Where can I get INPRS?

Planning for your retirement is a crucial step in securing your financial future. The Indiana Public Retirement System (INPRS) offers valuable resources and tools to help you navigate your retirement planning journey. In this guide, we'll explore how to access and utilize INPRS for effective retirement planning.

1. Create an INPRS Account

The first step is to create an account on the INPRS website. This account will provide you with access to personalized retirement information and planning tools.

2. Explore Retirement Options

Once you've created an account, you can explore the various retirement options offered by INPRS. This may include traditional pension plans, defined contribution plans, and more. Each option has its own features and benefits, so take the time to understand them.

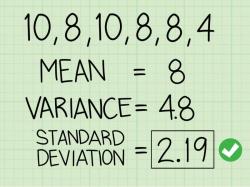

3. Calculate Your Retirement Benefits

Use the retirement benefit calculators available on the INPRS website to estimate your future retirement benefits based on your contributions and other factors. This can help you plan for your financial needs in retirement.

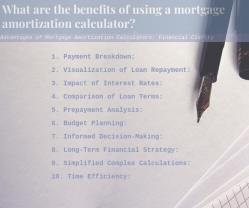

4. Access Financial Planning Resources

INPRS provides a range of financial planning resources, including educational materials, guides, and seminars. These resources can help you make informed decisions about your retirement savings and investment strategies.

5. Review Contribution Options

Explore the contribution options available to you and determine how much you can contribute to your retirement account. This step is essential for maximizing your retirement savings.

6. Monitor Your Retirement Account

Regularly log in to your INPRS account to monitor your retirement savings, contributions, and investment performance. Keeping track of your progress can help you stay on target to meet your retirement goals.

7. Attend Workshops and Seminars

INPRS often hosts workshops and seminars to provide in-depth information about retirement planning. These events are great opportunities to ask questions, learn from experts, and connect with other individuals on the same retirement journey.

Conclusion:

Accessing INPRS is a valuable step in effective retirement planning. By utilizing the resources and tools offered by INPRS, you can make informed decisions about your retirement options, contribution amounts, and investment strategies. Planning ahead will help you secure a comfortable and financially stable retirement.