How do you calculate a current ratio?

Calculating the current ratio involves gathering information from a company's balance sheet, specifically the current assets and current liabilities. Here's a step-by-step guide on how to calculate the current ratio:

Step 1: Gather Financial Information

- Access the Balance Sheet:

- Obtain the company's most recent balance sheet. The balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and equity at a specific point in time.

Step 2: Identify Current Assets

Locate Current Assets:

- Look for the section of the balance sheet that lists current assets. Current assets are assets that are expected to be converted into cash or used up within one year. Common current assets include:

- Cash and Cash Equivalents

- Accounts Receivable

- Inventory

- Prepaid Expenses

- Short-Term Investments

- Look for the section of the balance sheet that lists current assets. Current assets are assets that are expected to be converted into cash or used up within one year. Common current assets include:

Add Up Current Assets:

- Sum up the values of all the current assets identified in the balance sheet. This total represents the company's current assets.

Step 3: Identify Current Liabilities

Locate Current Liabilities:

- Find the section of the balance sheet that lists current liabilities. Current liabilities are obligations that are due within one year. Common current liabilities include:

- Accounts Payable

- Short-Term Debt

- Accrued Liabilities

- Current Portion of Long-Term Debt

- Find the section of the balance sheet that lists current liabilities. Current liabilities are obligations that are due within one year. Common current liabilities include:

Add Up Current Liabilities:

- Sum up the values of all the current liabilities identified in the balance sheet. This total represents the company's current liabilities.

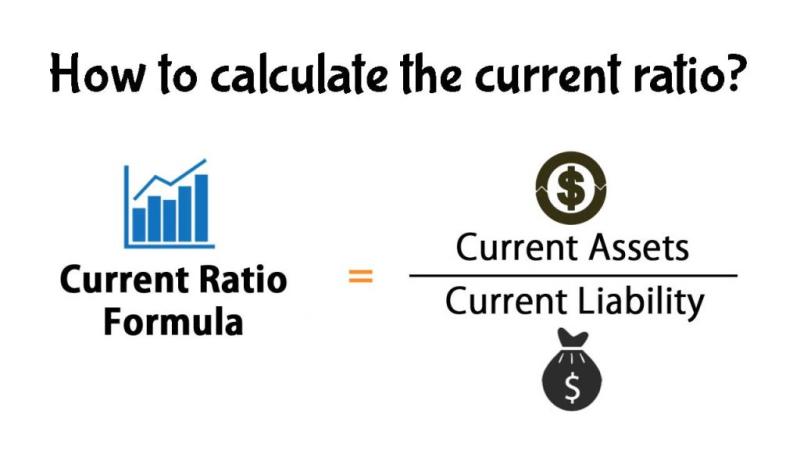

Step 4: Apply the Formula

- Use the Current Ratio Formula:

- Apply the following formula to calculate the current ratio:

Step 5: Interpret the Result

- Evaluate the Current Ratio:

- The resulting ratio provides a measure of the company's short-term liquidity. Interpret the ratio as follows:

- A ratio greater than 1 indicates that the company has more current assets than current liabilities, suggesting it can cover its short-term obligations.

- A ratio equal to 1 means that current assets are exactly equal to current liabilities.

- A ratio less than 1 indicates potential difficulty in covering short-term obligations.

- The resulting ratio provides a measure of the company's short-term liquidity. Interpret the ratio as follows:

Example:

Let's say a company has the following values on its balance sheet:

- Current Assets: $500,000

- Current Liabilities: $300,000

Using the formula:

The current ratio in this example would be or approximately 1.67. This means that the company has $1.67 in current assets for every $1 in current liabilities. Interpretation would depend on industry standards and the company's specific circumstances.

The current ratio is a crucial financial metric that provides insights into a company's short-term liquidity, indicating its ability to meet its immediate obligations. It's a fundamental tool for assessing a company's financial health and navigating business decisions.

Demystifying the Current Ratio Calculation

The current ratio calculation is straightforward:

Current Ratio = Current Assets / Current Liabilities

This formula measures the proportion of current assets a company has to cover its current liabilities. A higher current ratio suggests a stronger financial position, while a lower ratio raises concerns about liquidity.

Understanding the Components of the Current Ratio

Current Assets: These are resources readily convertible into cash within one year. Examples include cash, accounts receivable (money owed by customers), inventory, and prepaid expenses.

Current Liabilities: These are obligations that must be paid within the next 12 months. Examples include accounts payable (money owed to suppliers), short-term loans, accrued expenses (wages or rent owed but not yet paid), and the current portion of long-term debt.

Applying the Current Ratio Formula

To calculate a company's current ratio, simply divide the total current assets by the total current liabilities. For instance, consider a company with the following financial information:

Current Assets: $1,500,000

Current Liabilities: $750,000

In this scenario, the current ratio would be:

Current Ratio = $1,500,000 / $750,000 = 2:1

This indicates that the company has $2 of current assets for every $1 of current liabilities, suggesting a strong liquidity position.

Interpreting the Current Ratio: Gauging a Company's Ability to Meet Short-Term Obligations

Current Ratio Above 1:1: Generally considered favorable, indicating the company has sufficient current assets to cover its short-term obligations.

Current Ratio Close to 1:1: Indicates a company has minimal excess liquidity and may face challenges if short-term obligations increase.

Current Ratio Below 1:1: Raises concerns about the company's ability to meet its short-term obligations and could signal potential liquidity issues.

Considering industry benchmarks: Assessing the relative standing of a company's current ratio

Comparing a company's current ratio to industry benchmarks provides a more meaningful interpretation. Current ratio norms vary across industries due to differing operational and asset-intensive nature.

For instance, a manufacturing company with a high inventory level may naturally have a lower current ratio compared to a service-based company with fewer tangible assets.

Conclusion: Current Ratio as a Valuable Financial Tool

The current ratio is a simple yet powerful tool for assessing a company's short-term liquidity and financial health. It provides valuable insights into a company's ability to meet its immediate obligations, manage its cash flow effectively, and maintain financial stability.