How to process bank statements?

Processing bank statements is an essential task for individuals and businesses to ensure accurate financial records and maintain fiscal responsibility. Here are step-by-step guidelines on how to process bank statements:

Gather Necessary Materials:

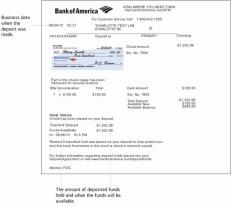

- Collect all relevant bank statements, including paper statements or electronic copies.

Check for Completeness:

- Ensure that you have statements for the entire period you need to process.

Verify Transactions:

- Go through each transaction listed on the statement.

- Verify that all transactions are accurate and legitimate.

Categorize Transactions:

- Categorize transactions into relevant expense or income categories.

- Use accounting software or create a spreadsheet to organize this information.

Reconcile with Internal Records:

- Compare the bank statement transactions with your internal financial records.

- Identify any discrepancies and investigate the reasons behind them.

Mark Cleared Transactions:

- Indicate which transactions have cleared the bank by marking them off on your records.

- This helps in identifying outstanding items.

Address Discrepancies:

- Investigate and resolve any discrepancies between your records and the bank statement.

- Common issues include missing transactions, incorrect amounts, or duplicate entries.

Update Software or Ledger:

- If you're using accounting software, update it with the reconciled information.

- If you maintain a manual ledger, update it accordingly.

Review Bank Fees:

- Check for any bank fees or charges.

- Ensure you understand the nature of the fees and confirm their accuracy.

Monitor Account Balances:

- Compare the ending balance on the bank statement with your internal records.

- Make adjustments if necessary to reconcile the balances.

Document Reconciliation:

- Keep a record of the reconciliation process, including any adjustments made.

- This documentation serves as an audit trail and is useful for future reference.

Flag Unusual Transactions:

- Identify any unusual or suspicious transactions.

- Investigate and report any unauthorized or fraudulent activity to the bank.

Archive Statements:

- Keep a well-organized record of processed bank statements for future reference and audit purposes.

Set a Regular Schedule:

- Establish a routine for processing bank statements, whether it's monthly, quarterly, or annually.

- Consistency is crucial for maintaining accurate financial records.

Back up Your Data:

- If you're using accounting software, regularly back up your financial data to prevent data loss.

By following these steps, you can ensure that your financial records accurately reflect your transactions, making it easier to track expenses, manage cash flow, and comply with accounting standards.

Bank Statement Processing for Financial Analysis:

1. Processing Steps:

a. Data Retrieval:

- Download statements: Obtain statements electronically (bank feeds) or in PDF format.

- Organize: Ensure correct chronological order and file naming for easy access.

b. Data Extraction:

- Manual input: Enter key details like date, payee, amount, category (if not provided).

- OCR & Automation: Use software with Optical Character Recognition (OCR) to automatically extract data from PDFs.

c. Data Categorization:

- Manual: Assign categories like groceries, rent, utilities to each transaction.

- Automatic tools: Utilize software with pre-defined or customizable categories for automatic classification.

d. Data Reconciliation:

- Compare: Match transactions with independent records (e.g., receipts, invoices) for accuracy.

- Correct: Address discrepancies and missing information.

e. Data Aggregation:

- Summarize: Calculate totals for income, expenses, specific categories, etc.

- Analysis: Use spreadsheets or financial analysis software to visualize trends, identify patterns, and draw insights.

2. Streamlining Tools & Applications:

- Accounting software: QuickBooks, Xero offer bank statement integration and automated features.

- Financial analysis tools: Power BI, Tableau create insightful reports and visualizations.

- Data extraction tools: DocuClipper, Rossum automates data extraction from PDFs with OCR technology.

3. Accuracy & Security:

- Data encryption: Utilize secure platforms and software with strong encryption for data protection.

- Access control: Limit access to bank statements and financial data to authorized personnel only.

- Regular backups: Create regular backups of your data to prevent loss or damage.

- Multi-factor authentication: Implement multi-factor authentication for additional security when accessing accounts.

- Fraud monitoring: Set up alerts for suspicious transactions and monitor accounts for unauthorized activity.

Additional Tips:

- Choose tools compatible with your bank and financial data formats.

- Train staff on proper data handling and security procedures.

- Consider professional bookkeeping or financial analysis services for complex needs.

- Regularly review and update your processes to ensure efficiency and accuracy.

By following these steps and utilizing appropriate tools, businesses can streamline bank statement processing and gain valuable insights for informed financial decisions.