How to calculate gross margin percentage?

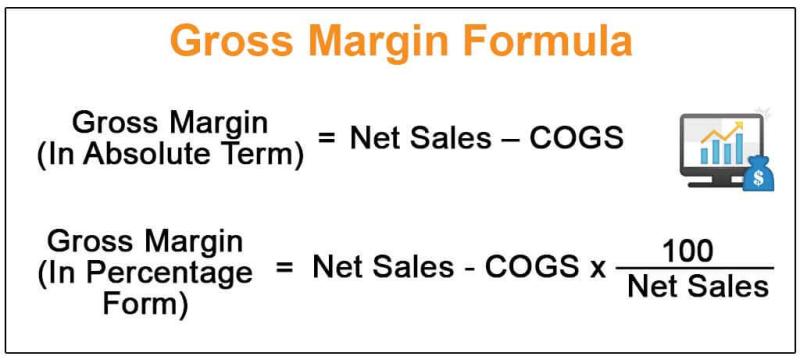

The gross margin percentage is a key financial metric that measures the profitability of a company's core business operations. It is calculated by comparing the gross profit to the revenue (sales) and is expressed as a percentage. Here's how you can calculate the gross margin percentage:

To break it down:

Determine Gross Profit:

- Gross Profit is calculated by subtracting the Cost of Goods Sold (COGS) from the Revenue.

Calculate Gross Margin Percentage:

- Use the formula mentioned above to find the Gross Margin Percentage.

Let's go through an example:

Suppose a company has total revenue of $500,000 and a cost of goods sold (COGS) of $300,000.

\text{Gross Profit} = $500,000 - $300,000 = $200,000

Now, calculate the Gross Margin Percentage:

\text{Gross Margin Percentage} = \left( \frac{$200,000}{$500,000} \right) \times 100

In this example, the gross margin percentage is 40%. This means that for every dollar of revenue, the company retains 40 cents as gross profit after covering the cost of goods sold. The gross margin percentage is a useful indicator of a company's profitability at the gross profit level, before accounting for other operating expenses.

What is the method for calculating gross margin percentage?

The method for calculating gross margin percentage is quite straightforward. Here are the steps involved:

1. Gather the necessary data:

- Total Revenue: This is the total amount of money your business earns from selling products or services during a specific period (e.g., month, quarter, year).

- Cost of Goods Sold (COGS): This is the direct cost associated with producing or acquiring the products or services your business sells. It includes costs like raw materials, labor, and manufacturing overhead.

2. Calculate Gross Profit:

Subtract the Cost of Goods Sold (COGS) from the Total Revenue. This will give you the Gross Profit, which represents the money your business earns after accounting for the direct costs of producing or acquiring its products or services.

3. Calculate Gross Margin Percentage:

Divide the Gross Profit by the Total Revenue and multiply the result by 100. This will give you the Gross Margin Percentage, which expresses the Gross Profit as a percentage of the Total Revenue.

Here's the formula:

Gross Margin Percentage = (Gross Profit / Total Revenue) * 100%

Example:

Suppose a business has a Total Revenue of $100,000 and a Cost of Goods Sold of $60,000.

- Gross Profit = $100,000 - $60,000 = $40,000

- Gross Margin Percentage = ($40,000 / $100,000) * 100% = 40%

Therefore, in this example, the Gross Margin Percentage is 40%, which means that for every $1 of revenue, the business earns $0.40 in gross profit.

Additional notes:

- Gross margin percentage is important for various reasons. It helps businesses gauge their efficiency, compare performance to competitors, and make informed pricing decisions.

- When comparing gross margin percentages, it's important to consider factors like the industry and type of business, as different industries have different average gross margins.

- Other profitability metrics, such as operating margin and net margin, can also be used to evaluate a business's financial health.

I hope this clarifies the method for calculating gross margin percentage. Please let me know if you have any further questions.