How do you calculate municipal bond interest?

Calculating municipal bond interest involves understanding the bond's coupon rate and par value. The interest paid by a municipal bond is typically expressed as a fixed annual percentage of its par value. Here are the steps to calculate municipal bond interest:

Formula for Municipal Bond Interest:

The formula to calculate municipal bond interest is straightforward:

Where:

- Interest Payment: The annual interest paid by the bond.

- Par Value (Face Value): The nominal value of the bond, which is usually $1,000 or a multiple of $1,000.

- Coupon Rate: The annual interest rate expressed as a percentage of the bond's par value.

Steps to Calculate Municipal Bond Interest:

Identify the Bond's Characteristics:

- Find information on the bond's par value (face value) and its coupon rate. This information is typically available in the bond's prospectus or official statement.

Convert Coupon Rate to Decimal:

- Convert the coupon rate from a percentage to a decimal by dividing it by 100. For example, if the coupon rate is 5%, convert it to 0.05.

Apply the Formula:

Use the formula mentioned above to calculate the annual interest payment:

For example, if the bond has a par value of $1,000 and a coupon rate of 5%, the interest payment would be:

This means the bond would pay $50 in annual interest.

Adjust for Semi-Annual Payments (Optional):

Some municipal bonds make semi-annual interest payments. In such cases, you would divide the annual interest payment by 2 to get the semi-annual interest payment.

The total interest paid over the year remains the same; it's just distributed across two payments.

Example:

Let's consider an example:

- Bond Par Value: $1,000

- Coupon Rate: 4%

So, the bond would pay $40 in annual interest.

It's important to note that the actual interest payment received by the bondholder depends on the bond's coupon rate, not its current market price. If the bond is trading at a premium or discount to its face value, the yield to the investor may differ from the stated coupon rate. Additionally, some bonds may have variable or floating interest rates, in which case the calculation may be more complex. Always refer to the bond's official documentation for accurate information.

How is the interest on municipal bonds calculated?

The interest on municipal bonds is calculated using a simple formula:

Interest = Coupon Rate x Face Value x Time

Here's what each term means:

- Coupon Rate: This is the annual interest rate that the bond issuer agrees to pay. It is typically expressed as a percentage of the face value of the bond.

- Face Value: This is the amount of money that the issuer will repay to the investor at the maturity date of the bond.

- Time: This is the amount of time that the investor holds the bond. For most municipal bonds, the interest is calculated on a semi-annual basis, meaning that the investor will receive two interest payments each year.

Here's an example of how to calculate the interest on a municipal bond:

- Face Value: $10,000

- Coupon Rate: 5%

- Time: 6 months

Interest = 0.05 x $10,000 x 0.5 = $250

Therefore, the investor would earn $250 in interest for holding the bond for 6 months.

Here are some additional points to note about calculating municipal bond interest:

- Accrued Interest: If you purchase a municipal bond between interest payment dates, you will be responsible for paying the accrued interest to the seller. This is the interest that has been earned since the last interest payment date.

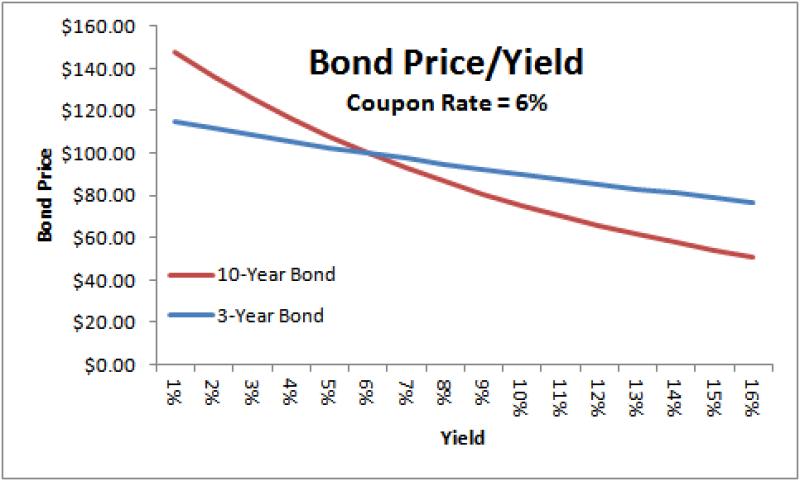

- Yield to Maturity: This is the total return that an investor will earn on a municipal bond if they hold it until maturity. It takes into account both the coupon rate and the current market price of the bond.

- Bond Prices: The price of a municipal bond can fluctuate depending on market conditions. This means that the yield to maturity can also change.

It's important to remember that this is a basic calculation for illustrative purposes. The actual calculation of interest on municipal bonds can be more complex and may involve additional factors, such as call provisions and prepayment risk.