How to write on a cheque?

Certainly! Here are the steps to correctly fill out a cheque:

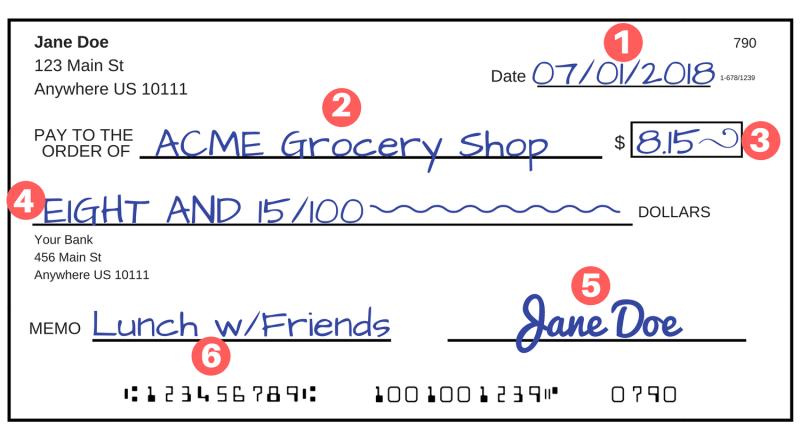

Date Line: Start by filling in the date on the "Date" line in the top right corner of the cheque. It's recommended to use the current date or the date when you're writing the cheque.

Payee Line: On the "Pay to the Order of" line, write the name of the person or organization you're paying. Ensure the name is accurate and matches the payee's name or the recipient's business name.

Amount in Numbers: In the box provided on the right side of the cheque, write the amount of money you're paying in numbers. Begin at the far left and make sure to include both dollars and cents. For example, if you're writing a cheque for $100.50, write "100.50" in this box.

Amount in Words: Below the "Pay to the Order of" line, write out the amount in words. This is to prevent any discrepancies between the numerical and written amounts. For instance, if you wrote "100.50" in the box, you would write "One hundred dollars and 50/100" on this line.

Memo Line (Optional): This line, located in the bottom left corner, allows you to write a note about the purpose of the payment. It's not mandatory but can be helpful for your records or for the recipient to understand the payment's purpose.

Signature Line: Finally, sign the cheque on the bottom right line. Your signature is essential for the cheque to be valid and processed by the bank.

Ensure your handwriting is clear and legible, especially when writing the payee's name and the amount in words, to avoid any confusion or errors during processing.

Once you've completed filling out the cheque, make sure to deduct the amount from your account balance to ensure sufficient funds are available when the cheque is presented for payment.

Always keep track of your cheque transactions to reconcile your bank statements accurately. Additionally, store unused cheques in a safe and secure location to prevent unauthorized use.

Filling out a check is a straightforward process that involves providing essential information to authorize the transfer of funds from your checking account. Here's a step-by-step guide on how to properly write and endorse a check:

Step 1: Date the Check

In the top right corner of the check, write the current date using a standard date format (e.g., MM/DD/YYYY). This indicates the date the check was issued.

Step 2: Fill in the Payee Information

On the "Pay to the Order of" line, write the full name of the person or organization you are paying. Ensure the name is spelled correctly and written legibly.

Step 3: Enter the Check Amount (Numeric)

In the "Dollars" box, write the check amount in numerical form. Use whole numbers and decimals (e.g., $100.50).

Step 4: Write the Check Amount (Written Form)

On the line below the "Dollars" box, write the check amount in written form. Start with the cents amount, followed by a slash (/), and then write the whole number amount. Spell out the entire amount clearly and legibly.

Step 5: Sign the Check

On the back of the check, in the designated area, sign your full name. This authorizes the bank to withdraw the stated amount from your checking account.

Step 6: Endorsement for Cash Deposits (Optional)

If you intend to cash the check, write "For Deposit Only" and your account number on the back of the check below the signature line. This instructs the bank to deposit the funds into your specified account.

Step 7: Endorsement for Third-Party Transfer (Optional)

If you are transferring the check to someone else, they will need to endorse the check. They should write their full name and sign below your signature on the back of the check.

Additional Tips:

Use a blue or black ink pen to write on the check.

Avoid making any alterations or erasures on the check.

Keep the check's information accurate and consistent with your bank records.

Store canceled checks for record-keeping purposes.