Does TD Bank have mobile check deposit?

Yes, TD Bank offers mobile check deposit as a feature within its mobile banking app. Mobile check deposit allows TD Bank customers to deposit checks into their accounts using their smartphones or other mobile devices. Here's how it generally works:

Download the TD Bank Mobile App: If you are a TD Bank customer, you can download the official TD Bank mobile banking app from your device's app store.

Log In: Open the app and log in to your TD Bank account using your username and password. If you haven't enrolled in online banking, you'll need to do so to use the mobile check deposit feature.

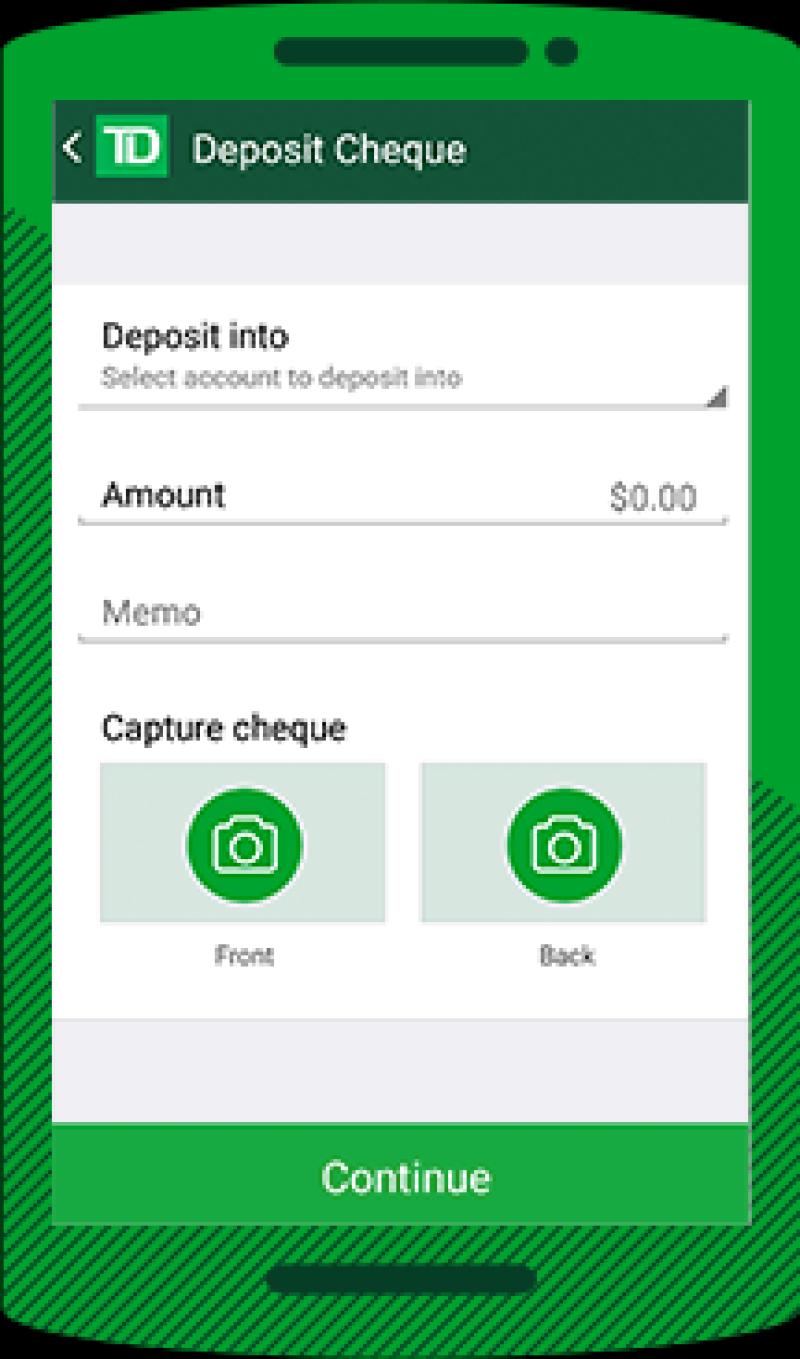

Select Mobile Deposit: Within the app, you should find an option for mobile check deposit. This option may be labeled as "Mobile Deposit" or something similar.

Enter Check Details: Follow the on-screen instructions to enter details about the check you want to deposit. This typically includes the check amount and the account where you want to deposit the funds.

Endorse the Check: Sign the back of the check and include a note like "For Mobile Deposit Only at TD Bank."

Capture Images: Use your device's camera to capture images of the front and back of the check. Make sure the images are clear and include all necessary details.

Review and Submit: Double-check the information and images you've provided. Once you are satisfied, submit the deposit for processing.

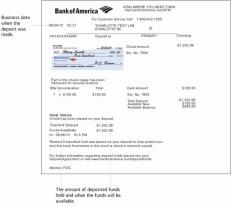

Confirmation: You will receive a confirmation that your deposit has been received and is being processed. Funds are typically made available in your account according to TD Bank's deposit availability policy.

Retain the Original Check: It's a good practice to retain the original check for a certain period, usually until you can verify that the deposit has been successfully processed.

Keep in mind that while mobile check deposit offers convenience, it's essential to follow TD Bank's specific guidelines and policies regarding deposit limits, fees (if any), and fund availability. Be sure to read and understand the terms and conditions associated with mobile check deposit provided by TD Bank.

TD Bank Mobile Check Deposit: A Convenient Banking Feature

TD Bank's mobile check deposit feature allows customers to deposit checks remotely using their smartphones or tablets. This convenient service saves time and eliminates the need to visit a physical bank branch.

Benefits of Using TD Bank Mobile Check Deposit

Convenience: Deposit checks anytime, anywhere, using your mobile device.

Time savings: Avoid waiting in line at the bank.

Accessibility: Deposit checks even when bank branches are closed.

Security: Deposits are protected with the same security measures as in-person deposits.

Depositing Checks on the Go with TD Bank

To deposit checks using TD Bank's mobile app, follow these simple steps:

Endorse the check: Sign your name on the back of the check, along with the words "For Mobile Deposit Only" and your account number.

Launch the TD Bank mobile app: Open the TD Bank app on your smartphone or tablet.

Select Mobile Deposit: Choose the "Mobile Deposit" option from the app's main menu.

Capture check images: Take clear images of the front and back of the check.

Enter deposit details: Verify the deposit amount and enter any necessary notes or references.

Review and submit: Review the deposit details and submit the transaction.

Simplifying Check Deposits with TD Bank's Mobile App

TD Bank's mobile app provides a seamless and user-friendly experience for check deposits. Features include:

Image capture guidance: Clear instructions and visual aids help ensure accurate image capture.

Real-time confirmation: Receive immediate confirmation once the deposit is processed.

Deposit history: Access a record of past check deposits for reference.

Additional Tips for Successful Mobile Check Deposits

Ensure proper lighting and background for clear image capture.

Flatten the check and eliminate any glare or shadows.

Focus on all corners and edges of the check.

Hold the device steady to avoid blurry images.

Deposit checks within a reasonable timeframe to maintain deposit timelines.

TD Bank's mobile check deposit feature is a valuable tool for customers who value convenience and efficiency. With its ease of use, security, and real-time confirmation, mobile check deposit simplifies the process of depositing checks and enhances the overall banking experience.