How to calculate amortization?

Amortization is the process of paying off a debt over time through a series of equal periodic payments. These payments cover both the principal amount borrowed and the interest charged on the outstanding balance. Amortization is commonly used for loans, mortgages, and other types of financial instruments. The calculation of amortization involves several steps:

Determine the Loan Details:

- Identify the principal amount of the loan or debt, which is the initial amount borrowed.

- Determine the annual interest rate, usually expressed as a percentage.

- Determine the loan term or the number of payment periods (e.g., months or years) over which the loan will be repaid.

Calculate the Monthly Interest Rate: Divide the annual interest rate by 12 to get the monthly interest rate. For example, if the annual interest rate is 6%, the monthly interest rate would be 0.06 / 12 = 0.005 (or 0.5%).

Calculate the Number of Payments: Multiply the number of years in the loan term by 12 to get the total number of monthly payments.

Use the Amortization Formula:

The formula to calculate the monthly payment amount in an amortizing loan is as follows:

Monthly Payment (PMT) = [P * (r * (1 + r)^n)] / [(1 + r)^n - 1]

- PMT: Monthly payment amount.

- P: Principal amount (initial loan amount).

- r: Monthly interest rate (in decimal form).

- n: Total number of payments.

This formula calculates the amount of each monthly payment that goes toward both interest and principal.

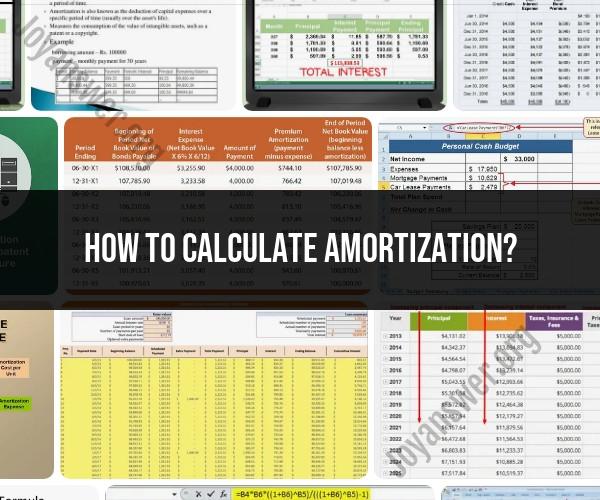

Calculate the Amortization Schedule:

To calculate the amortization schedule, you need to break down each payment into its principal and interest components for each period. Here's how to calculate it:

- For the first payment, calculate the interest portion of the payment by multiplying the outstanding principal balance by the monthly interest rate.

- Subtract the interest portion from the total monthly payment to determine the principal portion paid for that period.

- Subtract the principal portion from the outstanding balance to get the new outstanding balance.

- Repeat these steps for each subsequent payment.

Repeat for Each Payment Period:

Continue the calculations for each payment period until you have completed the entire loan term. The amortization schedule will show how the outstanding balance decreases with each payment until the loan is fully paid off.

Using spreadsheet software like Microsoft Excel or financial calculators can simplify the process of calculating amortization and generating an amortization schedule. Many loan calculators are available online as well, where you can input the loan details, and the calculator will generate the amortization schedule for you.

Demystifying Amortization: How to Calculate and Understand It

Amortization is the process of spreading the cost of a loan over its term, including both the principal and interest. It is a way to make equal monthly payments over the life of the loan, until the loan is paid off.

To calculate amortization, you will need to know the following information:

- The loan amount

- The interest rate

- The loan term (in months)

Once you have this information, you can use the following formula to calculate your monthly payment:

Monthly payment = (Loan amount * Interest rate) / (1 - (1 + Interest rate)^-Loan term)

For example, if you have a $200,000 loan with a 5% interest rate and a 30-year term, your monthly payment would be $1,041.40.

Managing Loan Repayment: Amortization Calculation Explained

The amortization calculation can be used to help you manage your loan repayment. For example, you can use the calculation to determine how much of your monthly payment is going towards principal and how much is going towards interest. You can also use the calculation to determine how long it will take you to pay off your loan.

To determine how much of your monthly payment is going towards principal and how much is going towards interest, you can use the following formula:

Principal payment = Monthly payment - Interest payment

The interest payment is calculated by multiplying the loan balance by the interest rate.

To determine how long it will take you to pay off your loan, you can use the amortization schedule. The amortization schedule is a table that shows how much of each monthly payment goes towards principal and how much goes towards interest over the life of the loan.

Financial Planning with Amortization Knowledge

Amortization knowledge can be helpful for financial planning. For example, you can use amortization knowledge to determine how much you need to save each month to reach your financial goals. You can also use amortization knowledge to determine how much you can afford to borrow when buying a home or car.

Conclusion

Amortization is a complex topic, but it is an important one to understand for anyone who has a loan. By understanding amortization, you can better manage your debt and make informed financial decisions.

Here are some additional tips for using amortization knowledge to your advantage:

- Use amortization to track your progress. You can use the amortization schedule to track your progress towards paying off your loan. This can help you stay motivated and on track.

- Use amortization to make informed decisions about refinancing. If you are considering refinancing your loan, you can use the amortization schedule to compare different loan options and determine which one is best for you.

- Use amortization to plan for your retirement. You can use amortization to plan for your retirement by determining how much income you will need from your retirement savings to cover your monthly expenses.

By following these tips, you can use amortization knowledge to improve your financial situation and reach your financial goals.