What are the types expense report?

Expense reports can vary based on the purpose, nature of expenses, and the organization's requirements. Here are several types of expense reports commonly used in businesses:

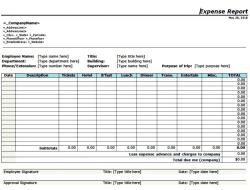

Individual Expense Report:

- Submitted by an individual employee for reimbursement of their business-related expenses, such as travel, meals, accommodations, and other out-of-pocket costs incurred during work.

Corporate Credit Card Expense Report:

- Accounts for expenses charged on a company-issued credit card. Employees reconcile and report these expenses, ensuring they align with company policies.

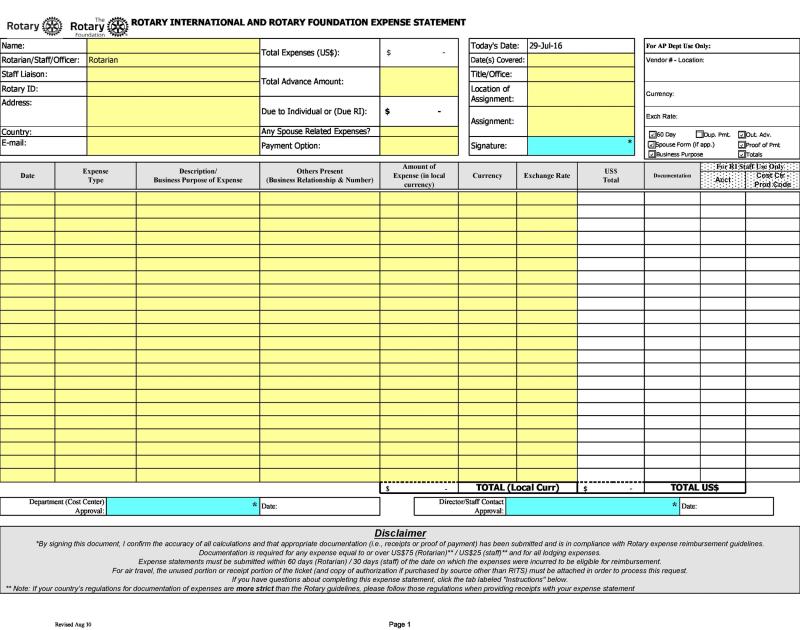

Travel Expense Report:

- Specifically focuses on expenses related to business travel, including flights, hotels, car rentals, meals, transportation, and other travel-related costs.

Entertainment Expense Report:

- Tracks expenses incurred during client entertainment, meetings, events, or hospitality activities. This might include meals, tickets to events, or gifts.

Mileage Expense Report:

- Records expenses related to business-related travel by car. Employees document mileage and associated costs, like gas and maintenance, for reimbursement.

Project Expense Report:

- Tracks expenses incurred for a specific project. It itemizes costs related to materials, labor, services, or other project-related expenditures.

Recurring Expense Report:

- Documents regular or recurring expenses, such as subscription services, monthly utilities, office supplies, or other ongoing operational costs.

Non-Reimbursable Expense Report:

- Accounts for expenses that are not eligible for reimbursement. This might include personal expenses, unauthorized purchases, or non-business-related costs.

Compliance or Audit Expense Report:

- Ensures compliance with company policies, government regulations, or audit requirements. It involves thorough documentation and verification of expenses.

Consolidated Expense Report:

- Compiles various expense reports from different individuals or departments into a comprehensive overview of all expenses incurred within a specified period.

These reports serve as documentation for tracking expenses, ensuring compliance with company policies, facilitating reimbursement processes, managing budgets, and aiding in financial analysis. Organizations might use one or several types of expense reports depending on their needs and operational activities.

What categories or types typically classify an expense report?

Expense report categories typically fall into several broad classifications, each encompassing specific types of expenses. These categories help organize and track spending for analysis, budgeting, and tax purposes. Here are some common categories and examples:

1. Travel Expenses:

- Transportation: Flights, train tickets, car rentals, mileage reimbursement.

- Accommodation: Hotel stays, Airbnb rentals, lodging fees.

- Meals: Restaurant meals, per diem allowances, food delivery.

- Other travel expenses: Airport fees, baggage fees, travel insurance, visas, public transportation costs.

2. Business Meals and Entertainment:

- Meals with clients, vendors, or partners.

- Entertainment expenses for clients or business purposes.

3. Office Supplies and Equipment:

- Computer hardware and software, office furniture, stationery, printing cartridges, and other office necessities.

4. Communication and Technology:

- Phone bills, internet service, data usage, video conferencing subscriptions, and other communication-related expenses.

5. Professional Development:

- Training courses, conference fees, workshops, subscriptions to professional journals, and other expenses related to professional development.

6. Marketing and Advertising:

- Advertising campaigns, social media marketing costs, website development, marketing materials, and other marketing-related expenses.

7. Legal and Professional Fees:

- Legal fees, accounting fees, consulting fees, and other professional service fees.

8. Miscellaneous Expenses:

- Office cleaning, security services, parking fees, postage, shipping costs, and other miscellaneous expenses not categorized elsewhere.

Additional categories:

- Project-specific expenses: Expenses incurred for specific projects may be categorized separately for better tracking and analysis.

- Employee-related expenses: Expenses related to employee benefits, salaries, and other personnel costs may have separate categories.

- Tax-deductible expenses: Some categories, like travel and professional development, may contain expenses eligible for tax deductions.

It's important to note that the specific categories and their names may vary depending on the organization's size, industry, and internal accounting practices. However, the broad classifications listed above provide a general framework for organizing and classifying expense reports.