How do I submit an expense report?

The specific steps for submitting an expense report can vary depending on the expense management system used by your organization. However, here is a general guide that outlines common procedures and steps you might encounter when submitting an expense report:

1. Gather Receipts and Documentation:

- Collect all relevant receipts and documentation for business-related expenses. This may include receipts for meals, lodging, transportation, and any other expenditures.

2. Log in to the Expense Management System:

- Access your organization's expense management system. This is typically a web-based platform or software where you can enter and submit your expenses.

3. Start a New Expense Report:

- Navigate to the section of the system that allows you to create a new expense report. This may be labeled as "Create New Report" or something similar.

4. Enter Expense Details:

- Fill in the required fields for each expense item. This typically includes information such as the date of the expense, the category (e.g., meals, travel), amount spent, and any additional notes or comments.

5. Attach Receipts:

- Upload digital copies of your receipts to the expense report. Some systems may allow you to take photos of receipts using a mobile app, while others may require you to upload scanned copies.

6. Verify Policy Compliance:

- Ensure that your expenses comply with your organization's policies. Some systems may have built-in checks to flag potential policy violations.

7. Review and Edit:

- Review the entire expense report for accuracy. Make any necessary edits or corrections before submission.

8. Submit the Expense Report:

- Once you are satisfied with the details, submit the expense report through the system. There may be a button or option labeled "Submit," "Send for Approval," or something similar.

9. Confirmation and Tracking:

- After submission, you may receive a confirmation message, and the status of your expense report may change to "Pending Approval." You can often track the progress of your report in the system.

10. Approval Process:

- Your expense report will go through an approval process, which may involve one or more approvers depending on your organization's workflow. Approvers may review the details, verify receipts, and ensure compliance with policies.

11. Reimbursement:

- Once the expense report is approved, the reimbursement process will be initiated. This may involve direct deposit, a check, or another method depending on your organization's practices.

12. Record Keeping:

- Keep a record of the submitted expense report for your records. Some systems allow you to access historical reports for reference.

Tips:

- Familiarize yourself with your organization's expense policy to ensure compliance.

- Use the mobile app if available for convenient on-the-go expense tracking and submission.

- Contact your organization's finance or HR department for assistance or clarification on any aspect of the process.

Remember that the above steps are general guidelines, and the specific process may vary based on the expense management system used by your organization. If you have questions or encounter issues, reach out to your organization's support or administrative staff for guidance.

What is the process for submitting an expense report within an organization?

The process for submitting an expense report within an organization can vary depending on the specific company and its chosen expense management system. However, here's a general overview of the common steps involved:

1. Gathering Receipts and Documentation:

- Collect and organize all receipts, invoices, and other supporting documentation for your business-related expenses.

- Ensure receipts are legible and include the date, merchant name, amount paid, and description of the expense.

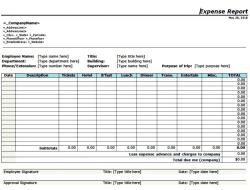

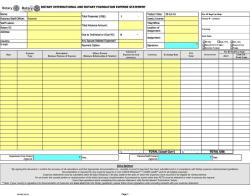

2. Completing the Expense Report Form:

- Use the organization's standard expense report form, either paper-based or online through an expense management system.

- Accurately enter details for each expense, including the date, category, amount, payment method, and a brief description.

- Attach scanned copies of receipts or images captured through the mobile app for electronic submissions.

3. Obtaining Approvals:

- Submit the completed expense report to the appropriate supervisor or manager for review and approval.

- Some organizations may require additional approvals from other departments, depending on the nature and amount of the expenses.

4. Reimbursement:

- Once approved, the organization will process the reimbursement according to their standard procedures.

- This may involve receiving a direct deposit, a physical check, or reimbursement through the chosen expense management system.

5. Recordkeeping:

- Maintain copies of your expense reports and supporting documentation for record-keeping purposes and potential audits.

Here are some additional factors that may influence the process:

- Expense thresholds: Some organizations may have limits on the amount of expenses that can be self-approved, requiring additional approvals for higher amounts.

- Company policies: Specific company policies may dictate the acceptable methods of submitting expense reports, the required documentation, and the timeframe for submission.

- Expense management software: Many organizations utilize dedicated expense management software that streamlines the reporting process, facilitates electronic submission, and automates workflows.

It's important to always consult your company's specific guidelines and procedures for submitting expense reports to ensure accuracy, compliance, and timely processing.