Do banks accept ripped or torn checks?

Banks have varying policies regarding the acceptance of ripped or torn checks, and these policies can depend on the extent of the damage and the bank's discretion. Here are some general guidelines to keep in mind:

Minor Damage: If the check has minor rips or tears that don't affect critical information like the payee, amount, or signature, many banks will still accept it for deposit or processing. However, they may choose to endorse or stamp the check with a note indicating the damage.

Major Damage: If the check has significant damage that makes it difficult to read or process, banks may be hesitant to accept it. Major damage could include missing parts of the check, critical information being torn or illegible, or multiple tears.

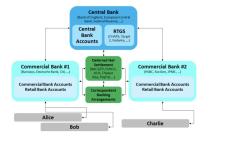

Bank Policies: Each bank may have its own policies regarding damaged checks, and these policies can vary. It's a good idea to check with your bank to understand their specific guidelines for accepting or rejecting torn or damaged checks.

Deposit Options: Some banks offer remote deposit services, allowing you to deposit checks using a mobile app or scanner. In some cases, these services may be more forgiving of minor damage as they rely on digital image processing rather than manual handling.

Replacement Checks: If the check is damaged to the point where it cannot be processed, you may need to request a replacement check from the issuer. This is common for situations where the check was damaged during delivery or handling.

Notify the Issuer: If you receive a check that is damaged, it's a good practice to notify the issuer and explain the situation. They may be able to issue a replacement or take other appropriate action.

It's important to handle checks carefully to prevent damage, as damaged checks can lead to delays in processing and potential complications. If you're unsure whether a bank will accept a torn or damaged check, it's best to check with the bank directly before attempting to deposit or cash it. Banks are more likely to accept checks with minor damage that can be easily processed and verified.