How to calculate compounded annual growth rate?

The Compound Annual Growth Rate (CAGR) is a useful measure of an investment's annual growth rate over time, with the effect of compounding taken into account. The formula for calculating CAGR is as follows:

Here's a step-by-step guide on how to calculate CAGR:

Identify the Initial Value (Beginning Value):

- This is the value of the investment or business at the beginning of the period.

Identify the Final Value (Ending Value):

- This is the value of the investment or business at the end of the period.

Determine the Number of Years:

- Calculate the number of years between the starting point and the ending point.

Apply the Formula:

Plug the values into the CAGR formula:

Calculate the Result:

- After applying the formula, you'll get the CAGR expressed as a decimal.

Convert to Percentage:

- Multiply the result by 100 to convert the CAGR to a percentage.

The formula essentially calculates the constant rate of return that provides the equivalent cumulative value of the investment over the specified period.

Here's the simplified version of the CAGR formula:

It's important to note that the CAGR assumes a steady rate of growth over the entire period, which may not always accurately reflect the actual performance of an investment, especially if there are significant fluctuations in value over the years. Additionally, the CAGR doesn't account for the timing of returns or any external factors that might impact the investment.

Sure, I can help you with that.

Calculating the Compounded Annual Growth Rate (CAGR)

The compounded annual growth rate (CAGR) is a measure of the average growth rate of an investment over a specified period of time, taking into account the effect of compounding. Compounding is the process of earning interest on interest, which can significantly increase the overall growth of an investment over time.

Formula for Calculating CAGR

The formula for calculating CAGR is:

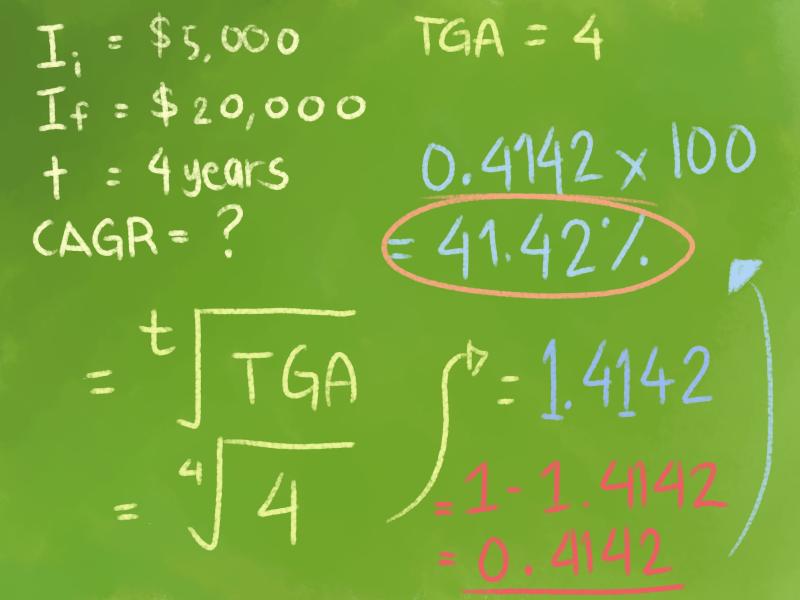

CAGR = (Ending Value / Beginning Value)^(1/n) - 1

where:

- CAGR is the compounded annual growth rate

- Ending Value is the value of the investment at the end of the period

- Beginning Value is the value of the investment at the beginning of the period

- n is the number of years in the period

Steps in Determining CAGR

Here are the steps involved in determining the compounded annual growth rate (CAGR):

Gather the necessary data: Collect the investment's beginning value and ending value for the specified period. For example, if you want to calculate the CAGR of an investment that started at $10,000 and ended at $20,000 over a period of 5 years, your beginning value would be $10,000 and your ending value would be $20,000.

Substitute the values in the formula: Once you have the beginning value, ending value, and the number of years, plug them into the CAGR formula:

CAGR = (Ending Value / Beginning Value)^(1/n) - 1

CAGR = ($20,000 / $10,000)^(1/5) - 1

- Evaluate the expression: Use a calculator or spreadsheet software to evaluate the expression. The result will be the compounded annual growth rate (CAGR) for the investment or economic indicator.

CAGR = 1.487 ≈ 14.9%

This indicates that the investment's average annual growth rate over the 5-year period was approximately 14.9%.

CAGR as a Useful Metric

CAGR is a useful metric for comparing the performance of different investments or for assessing the overall growth of an economy or market. It is a valuable tool for investors, financial analysts, and policymakers.