Can a bank Freeze my checking account?

Yes, a bank can freeze your checking account under certain circumstances, but this action is typically taken for specific legal or regulatory reasons. Here are some common situations in which a bank may freeze a checking account:

Legal Orders: If a court issues a judgment or legal order against you, and it involves a debt or financial obligation, the bank may freeze your account to comply with the court's directive. This can happen in cases of unpaid child support, tax debts, or other legal disputes where a court order is issued.

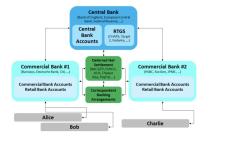

Suspicious Activity: Banks are required to monitor accounts for suspicious or potentially fraudulent activity as part of their anti-money laundering and fraud prevention efforts. If your account displays unusual or suspicious transactions, the bank may temporarily freeze it until they can investigate and verify the activity.

Overdraft or Negative Balance: If you have repeatedly overdrafted your account or have a negative balance, the bank may freeze your account to prevent further negative balances and assess fees.

Account Review: In some cases, banks may freeze accounts for routine account reviews. This can occur if the bank needs to verify your identity, confirm the source of funds, or address compliance issues.

Unauthorized Transactions: If you report unauthorized or fraudulent transactions on your account, the bank may freeze your account while they conduct an investigation to determine the legitimacy of the claims.

Suspicion of Account Compromise: If the bank suspects that your account information has been compromised or your account has been involved in a data breach, they may temporarily freeze it to protect your funds and investigate the issue.

It's important to note that when a bank freezes your account, they are typically required to provide you with notice and an explanation for the freeze, especially in cases involving legal orders or suspicious activity. You should contact your bank immediately if your account is frozen to understand the reason for the freeze and take appropriate steps to resolve the issue.

To prevent account freezes or complications, it's essential to manage your account responsibly, promptly report any unauthorized transactions, and keep your contact information up to date with the bank. Additionally, understanding your bank's terms and conditions and complying with relevant laws and regulations will help you maintain a smooth banking experience.

Banking Woes: Can a Bank Legally Freeze Your Checking Account?

Yes, a bank can legally freeze your checking account. However, they must have a valid reason to do so. Some common reasons for a bank to freeze a checking account include:

- Suspected fraud: If a bank suspects that your checking account is being used for fraudulent activity, they may freeze your account to prevent further losses.

- Government investigation: If a government agency is investigating you, they may ask your bank to freeze your checking account.

- Court order: If you have been served with a court order to freeze your checking account, your bank must comply.

- Outstanding debt: If you have an outstanding debt, such as a loan or credit card bill, your creditor may ask your bank to freeze your checking account to prevent you from withdrawing money to pay off the debt.

Navigating a Frozen Checking Account: Your Rights and Next Steps

If your checking account is frozen, you have certain rights. You are entitled to:

- Be notified of the reason for the freeze: Your bank must tell you why they have frozen your account and provide you with a copy of any documentation they have to support the freeze.

- An opportunity to dispute the freeze: You have the right to dispute the freeze and provide your bank with evidence to support your dispute.

- A hearing: If your bank refuses to unfreeze your account, you may be entitled to a hearing before an independent third party.

If your checking account is frozen, here are some steps you can take:

- Contact your bank immediately: Ask them why your account has been frozen and request a copy of any documentation they have to support the freeze.

- Dispute the freeze: If you believe that the freeze is unjustified, you can provide your bank with evidence to support your dispute.

- Request a hearing: If your bank refuses to unfreeze your account, you may be entitled to a hearing before an independent third party.

Preventing Account Freezes: Tips for a Smooth Banking Experience

Here are some tips to help you prevent your checking account from being frozen:

- Be careful about what information you share online: Avoid sharing your personal information, such as your account number and PIN, with unknown individuals or websites.

- Use strong passwords and enable two-factor authentication: This will help to protect your account from unauthorized access.

- Review your bank statements regularly: Check your bank statements for any unauthorized transactions.

- Report any suspicious activity to your bank immediately: If you notice any suspicious activity on your account, such as large withdrawals or unusual transactions, contact your bank immediately.

By following these tips, you can help to protect your checking account from being frozen and ensure a smooth banking experience.