of the teller. If you are depositing a check, you will need to endorse it on the back.

Are there restrictions on depositing funds in credit union accounts?

Yes, there may be restrictions on depositing funds in credit union accounts. For example, there may be limits on the amount of cash you can deposit in a single day or on the number of checks you can deposit in a single month.

You may also be required to hold a deposit for a certain period of time before it is available to withdraw. This is known as a hold period.

To find out about the specific restrictions on depositing funds in credit union accounts, you should contact the credit union where you have your account.

Here are some additional tips for making deposits at credit unions:

- Make sure you have all of the required documentation, such as your account number, identification, and deposit slip.

- Be prepared to count out your cash in front of the teller.

- Endorse any checks you are depositing.

- Be aware of any restrictions on depositing funds, such as hold periods or limits on the amount of cash or checks you can deposit.