How is full pension calculated?

The calculation of a full pension can vary depending on the retirement plan and pension system you are enrolled in. Full pension calculations are typically based on factors such as your years of service, your average salary, and the specific rules of the pension plan. Below are some general steps on how a full pension may be calculated:

Determine Your Years of Service: Calculate the total number of years you have worked or contributed to the pension plan. This may include both credited years of service and any additional factors like military service or purchased service credits.

Determine Your Average Salary: In many pension systems, your pension is based on your average salary over a specific period, often the highest-earning years of your career. This period is often referred to as your "high-three" or "high-five" years, depending on the plan.

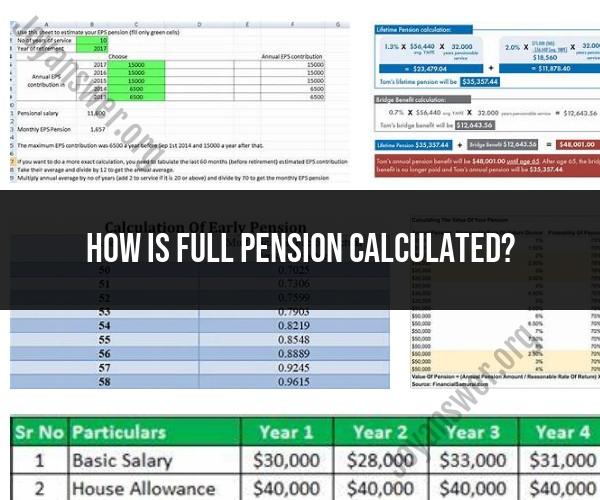

Calculate Your Pension Benefit: Once you have your years of service and average salary, you can use the pension plan's formula to calculate your pension benefit. The formula typically looks like this:

Pension Benefit = (Years of Service) x (Average Salary) x (Multiplier)

- "Years of Service" is the total years you've worked or contributed to the plan.

- "Average Salary" is the average of your highest-earning years.

- "Multiplier" is a percentage determined by the pension plan. For example, if the multiplier is 2%, your pension benefit would be 2% of your average salary for each year of service.

Consider Any Early or Late Retirement Factors: Some pension plans offer adjustments for retiring before or after the normal retirement age. Early retirement may result in a reduced pension, while delaying retirement may lead to an increased pension.

Factor in Any Optional Forms of Payment: Some pension plans offer different payment options, such as joint and survivor annuities or lump-sum payments. The type of payment you choose may affect your pension amount.

Review Plan-Specific Rules: Pension plans can have unique rules and provisions that affect the calculation of a full pension. Be sure to understand your specific plan's guidelines and consult with the plan administrator or a financial advisor for personalized guidance.

It's important to note that pension calculations can be complex, and different pension plans have different rules and formulas. To get an accurate estimate of your full pension, you should refer to your pension plan's official documentation or consult with the plan administrator. Additionally, if you're planning for retirement, it's advisable to work with a financial advisor who specializes in retirement planning to ensure that you make informed decisions about your pension and overall retirement strategy.

To calculate your full pension, you will need to consider the following factors:

- Your years of service

- Your final average salary

- Your pension benefit formula

- Your age at retirement

Your years of service is the total number of years you have worked for your employer and participated in the pension plan. Your final average salary is the average of your highest salary over a certain period of time, typically the last three to five years of your employment. Your pension benefit formula is the equation that your employer uses to calculate your pension benefit. It typically includes your years of service and final average salary. Your age at retirement is the age at which you start receiving your pension benefits.

Once you have this information, you can use the following formula to calculate your full pension:

Full pension = (Years of service) x (Final average salary) x (Pension benefit formula)

For example, if you have worked for your employer for 30 years, your final average salary is $100,000, and your pension benefit formula is 2% per year of service, then your full pension would be:

Full pension = (30 years) x ($100,000) x (2%) = $60,000

This means that you would receive $60,000 per year in pension benefits for the rest of your life.

It is important to note that this is just a basic formula. There are a number of other factors that can affect your full pension, such as early retirement, disability, and death. You should speak with your employer or a pension advisor to get an accurate estimate of your full pension benefit.

Here are some tips for maximizing your retirement income with your pension:

- Start saving early. The earlier you start saving, the more time your money has to grow.

- Make the maximum contributions to your pension plan.

- Invest your pension savings wisely.

- Delay retirement if possible. The longer you work, the higher your pension benefit will be.

- Consider working part-time in retirement. This can help you to supplement your pension income.

- Get professional advice from a pension advisor. They can help you to develop a retirement plan that meets your individual needs.