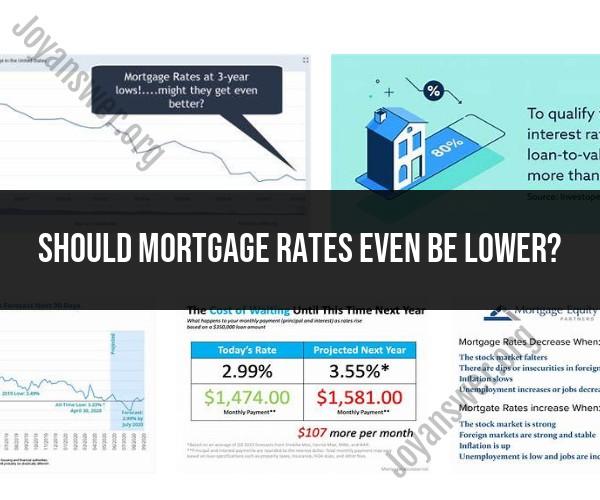

Should mortgage rates even be lower?

Mortgage rates are influenced by a variety of factors that can cause them to rise or fall. When mortgage rates are lower, it can be advantageous for homebuyers and homeowners looking to refinance. Here are some key factors that can influence lower mortgage rates:

**1. Economic Conditions:The overall health of the economy plays a significant role in mortgage rate movements. In times of economic uncertainty or recession, central banks might lower interest rates to stimulate borrowing and spending, which can lead to lower mortgage rates.

**2. Central Bank Policies:Central banks, such as the Federal Reserve in the United States, have the power to influence short-term interest rates. When the central bank lowers its benchmark interest rate, it can lead to lower borrowing costs across the economy, including mortgage rates.

**3. Inflation Rate:Higher inflation erodes the purchasing power of money over time. To combat inflation, central banks may raise interest rates, which can cause mortgage rates to increase. Conversely, lower inflation can contribute to lower mortgage rates.

**4. Government Bond Yields:Mortgage rates often track the yields of government bonds. When bond yields decline, mortgage rates may follow suit. Bonds are considered relatively safe investments, and their yields can influence how lenders price mortgage rates.

**5. Global Economic Conditions:Global events, such as geopolitical tensions or economic developments in major economies, can impact financial markets and interest rates. If global economic conditions weaken, investors may seek safer investments like bonds, which can lead to lower mortgage rates.

**6. Housing Market Conditions:When demand for homes is strong, mortgage rates may rise due to increased borrowing. Conversely, a weaker housing market might lead to lower rates to incentivize homebuyers.

**7. Credit Market Conditions:Lenders assess borrowers' creditworthiness before offering loans. If credit market conditions improve and lenders are more willing to lend, borrowers with strong credit profiles may qualify for lower mortgage rates.

**8. Federal Reserve Communication:Statements and signals from the central bank, such as the Federal Reserve's forward guidance, can influence market expectations for future interest rate movements. If the central bank indicates a commitment to keeping rates low, it can contribute to lower mortgage rates.

**9. Global Interest Rate Trends:Interest rates in other major economies can impact global financial markets. When interest rates are lower in other countries, it can lead to increased demand for higher-yielding investments, including bonds, which can influence mortgage rates.

**10. Market Sentiment:Investor sentiment, market speculation, and the overall confidence in the economic outlook can influence short-term interest rates and, consequently, mortgage rates.

It's important to note that while these factors influence mortgage rates, they can change over time and are subject to complex interactions. As a result, mortgage rates can be difficult to predict with certainty. Borrowers interested in obtaining the best mortgage rates should stay informed about economic conditions and consult with financial experts or mortgage professionals.