Why First Bank&Trust?

The decision to choose a specific bank, such as First Bank & Trust, can depend on various factors that are important to an individual or business. Here are some common reasons why someone might choose First Bank & Trust:

Location and Accessibility: Many people choose a bank based on its physical locations and accessibility. If First Bank & Trust has branches and ATMs conveniently located near your home or workplace, it can make banking more convenient.

Reputation and Trustworthiness: A bank's reputation for trustworthiness and financial stability is crucial. People often choose well-established banks with a solid track record to ensure the safety of their deposits and financial transactions.

Financial Products and Services: The range of financial products and services offered by a bank is an essential consideration. First Bank & Trust may offer a variety of banking services, including checking and savings accounts, loans, credit cards, investment options, and more.

Customer Service: Excellent customer service is a key factor in choosing a bank. A bank that provides responsive and helpful customer support can enhance the banking experience.

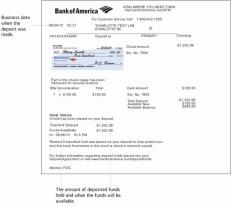

Online and Mobile Banking: In today's digital age, many people prioritize online and mobile banking options. Check if First Bank & Trust offers user-friendly online and mobile banking platforms, as well as features like mobile check deposit and bill pay.

Fees and Account Costs: Consider the fees associated with various accounts and services. Low fees or account options that align with your financial needs may be a deciding factor.

Interest Rates: If you're looking to earn interest on your savings or investments, compare the interest rates offered by First Bank & Trust with those of other financial institutions.

Specialized Services: Some people may require specialized banking services, such as business banking, wealth management, or mortgage lending. Assess whether First Bank & Trust offers these services if they are relevant to your needs.

Community Involvement: First Bank & Trust's involvement in the local community and its commitment to social responsibility may be important to those who value corporate citizenship.

Recommendations and Referrals: Personal recommendations from friends, family, or business associates who have had positive experiences with First Bank & Trust can influence your decision.

Ultimately, the choice of a bank, including First Bank & Trust, should align with your individual or business financial goals, needs, and preferences. It's a good idea to research and compare multiple banking options to determine which one best suits your specific circumstances.

Why Choose First Bank & Trust: Banking Benefits and Features

First Bank & Trust offers a wide range of banking benefits and features that can make it a great choice for individuals, families, and businesses. Here are some of the reasons why you might choose to bank with First Bank & Trust:

Convenient banking options: First Bank & Trust offers a variety of convenient banking options, including online banking, mobile banking, and a network of ATMs and branches.

Competitive rates: First Bank & Trust offers competitive rates on a variety of products, including savings accounts, checking accounts, loans, and credit cards.

Personalized service: First Bank & Trust is committed to providing personalized service to its customers. They offer a variety of financial planning and investment services to help you reach your financial goals.

Community involvement: First Bank & Trust is actively involved in the communities it serves. They support a variety of local charities and organizations.

The Advantages of Banking with First Bank & Trust

There are many advantages to banking with First Bank & Trust. Here are a few of the most notable:

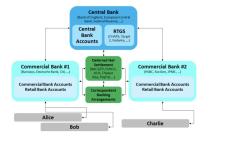

Financial security: First Bank & Trust is a FDIC-insured institution, which means that your deposits are safe up to $250,000 per depositor, per insured depository institution, for each account ownership category, in the event of an institution's failure.

Strong financial performance: First Bank & Trust has a strong financial history and is well-capitalized. This means that you can be confident that your money is safe with them.

Wide range of products and services: First Bank & Trust offers a wide range of products and services to meet the needs of individuals, families, and businesses.

Commitment to customer satisfaction: First Bank & Trust is committed to providing excellent customer service. They are always available to answer your questions and help you with your banking needs.

First Bank & Trust: Your Trusted Financial Partner

First Bank & Trust is a trusted financial partner that can help you achieve your financial goals. They offer a variety of products and services to help you save, invest, and borrow money. They are also committed to providing personalized service and financial education to their customers.

If you are looking for a reliable and trustworthy bank, First Bank & Trust is a great option. They have a long history of serving the community and are committed to helping their customers succeed financially.