Can a bank take money out of my checking accoun?

Banks generally cannot take money out of your checking account without your permission or a legal basis for doing so. Your checking account is considered your private financial asset, and banks are required to follow specific rules and regulations when it comes to withdrawing money from your account. Here are some important points to understand:

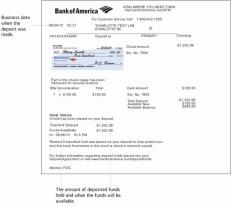

Authorized Transactions: Money can be withdrawn from your checking account when you initiate transactions, such as writing a check, making an electronic funds transfer, using your debit card, or setting up automatic bill payments. These transactions are typically authorized by you, and the bank processes them accordingly.

Overdrafts: If you do not have sufficient funds in your account to cover a transaction, your bank may allow the transaction to go through and charge you an overdraft fee. This is a service the bank provides, but it requires your consent, often through an opt-in process.

Court Orders and Legal Actions: In certain legal situations, a bank may be required to freeze or withdraw funds from your account. This can happen if a court issues a judgment against you, or if there are legal claims or debts that you owe and have not paid. However, this typically requires a legal process and notification to you.

Debt Collection: If you owe money to the bank itself, such as unpaid fees or loan payments, the bank may have the right to withdraw funds from your account to cover the outstanding debt. This is usually outlined in the terms and conditions of your account agreement.

Account Agreements: When you open a checking account, you agree to the terms and conditions set by the bank. These terms may include information about when the bank can deduct fees, what actions may trigger such deductions, and the bank's policies on handling disputed transactions.

It's essential to carefully read and understand the terms and conditions of your checking account agreement and keep your account in good standing to avoid unexpected fees or withdrawals. If you believe that your bank has taken money out of your account without a valid reason or without your authorization, you should immediately contact your bank to inquire about the transaction and resolve any issues.

In summary, while banks have certain rights and mechanisms for withdrawing money from your checking account in specific situations, they cannot do so arbitrarily or without proper authorization or legal grounds. Always stay informed about your account's terms and conditions and monitor your transactions regularly to avoid any surprises.

Understanding Bank Withdrawals: Can a Bank Access Your Checking Account?

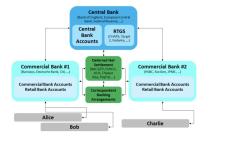

Yes, a bank can access your checking account. However, they must have a valid reason to do so. Some common reasons for a bank to access your checking account include:

- To process authorized transactions, such as checks, debit card purchases, and bill payments.

- To investigate suspected fraudulent activity.

- To comply with a court order or government subpoena.

- To offset your checking account balance with an outstanding debt, such as a loan or overdraft fee.

Right to offset

A bank's right to offset allows them to take money from your checking account to pay off an outstanding debt, without your permission. However, this right is limited and cannot be used to offset debts that are not legally enforceable.

For example, a bank cannot offset your checking account balance to pay off a debt that is disputed or that has been discharged in bankruptcy.

The Legalities and Procedures of Bank Withdrawals from Your Checking Account

The legality of a bank withdrawal from your checking account depends on the reason for the withdrawal. Withdrawals made to process authorized transactions are generally legal, as are withdrawals made to comply with a court order or government subpoena.

However, withdrawals made to offset an outstanding debt are more complex. Under federal law, banks must provide you with advance notice before offsetting your checking account balance. They must also give you an opportunity to dispute the debt before they take any money from your account.

Protecting Your Funds: What to Do If Your Bank Attempts to Withdraw Money Unlawfully

If you believe that your bank has attempted to withdraw money from your checking account unlawfully, you should take the following steps:

- Contact your bank immediately and explain the situation.

- Ask for a copy of the bank's documentation to support the withdrawal.

- If you disagree with the withdrawal, ask the bank to reverse it.

- If the bank refuses to reverse the withdrawal, you may need to file a complaint with the Consumer Financial Protection Bureau (CFPB).

Additional Tips for Protecting Your Funds

- Review your bank statements regularly to check for unauthorized withdrawals.

- Be careful about sharing your personal information with others, such as your account number and PIN.

- Use strong passwords and enable two-factor authentication on your online banking accounts.

- Consider setting up alerts for large withdrawals or unusual activity on your account.

By following these tips, you can help to protect your funds from unlawful bank withdrawals.