Can I write a cheque to myself?

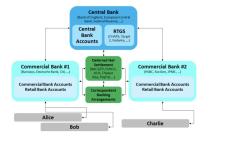

Yes, you can absolutely write a check to yourself. This process is also referred to as a "self-check" or "self-drawn check." Writing a check to yourself allows you to transfer money from one of your accounts to another or simply access funds from one account using a different means.

The steps to write a check to yourself are quite straightforward:

Fill in the Payee Line: In the "Pay to the Order of" line, write your own name or write "Cash." If you write "Cash," it means that anyone can cash the check, so it's advisable to be cautious with this method.

Fill in the Amount: In the box provided for the dollar amount, write the amount you wish to transfer from one account to another.

Sign the Check: On the signature line, sign your name just as you would for any other check.

Deposit or Cash the Check: Once you have written the self-check, you can deposit it into your other account using various methods like mobile deposit, ATM deposit, or by visiting your bank branch. Alternatively, if you wrote "Cash," you can cash it at your bank or another institution.

Before writing a self-check, it's a good idea to check with your bank to ensure there are no specific restrictions or policies related to self-drawn checks. Overall, writing a check to yourself can be a convenient way to transfer funds or access money from one account to another.

Yes, it is perfectly legal and acceptable to write a check to yourself. This can be a useful way to transfer funds between your own accounts, make a cash deposit, or pay yourself a salary if you are a freelancer or business owner.

Steps on How to Write a Check to Yourself:

Ensure Sufficient Funds: Confirm that you have sufficient funds in your checking account to cover the amount of the check you intend to write to yourself.

Payee Information: On the check, write your full name as the payee. This indicates that you are the recipient of the check's funds.

Check Amount: Legibly write the check amount in both numerical and written forms. This ensures clear communication of the check's value.

Signature: Sign the check on the back in the designated area. This confirms your authorization to withdraw the stated amount from your account.

Endorsement: For cash deposits, endorse the check on the back by writing "For Deposit Only" and your account number. This instructs the bank to deposit the funds into your specified account.

Cashing or Depositing: Depending on your purpose, either cash the check at your bank or deposit it into your account using an ATM, mobile app, or in-person at a teller.

Considerations when Writing a Personal Check:

Bank Policies: Check your bank's policies regarding self-written checks, as some banks may have restrictions or limitations.

Verification: Banks may verify the authenticity of self-written checks, especially for large amounts, to prevent fraud.

Record Keeping: Keep a record of self-written checks for personal financial tracking and tax purposes.

Alternative Methods: Consider alternative methods like electronic transfers for large or frequent transactions.

Remember, self-written checks are generally accepted, but it's always advisable to check with your bank and be aware of any policies or restrictions that may apply.