Which bank has the best online bill pay?

The "best" bank for online bill pay can vary depending on your individual preferences and needs. Several banks offer robust online bill pay services with various features, and the choice ultimately depends on what matters most to you.

Chase Bank: Chase offers a user-friendly online bill pay platform that allows customers to schedule one-time or recurring payments to individuals and businesses. They also have a feature called "QuickPay," which simplifies sending money to people you know.

Wells Fargo: Wells Fargo's online banking provides a bill pay service with features like the ability to set up automatic payments, receive e-bills, and track payment history. They also offer a Bill Pay Guarantee, which can provide added peace of mind.

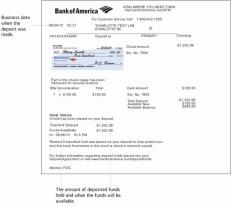

Bank of America: Bank of America's online bill pay service is integrated with their online banking platform and offers options for both one-time and recurring payments. They also have a feature called "eBills" that allows you to receive and pay bills electronically.

US Bank: US Bank provides an online bill pay service that lets customers schedule payments to individuals and businesses. They offer features such as payment tracking, payment history, and e-bill capabilities.

Capital One 360: Capital One 360, the online banking division of Capital One, offers a straightforward online bill pay service. Customers can set up automatic payments and pay bills electronically.

Ally Bank: Ally Bank's online bill pay service is known for its simplicity and ease of use. They offer a Bill Pay feature that allows customers to schedule payments to individuals and companies.

PNC Bank: PNC Bank's online bill pay service includes features like e-bills, automatic payments, and the ability to set up future-dated payments.

When choosing the best bank for online bill pay, consider the following factors:

User Interface: Look for an online banking platform that is intuitive and easy to use.

Payment Options: Ensure the bank allows you to pay a variety of bills, including one-time and recurring payments.

E-Bills: Some banks offer e-bills, which allow you to receive and pay bills electronically.

Payment History: Access to a payment history can help you track your financial transactions.

Security: Choose a bank with strong security measures to protect your financial information.

Fees: Check for any fees associated with online bill pay, although many banks offer this service for free.

Integration: If you use other financial management tools or apps, consider how well the bank's online bill pay service integrates with them.

Keep in mind that the quality of online bill pay services can change, and banks may update their features over time. It's a good idea to research and compare the current offerings of banks in your area or those accessible online to find the best fit for your needs.