What is the purpose of an expense report?

An expense report serves several important purposes in the context of business and financial management. The primary objectives of an expense report include:

Recordkeeping:

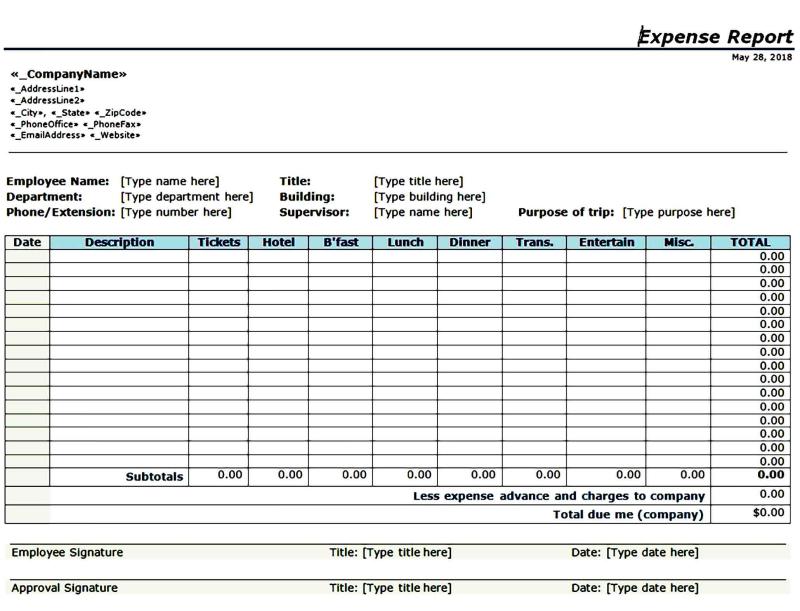

- Expense reports provide a detailed record of all business-related expenditures incurred by employees on behalf of the company. This documentation is crucial for maintaining accurate financial records.

Budget Tracking:

- Expense reports help organizations track and manage their budgets effectively. By categorizing and analyzing expenses, companies can identify trends, control costs, and make informed decisions about future spending.

Reimbursement:

- Employees often spend their own money on business-related activities such as travel, meals, or supplies. The expense report serves as a formal request for reimbursement, allowing employees to be compensated for out-of-pocket expenses.

Compliance and Policy Enforcement:

- Expense reports play a vital role in ensuring compliance with company policies and external regulations. They help verify that expenses are in line with established guidelines, preventing fraudulent or non-compliant activities.

Tax Deductions:

- For both businesses and employees, accurate and detailed expense reports are essential for claiming tax deductions. Certain business expenses are deductible, and proper documentation is required to support these claims during tax filings.

Audit Trail:

- Expense reports create a transparent and traceable audit trail. This can be crucial in the event of an internal or external audit, helping to validate financial transactions and demonstrate the legitimacy of business expenses.

Analysis and Reporting:

- By consolidating expenses into reports, organizations can generate meaningful financial reports and analyses. This can aid in strategic decision-making, performance evaluation, and identifying areas for cost optimization.

Policy Improvement:

- Reviewing expense reports can highlight areas where existing policies may need adjustment. For example, if employees consistently incur expenses that are not covered by current policies, the organization may need to update its guidelines.

Vendor Relationships:

- Expense reports can include payments to vendors for goods and services. Analyzing these reports can help businesses manage and evaluate their relationships with suppliers and negotiate more favorable terms.

Workflow Efficiency:

- The process of preparing, submitting, and approving expense reports contributes to the overall efficiency of financial workflows within an organization. Automated expense management systems can streamline these processes, reducing administrative burden and improving accuracy.

In summary, expense reports serve as a comprehensive tool for financial management, ensuring accountability, transparency, and compliance with financial policies. They play a crucial role in maintaining accurate financial records, supporting tax-related activities, and contributing to the overall financial health of an organization.

What objectives or goals are typically associated with the creation of an expense report?

The creation of an expense report serves several key objectives and goals:

1. Reimbursement:

- Primary objective: Expense reports are used to document business-related expenses incurred by employees and facilitate their reimbursement. This ensures employees are compensated for their out-of-pocket spending on behalf of the company.

2. Compliance and Auditing:

- Meeting tax and regulatory requirements: Accurate expense reports ensure compliance with tax regulations and provide documented evidence of legitimate business expenses. This facilitates smooth audits and minimizes the risk of penalties.

3. Budgeting and Cost Control:

- Monitoring and analyzing spending: Expense reports provide valuable data for tracking and analyzing company spending. This helps identify areas where costs can be reduced and enables effective budgeting for future expenses.

4. Financial Management and Decision-Making:

- Gaining insights into spending habits: Analyzing expense reports reveals trends and patterns in spending behavior. This knowledge aids in strategic decision-making and helps optimize resource allocation.

5. Improved Efficiency and Workflow:

- Streamlining expense management: Automated expense reporting systems eliminate manual paperwork and data entry, reducing time spent on administrative tasks and improving overall efficiency.

6. Transparency and Accountability:

- Promoting responsible spending: Accurate and detailed expense reports foster transparency and accountability in company finances, encouraging responsible spending among employees.

7. Risk Mitigation:

- Identifying and preventing fraud: Thorough expense reporting helps detect and prevent fraudulent activity, safeguarding company funds and assets.

8. Improved Employee Experience:

- Simplifying expense reporting: User-friendly expense reporting systems simplify the process for employees, enhancing their overall experience and job satisfaction.

Overall, the creation of an expense report serves a multi-faceted role in a company's financial management and operational efficiency. It ensures accurate reimbursement, facilitates compliance, and provides valuable insights for informed decision-making, contributing to the financial health and success of the organization.