How to calculate an amortized bond premium?

Calculating the amortized bond premium involves spreading the premium amount over the life of the bond. Bond premium arises when a bond is issued at a price higher than its face value or par value. To calculate the amortized bond premium, you'll need to follow these steps:

Step 1: Gather Bond Information

Collect the necessary information about the bond, including:

- The bond's face value (par value or principal).

- The bond's issue price (the price at which it was sold to investors).

- The bond's stated interest rate (also known as the coupon rate).

- The bond's maturity date (the date when the bond will be redeemed at face value).

Step 2: Calculate the Premium Amount

To calculate the premium amount, subtract the bond's face value from its issue price:

Premium Amount = Issue Price - Face Value

Step 3: Determine the Bond's Premium Amortization Period

The premium is amortized over the life of the bond, so you need to determine the number of periods (usually years) for which you will amortize the premium. This is equal to the bond's maturity or the time until the bond is redeemed.

Step 4: Calculate the Annual Amortization Amount

To calculate the annual amortization amount, divide the premium amount by the number of amortization periods:

Annual Amortization Amount = Premium Amount / Number of Amortization Periods

Step 5: Adjust the Carrying Amount

The carrying amount of the bond on the balance sheet needs to be adjusted each year to reflect the amortization of the premium. Here's how to calculate it:

Carrying Amount at the End of Year N = Initial Carrying Amount - (Annual Amortization Amount × N)

Where:

- Initial Carrying Amount is the bond's issue price when it was first recorded on the balance sheet.

- N is the current year of the amortization period.

Step 6: Calculate the Bond's Interest Expense

Each year, the bond's interest expense on the income statement should be calculated using the adjusted carrying amount from the previous step and the bond's stated interest rate. The formula is as follows:

Interest Expense for Year N = Carrying Amount at the Start of Year N × Stated Interest Rate

Step 7: Record Journal Entries

For each accounting period, you'll need to record journal entries to reflect the amortization of the premium and the interest expense. Here's a general format for the journal entry:

- Debit: Bond Interest Expense (income statement)

- Debit: Bond Premium Amortization (income statement)

- Credit: Cash or Bond Payable (balance sheet)

Repeat these journal entries each year until the bond matures, at which point the premium should be fully amortized, and the bond's carrying amount should equal its face value.

It's important to note that bond premium amortization can have tax implications, and you should consult with a financial professional or accountant to ensure accurate accounting and tax treatment for your specific situation. Additionally, the method of premium amortization may vary based on accounting standards (such as Generally Accepted Accounting Principles or International Financial Reporting Standards), so be sure to follow the applicable guidelines for your reporting requirements.

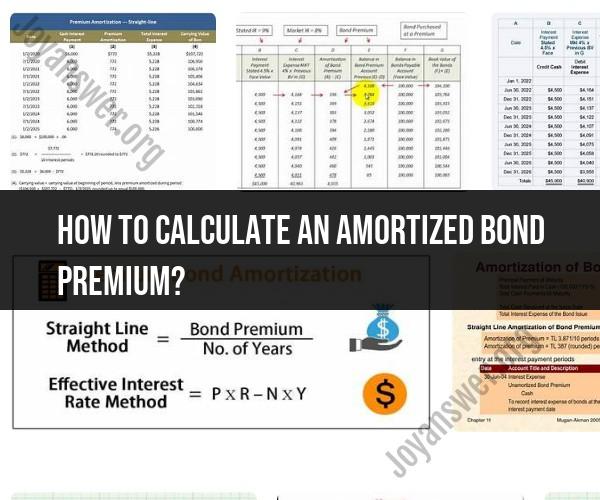

Calculating Bond Premium Amortization: Methods and Formulas

There are two main methods for calculating bond premium amortization:

- The straight-line method: This method amortizes the bond premium evenly over the life of the bond.

- The effective interest method: This method amortizes the bond premium based on the effective yield of the bond.

The straight-line method is simpler to calculate, but the effective interest method is more accurate.

To calculate bond premium amortization using the straight-line method:

- Divide the bond premium by the number of years in the bond's term.

- This amount is the amount of bond premium that is amortized each year.

To calculate bond premium amortization using the effective interest method:

- Calculate the effective yield of the bond.

- Calculate the amortized bond premium for each year using the following formula:

Amortized bond premium = (Bond premium * Effective yield) - (Coupon payment - Amortized bond premium from previous year)

Bond Premium Amortization Schedule: Calculating with Precision

A bond premium amortization schedule is a table that shows the amount of bond premium that is amortized each year. The table also shows the adjusted basis of the bond and the annual interest income.

To create a bond premium amortization schedule, you will need to know the following information:

- The bond premium

- The term of the bond

- The coupon rate

- The effective yield of the bond

Once you have this information, you can use the following steps to create a bond premium amortization schedule:

- Calculate the annual interest income by multiplying the coupon rate by the face value of the bond.

- Calculate the amortized bond premium for each year using the effective interest method.

- Calculate the adjusted basis of the bond at the end of each year by subtracting the amortized bond premium for the year from the adjusted basis of the bond at the beginning of the year.

Managing Bond Investments: Understanding Amortized Bond Premium

Amortized bond premium is an important concept for investors to understand when managing their bond investments. By understanding amortized bond premium, investors can accurately track their investment performance and make informed decisions about their bond portfolios.

Here are some things to keep in mind about amortized bond premium:

- Amortized bond premium reduces the investor's taxable income.

- Amortized bond premium also reduces the investor's basis in the bond. This means that the investor will need to pay capital gains taxes on the difference between the bond's sale price and its basis when the bond is sold.

Investors should work with a financial advisor to develop a bond investment strategy that meets their individual needs and goals.