How to calculate business interest expense?

The calculation of business interest expense depends on the specific details of the debt and the terms of the interest. The general formula for calculating interest expense is:

Here's a step-by-step guide on how to calculate business interest expense:

Determine the Principal Amount:

- The principal amount is the initial amount of money borrowed. This could be the face value of a loan or the outstanding balance on a loan.

Identify the Interest Rate:

- The interest rate is the cost of borrowing and is typically expressed as an annual percentage rate (APR). Make sure to use the appropriate rate based on the terms of the loan (e.g., annual, semi-annual, monthly).

Convert the Annual Interest Rate:

- If the interest rate is expressed on a different basis than annual, convert it to an annual rate. For example:

- If the interest is semi-annual, multiply the interest rate by 2.

- If the interest is quarterly, multiply the interest rate by 4.

- If the interest is monthly, multiply the interest rate by 12.

- If the interest rate is expressed on a different basis than annual, convert it to an annual rate. For example:

Apply the Formula:

- Use the formula .

Example Calculation:

- Let's say you have a business loan with a principal amount of $100,000 and an annual interest rate of 6%.

It's important to note that interest expense is deductible for tax purposes in many jurisdictions. However, tax rules and regulations can vary, so it's advisable to consult with a tax professional for specific guidance related to your business and location.

Additionally, some loans may have more complex structures, such as variable interest rates or compounding interest. In such cases, the calculation may involve more factors, and it's recommended to refer to the loan agreement or seek financial advice for accurate calculations.

Formula for Calculating Business Interest Expense

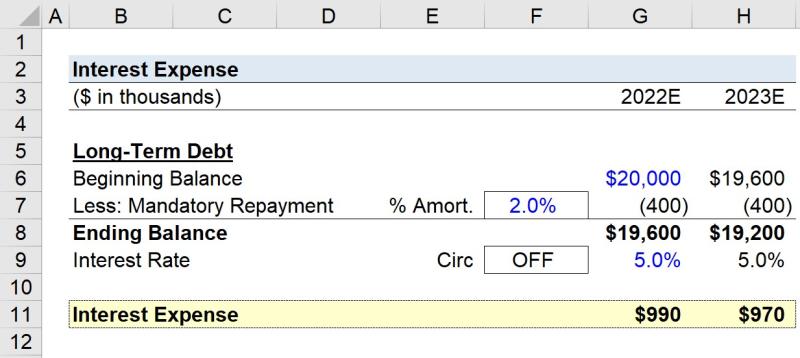

Business interest expense is the amount of interest a company pays on its debts during a given period. It is calculated using the following formula:

Business Interest Expense = Average Debt * Interest Rate

Where:

Average Debt: This is the average balance of all the company's debts over the period being considered. It can be calculated by taking the sum of the beginning and ending balances of all debts and dividing by 2.

Interest Rate: This is the average interest rate that the company pays on its debts. It can be calculated by taking the weighted average of the interest rates on all debts, where the weights are the balances of the debts.

For example, let's say a company has the following debts at the beginning and end of a year:

| Debt | Beginning Balance | Ending Balance | Interest Rate |

|---|---|---|---|

| Loan 1 | $10,000 | $12,000 | 5% |

| Loan 2 | $5,000 | $4,000 | 8% |

| Loan 3 | $15,000 | $18,000 | 6% |

To calculate the average debt, we would add the beginning and ending balances of each debt and divide by 2:

Average Debt = ($10,000 + $12,000) / 2 + ($5,000 + $4,000) / 2 + ($15,000 + $18,000) / 2 = $33,500

To calculate the weighted average interest rate, we would multiply the interest rate for each debt by its balance, add the products together, and divide by the total debt:

Weighted Average Interest Rate = ($10,000 * 5%) + ($5,000 * 8%) + ($15,000 * 6%) / $33,500 = 6.27%

Finally, to calculate the business interest expense, we would multiply the average debt by the weighted average interest rate:

Business Interest Expense = $33,500 * 6.27% = $2,087.45

Therefore, the company's business interest expense for the year would be $2,087.45.

In addition to the formula above, there are a few other things to keep in mind when calculating business interest expense:

Business interest expense is typically deductible for tax purposes. This means that the company can reduce its taxable income by the amount of business interest expense it pays.

Business interest expense is reported on the company's income statement under the heading of "Interest expense." This is where investors and analysts can find information about the company's debt obligations and its cost of borrowing.

Business interest expense can vary from period to period depending on the company's debt levels and the prevailing interest rates. Companies with higher debt levels or higher interest rates will typically have higher business interest expenses.

I hope this helps!