How to write a business expense report?

Writing a comprehensive business expense report involves documenting all relevant expenses incurred during business-related activities. Here's a step-by-step guide:

Collect Receipts and Records:

- Gather all receipts, invoices, and records related to business expenses. Ensure they include necessary details like dates, amounts, vendors, and descriptions of the expenses.

Use an Expense Report Template or Software:

- If your company provides a specific template or uses expense management software (e.g., Excel, Concur, Expensify), use that format to organize your expenses.

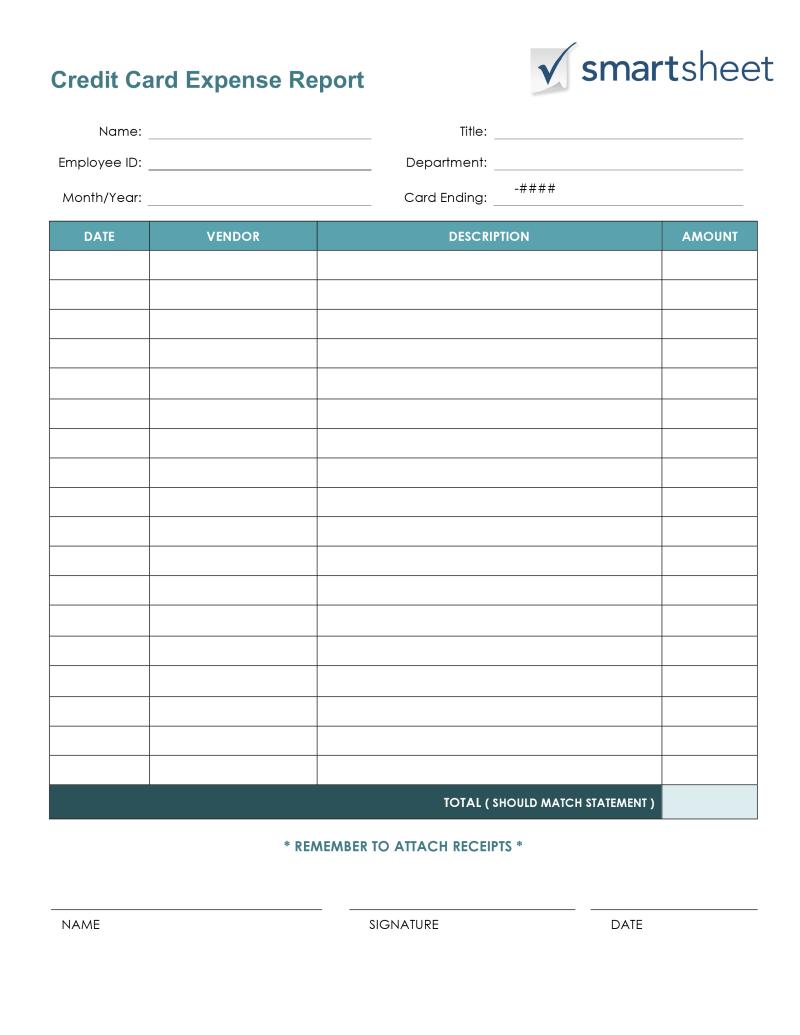

Header Information:

- Include essential information at the top, such as your name, employee ID, department, date range for the expenses, and the purpose of the report.

List Expenses:

- Create a detailed list of expenses incurred during the specified period.

- Include date, vendor name, description of the expense, amount, and payment method for each expense.

- Categorize expenses by type (e.g., travel, meals, accommodation, supplies).

Attach Supporting Documents:

- Scan or attach digital copies of receipts and invoices to support each expense listed. Ensure they are clear and legible.

Total and Subtotal Expenses:

- Calculate the total amount of expenses incurred during the reporting period.

- Provide subtotals for each expense category, if applicable.

Explanations or Notes:

- Include any necessary explanations or notes regarding specific expenses, deviations from company policy, or additional context that might be relevant for approvers or auditors.

Policy Compliance:

- Ensure that all expenses align with company policies and guidelines. Highlight any exceptions or deviations from the policy, if applicable.

Approval and Signatures:

- If required, include spaces for approval signatures from managers or supervisors.

- Date and sign the expense report to certify its accuracy and completeness.

Submission:

- Submit the expense report through the designated channels or platforms specified by your company's expense reimbursement process.

Remember, accuracy, transparency, and adherence to company policies are crucial when preparing a business expense report. Clear documentation and proper organization of expenses, along with supporting receipts, help expedite the approval process and ensure compliance with financial regulations and company policies.

What are the necessary steps to compose a comprehensive business expense report?

Composing a Comprehensive Business Expense Report:

Here are the necessary steps to ensure a complete and accurate business expense report:

Preparation and Gathering Information:

1. Understand company policies: Familiarize yourself with your company's expense reporting policies and procedures. This includes identifying the required documentation, deadlines, and approval process.2. Collect and organize receipts: Maintain accurate and legible receipts for all business-related expenses incurred. Keep them organized chronologically or by expense type.3. Track expenses: Utilize a notebook, spreadsheet, or expense tracking app to record details like date, vendor, amount, description, and expense type for each expense.4. Review expense types: Ensure you understand which expenses are eligible for reimbursement based on your company's policies.

Creating the Report:

1. Choose the format: Utilize the preferred format specified by your company or department, which could be a paper form, online portal, or specific software.2. Fill in basic details: Include your name, employee ID, department, reporting period, and any other required information.3. Enter each expense: Carefully record each expense entry, including the date, vendor, amount, description, expense type, payment method, and currency (if applicable).4. Attach receipts: Scan or upload a clear copy of each receipt corresponding to the expense entries.5. Review and proofread: Thoroughly review the report for any errors or missing information. Ensure all details are accurate and consistent.

Submission and Approval:

1. Submit the report: Follow the established procedure within your company for submitting expense reports. This may involve electronic submission through a portal or physical delivery to a designated department.2. Address any questions: Respond promptly to any inquiries or clarifications requested by approvers regarding specific expense entries.3. Track approval status: Monitor the status of your report and keep track of the approval process timeline.4. Retain copies: Keep a copy of your submitted expense report and all supporting documentation for your records.

Additional Tips:

- Use clear and concise language when describing expenses.

- Provide sufficient detail to justify each expense.

- Keep receipts organized and readily available for review.

- Submit expense reports promptly within the designated timeframe.

- Be transparent and communicate any discrepancies or missing information quickly.

- Familiarize yourself with commonly non-reimbursable expenses.

- Regularly review company policies and updates regarding expense reporting.

By systematically following these steps and paying attention to detail, you can ensure your business expense report is comprehensive, accurate, and compliant with company policies, leading to a smooth and efficient approval process.