What is the function of a municipal bond?

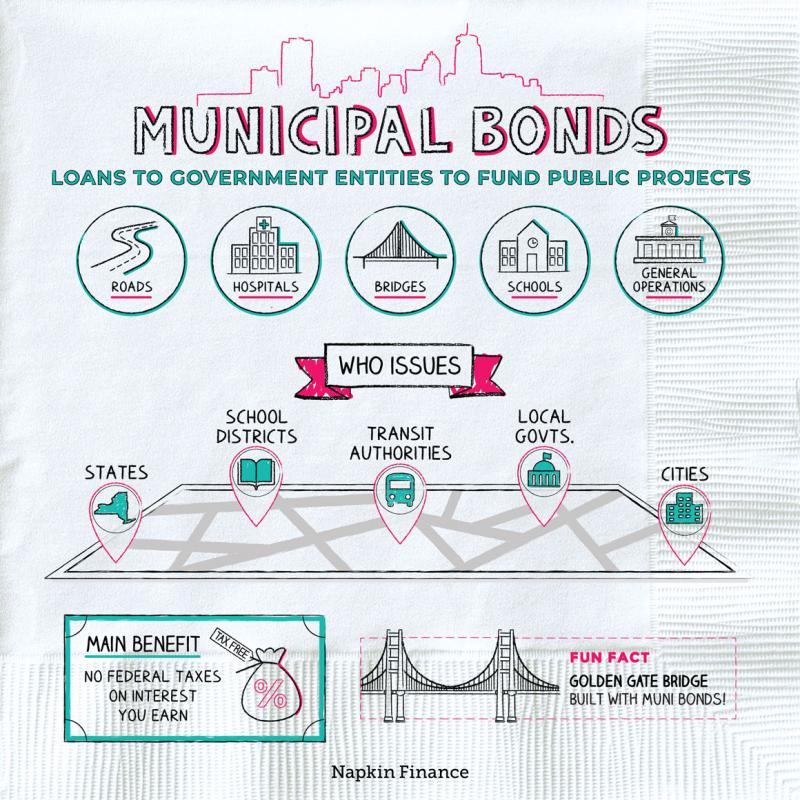

A municipal bond, often referred to as a "muni" bond, serves as a debt security issued by a local government entity, such as a city, county, state, or other municipal authority. The primary function of municipal bonds is to provide these governmental entities with a means to raise capital for various public projects and initiatives. Here are the key functions of municipal bonds:

Fund Public Projects:

- Municipal bonds are a way for local governments to raise funds for public projects and infrastructure development. This can include building schools, highways, bridges, water treatment facilities, and other essential public facilities.

Finance Capital Expenditures:

- Governments often require substantial capital for large-scale capital expenditures. Municipal bonds allow them to finance these projects over an extended period by borrowing from investors.

Debt Issuance for Government Entities:

- Municipal bonds represent a form of debt issuance for government entities. Investors, such as individuals, institutions, or mutual funds, lend money to the municipality in exchange for periodic interest payments and the return of principal when the bond matures.

Diversify Funding Sources:

- Municipalities use bonds to diversify their funding sources beyond tax revenues. By tapping into the bond market, governments can access additional capital without solely relying on taxes to fund projects.

Infrastructure Development:

- Municipal bonds play a crucial role in funding the construction and maintenance of essential infrastructure. This includes projects related to transportation, utilities, public buildings, and other facilities that contribute to the well-being of the community.

Provide Investment Opportunities:

- Municipal bonds offer individuals and institutional investors a way to invest in relatively safe fixed-income securities. Investors receive periodic interest payments, and the principal is repaid at maturity.

Tax Advantages:

- The interest income earned from many municipal bonds is often exempt from federal income tax. In some cases, it may also be exempt from state and local taxes, providing a tax advantage for investors.

Support Economic Development:

- By financing projects that stimulate economic development, municipal bonds contribute to job creation and economic growth within the community.

Facilitate Local Government Operations:

- Municipal bonds can be used to cover operating expenses during periods of budget shortfalls. However, their primary purpose is typically for long-term capital projects rather than day-to-day operations.

Affordable Housing and Community Development:

- Funds raised through municipal bonds can be directed toward projects aimed at providing affordable housing or supporting community development initiatives.

Investors in municipal bonds are essentially lending money to the issuing government entity, and in return, they receive regular interest payments and the return of their principal when the bond matures. The interest rates on municipal bonds are influenced by factors such as the creditworthiness of the issuer and prevailing market conditions.

What role does a municipal bond serve in financial markets?

Municipal bonds play a crucial role in financial markets by facilitating infrastructure development and public projects. They serve several key functions:

1. Funding for public projects: Municipal bonds provide local governments with access to capital needed to finance essential projects like building schools, roads, bridges, parks, and other public facilities. This investment allows governments to avoid relying solely on taxes for funding, spreading the cost of projects over a longer period.

2. Investment opportunity for individuals and institutions: Municipal bonds offer investors a reliable income stream with a low risk of default. This makes them attractive to a range of investors, including individuals, pension funds, and insurance companies. The tax-exempt nature of municipal bonds, especially for residents within the issuing jurisdiction, further enhances their attractiveness.

3. Economic development: By financing essential infrastructure and public services, municipal bonds contribute to economic growth and development. They create jobs, improve quality of life, and attract businesses and residents. This ultimately strengthens the local economy and enhances its long-term sustainability.

4. Diversification tool: Municipal bonds offer a valuable tool for investors to diversify their portfolios and reduce risk. Their low correlation with other asset classes, such as stocks and real estate, helps to buffer the overall portfolio against market volatility. This diversification can be beneficial for investors seeking to achieve their financial goals with more stability and lower risk.

5. Liquidity and price discovery: Municipal bonds are traded in secondary markets, which provides investors with liquidity and allows them to buy and sell bonds easily. This price discovery mechanism ensures efficient allocation of capital and helps to determine the fair market value of municipal bonds based on current market conditions.

6. Benchmarking for other investments: Municipal bond yields serve as a benchmark for other types of investments, such as corporate bonds and structured products. This allows investors to compare the relative risks and returns of different investment options and make informed decisions.

7. Supporting local communities: Investing in municipal bonds provides an opportunity for individuals and institutions to support the communities they live and work in. This investment helps to improve public services, create jobs, and enhance the overall well-being of the community.

In conclusion, municipal bonds play a multifaceted role in financial markets. They contribute significantly to infrastructure development, provide investment opportunities, and support economic growth. Their unique characteristics make them valuable instruments for investors seeking to diversify their portfolios, manage risk, and support their local communities.