How do I sign up for a bank account online?

Signing up for a bank account online is a convenient process. Here's a step-by-step guide to help you get started:

Choose a Bank:

- Research and choose a bank that suits your needs. Consider factors like account types, fees, interest rates, and branch availability.

Visit the Bank's Website:

- Go to the official website of the bank you've selected.

Explore Account Options:

- Browse through the bank's account offerings and select the one that best fits your requirements. Most banks offer savings accounts, checking accounts, and more.

Initiate the Online Application:

- Locate the "Open an Account" or "Apply Now" button on the bank's website, and click on it to begin the application process.

Provide Personal Information:

- You'll need to provide personal information, including your full name, contact information, date of birth, Social Security number (or equivalent), and employment details.

Choose Account Type:

- Select the type of account you want to open (e.g., savings or checking). Some banks offer different variations within these categories, so choose the one that suits you.

Deposit Amount:

- Decide on your initial deposit amount. Most banks require an initial deposit to fund your new account. Make sure you have the required amount available in another bank account or via a credit/debit card.

Review and Agree to Terms and Conditions:

- Carefully read through the bank's terms and conditions, account agreement, and fee schedule. Ensure you understand the terms and fees associated with the account.

Identity Verification:

- The bank will typically require identity verification. This may involve answering security questions or providing a copy of your identification (passport, driver's license, or state ID) and other documents. Be prepared to submit these documents electronically.

Electronic Signature:

- You will usually be required to electronically sign the account agreement and other relevant documents. This is legally binding.

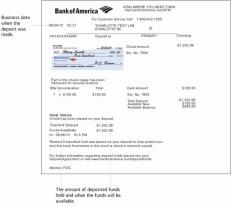

Fund Your Account:

- Transfer the initial deposit amount from your existing bank account to your new account. Most banks provide options for electronic fund transfers (EFT), wire transfers, or mobile check deposits.

Set Up Online Banking Access:

- After your account is opened, you'll need to set up online banking access. This involves creating a username and password to log in securely to your account online.

Order Checks and Debit Card:

- If you've opened a checking account, you may have the option to order checks and a debit card. Some banks issue a temporary debit card immediately for online use.

Activate Your Account:

- Some banks may require you to activate your account by making an initial purchase or transaction with your debit card.

Review Account Details:

- Double-check the account details, terms, and conditions to ensure everything is as expected. Contact the bank's customer service if you have any questions or concerns.

Set Up Alerts and Notifications:

- Customize your account settings by setting up alerts and notifications to keep track of account activity and balance changes.

Download Mobile Banking Apps:

- If the bank offers a mobile app, consider downloading it for convenient access to your account on your smartphone or tablet.

Keep Account Information Secure:

- Safeguard your account information, username, and password. Regularly monitor your account for any unauthorized activity.

Once you've completed these steps, your online bank account should be up and running, and you can start managing your finances online.

Simplified: Signing Up for a Bank Account Online

Opening a bank account online is a quick and easy process that can be done in just a few minutes. Here are a few simple steps to follow:

- Choose a bank. There are many different banks to choose from, so it is important to do your research and compare different options. Consider factors such as the bank's fees, interest rates, and customer service.

- Visit the bank's website. Once you have chosen a bank, visit their website and look for the link to open an account.

- Provide your personal information. You will need to provide some personal information, such as your name, address, date of birth, and Social Security number.

- Choose an account type. There are different types of bank accounts available, such as checking accounts, savings accounts, and money market accounts. Choose the type of account that best meets your needs.

- Fund your account. You will need to fund your account with a minimum deposit. This amount can vary depending on the bank and the type of account you choose.

- Start banking! Once your account is open, you can start using it to deposit and withdraw money, pay bills, and transfer money to other people.

Online Banking Made Easy: Account Registration Steps

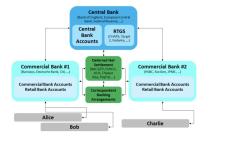

To register for online banking, you will need to create a username and password. You may also need to provide your account number and Social Security number. Once you have registered, you will be able to log in to your online banking account and access all of your account information.

Document Requirements for Opening an Online Bank Account

The document requirements for opening an online bank account may vary depending on the bank. However, most banks will require you to provide the following:

- Valid government-issued ID: This could be a driver's license, passport, or state ID.

- Social Security number: This is required to verify your identity and to open a bank account.

- Proof of address: This could be a recent utility bill or bank statement.

Security and Privacy Considerations in Online Banking

Online banking is a safe and secure way to manage your finances. However, there are a few things you can do to protect yourself from fraud and identity theft:

- Use a strong password.Your password should be at least eight characters long and should include a mix of upper and lowercase letters, numbers, and symbols.

- Never share your personal information with anyone. This includes your username, password, account number, and Social Security number.

- Be careful about what websites you visit. Only enter your personal information on secure websites that use HTTPS encryption.

- Keep your computer security software up to date. This will help to protect your computer from viruses and malware.

Making the Most of Online Banking Services

Online banking offers a number of features and benefits that can make it easier to manage your finances. Here are a few ways to make the most of online banking services:

- Set up direct deposit. This will allow your paycheck or government benefits to be deposited directly into your bank account.

- Set up automatic bill pay. This will automatically pay your bills on time each month.

- Use online budgeting tools. These tools can help you to track your spending and create a budget.

- Use mobile banking. Mobile banking allows you to access your bank account from your smartphone or tablet.

By following these tips, you can make the most of online banking services and manage your finances more effectively.